Outlook to 2050

Authors: Linden Whittle, Peter Lock and Beau Hug

[expand all]

Summary

Australia’s commercial timber plantation estate is fundamental to the sustainability and competitiveness of the Australian forestry sector and growing the estate has been a key Australian Government policy objective for some time (National Forestry Policy Statement (1992) and Plantations for Australia: The 2020 Vision (1997)). However, after decades of substantial growth in Australia’s commercial timber plantation estate, the area of plantations declined from 2.02 million hectares in 2011–12 to 1.97 million hectares in 2015–16. This raises questions about the future availability of plantation logs and consequent impacts on the forestry sector.

In light of this decline, Forest and Wood Products Australia and ABARES jointly funded research into the long-term potential for new timber plantation establishment in Australia. This report examines the economic potential of new timber plantation establishment to 2050 under current conditions, referred to as the base case scenario. The modelling builds on previous land use change modelling developed by ABARES (Burns et al. 2011) and incorporates a range of factors such as productivity of agricultural land for growing trees, value of land under existing agricultural production and proximity of land to wood-processing facilities and markets. Policymakers and industry can use these projections to anticipate and adapt to expected changes in the industry and to better take advantage of new opportunities.

Key findings

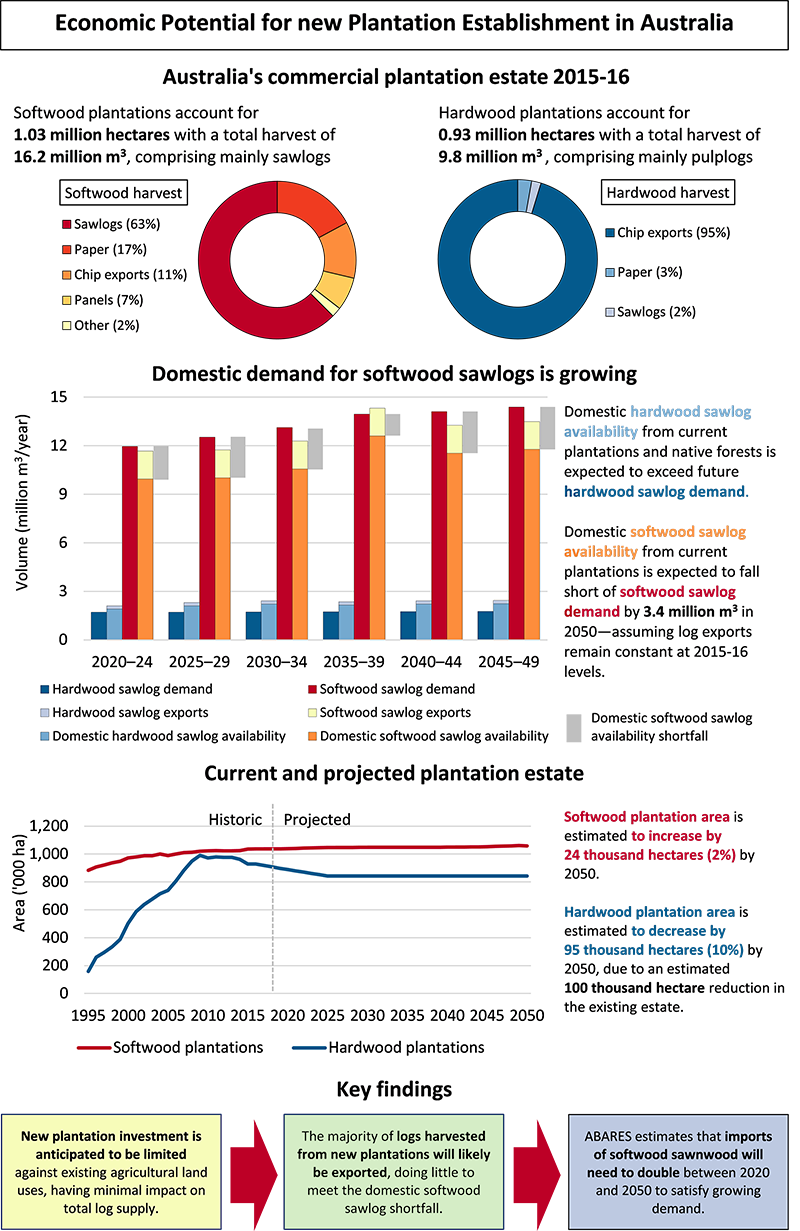

The plantation sector is critical to the forestry industry

In 2015–16 commercial timber plantations covered 1.97 million hectares, split virtually evenly between softwood and hardwood species. While the total timber plantation area is only a fraction of the native forest area available for wood production it accounts for 87 per cent of Australia’s log production. The 1.03 million hectare softwood estate is primarily managed for sawlog production for the domestic market, but also produces a substantial volume of pulplogs for paper and panel production. In contrast, 95 per cent of logs harvested from the 0.93 million hectares hardwood estate are exported as woodchips, having little impact on the domestic market.

Domestic demand for sawlogs is growing

While future availability of hardwood sawlogs will likely be sufficient to meet log equivalent demand, ABARES forecasts a shortfall in the volume of softwood sawlogs available to the domestic market. If exports of softwood sawlogs remain at 2015–16 levels the total volume of sawlogs available to the domestic market is forecast to fall short of demand by 2.6 million cubic metres per year between 2045 and 2049. With continuing growth in demand for softwood sawlogs, ABARES estimates that the domestic log availability shortfall could increase to 3.4 