Authors: Trish Gleeson, Donkor Addai and Liangyue Cao

Summary

On 26 March 2021, China announced final decisions on its anti-dumping (AD) and countervailing duty (CVD) investigations into wine from Australia. The AD duties – in the range of 116.2% to 218.4%, with the rate varying by supplying company – will apply to wine in containers of 2 litres or less, excluding sparkling wine (HS 2204.21.00), for 5 years from 28 March 2021. Fortified and bulk wines are also excluded. These AD duties, and the provisional security deposits that had preceded them since 28 November 2020, have immediately limited Australian wine exports to China, rendering the market unviable in the near term. China determined that CV duties of 6.3% to 6.4% were applicable but elected to not apply them.

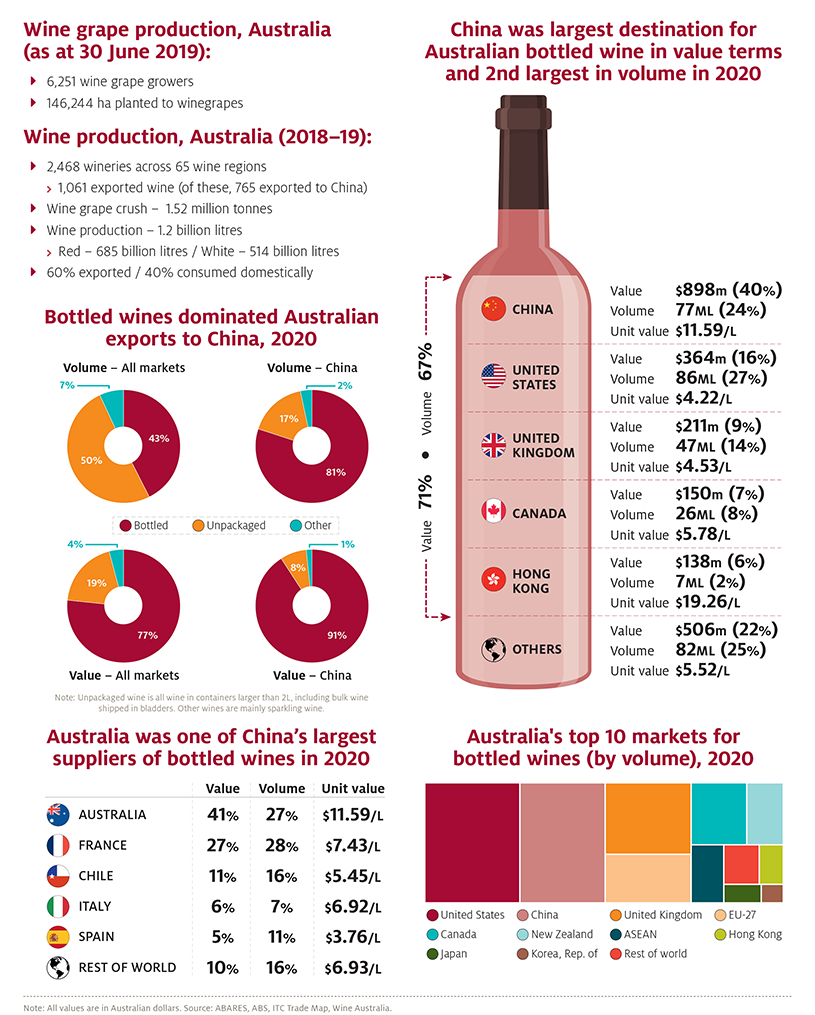

Australia exports wine to over 100 markets, but in 2020 the top 5 markets (Canada, China, Hong Kong, United Kingdom and United States) accounted for 75% of total wine export volume and 77% of export revenue. China was the largest in value terms, accounting for 33% of export revenue and ranking third in volume (after United Kingdom and United States) at 13%. However, for bottled wines specifically, China was Australia’s largest market in value and 2nd largest in volume, with 40% of the export value share and 24% of the export volume share.

Strong demand in China for Australian bottled wine coincided with the phased removal of import tariffs on Australian wine, which commenced in 2015 under the China-Australia Free Trade Agreement (ChAFTA). On 1 January 2019, the tariff on Australian wine fell to zero, giving Australia a 14% tariff advantage over competitors. Under zero tariff, Australia's share of China's total bottled wine imports increased from 28% in 2018 to 37% in 2019 in value terms.

Australian exports of bottled wine to China are expected to cease under a 167% AD duty (the average of AD duties levied across companies). The immediate impact of any duties on Australian bottled wine exports to China is likely to be bigger than the impact in the medium term because of the time required to develop new markets. While gradual adjustment will occur, only small volumes of wine are likely to be redirected to alternative markets in the short term.

In the medium term, altered production decisions and diversion to other markets will lessen the impact of China’s duties. In 2025, it is estimated that 60% of Australia’s wine exports that would originally have been destined for China that year – the equivalent of $720 million in 2020 dollars – will be diverted to alternative markets. The negative impact on export value is likely to be more significant than on export volume. Modelling shows total Australian wine export value (which included both bottled and unpackaged or bulk wine) would be around $480 million lower in 2025 (in 2020 dollars) than would be the case without the duties.

Model results show the gross value of wine production in 2025 also being $480 million lower than would otherwise be the case without China’s AD duties, due to reduced production combined with a lower expected average price. This would result in a loss of around $67 million to wine grape growers, equivalent to a 6.7% loss of the gross value of production of wine grapes. Applying this loss to ABARES farm survey data across 3 key wine grape producing regions represents a loss of about $11 million for wine grape growers in the Riverina, a similar loss for growers in Victoria’s North West region and a loss of about $23 million for wine grape growers in South Australia’s South East region.

Download this report

Australian wine in China: Impact of China’s anti-dumping duties - PDF

Australian wine in China: Impact of China’s anti-dumping duties - DOCX

Australian wine in China: Impact of China’s anti-dumping duties infographic - PDF