million cubic metres per year between 2050 and 2054. To provide context to these figures an additional 200,000 to 250,000 hectares of new softwood plantations would be required by 2050 to meet an annual deficit of 3.4 million cubic metres per year. However, given the uncertainty around future softwood sawlog supply and log equivalent demand in 2050, it has been proposed that the required area could be as high as 490,000 hectares (Omega Consulting 2017).

Future plantation investment may not be enough

Under the base case scenario, ABARES estimates that around 4,773 hectares of new short rotation hardwood plantations could be economically competitive with current agricultural land use by 2050. However, with expected declines in the existing hardwood estate, the total area of hardwood plantations is expected to fall by around 95,227 hectares, or 10 per cent, by 2050.

Around 24,009 hectares of new softwood plantations could also be viable by 2050. However, this is only a 2 per cent increase over the existing estate. Furthermore, ABARES estimates that around three quarters of the logs harvested from the new plantation estate before 2050 will be exported, doing little to meet the growing shortfall.

In order to meet growing demand, the domestic market will become increasingly reliant on imports of sawnwood. ABARES estimates that the volume of softwood sawnwood imports will more than double from 560,215 cubic metres per year in 2020 to around 1.15 million cubic metres per year in 2050. This represents a potential missed opportunity for the Australian forestry sector unless there are new policies or drivers to expand the current softwood timber plantation estate to meet growing demand.

But there may be potential opportunities in the future

In addition to the base case, ABARES estimated potential plantation investment under a range of alternative scenarios, highlighting potential barriers to and opportunities for the future expansion of the Australian timber plantation estate.

While land prices were shown to have a moderate impact on profitability and potential plantation investment, the most significant barrier to investment in new plantations is the long delay between investment and final harvest, particularly for long rotation plantations.

However, changes in future market conditions could open up opportunities. Higher domestic demand for some wood products could allow the establishment of additional softwood plantations and given the high degree of trade exposure faced by the domestic forestry industry, future decreases in the value of the Australia dollar would be highly favourable to expansion of the current estate.

Download the full report

| Document | Pages | File size |

|---|---|---|

Economic potential for new plantation establishment in Australia: Outlook to 2050 PDF  |

72 | 1.8 MB |

If you have difficulty accessing this file, visit web accessibility for assistance.