Summary

ABARES has applied a paddock-to-plate framework to examine key drivers of Australia’s citrus export growth following biosecurity market access. This case study is part of a broader ABARES research program that aims to inform governments and other agricultural industries in prioritising and building export markets. In doing so, this research supports the Australian Government’s Agriculture 2030 package to expand trade opportunities and build the competitiveness, resilience, and innovative capacity of Australian agriculture.

This report is a case study that examines key drivers of Australia’s citrus exports to ASEAN countries following biosecurity market access. The citrus industry is an example of an agricultural industry that, over the past decade, has successfully expanded and broadened its exports to a significant group of countries in south-east Asia. The value of Australia’s orange and mandarin exports more than doubled from $235 million in 2009–10 to $520 million in 2019–20, of which 19% or $120 million went to ASEAN countries (in 2019–20 prices).

New and enhanced market access provides the citrus industry with additional economic opportunities to supply citrus fruit to overseas markets. Access to a wide variety of markets also provides farmers the flexibility to respond to changing market circumstances.

- The Department of Agriculture, Water and the Environment (the Department) also negotiated 11 key market access achievements for Australia’s citrus exports between July 2013 and April 2020. These achievements mainly relate to biosecurity market access where biosecurity protocols are required to manage the risk of pest spread.

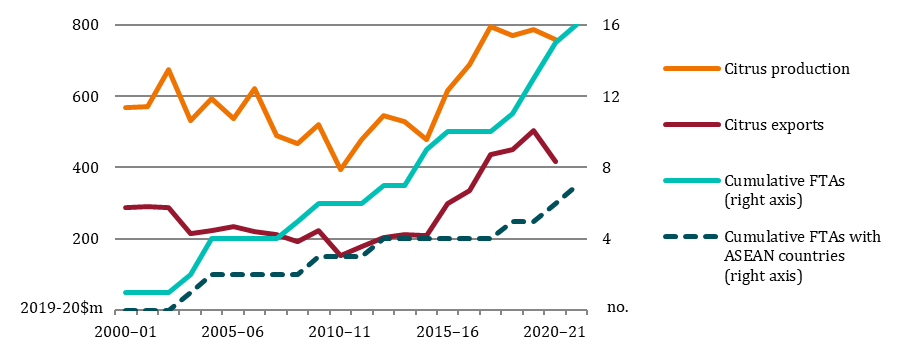

- The Australian Government has negotiated 16 free trade agreements (FTAs) of which seven include ASEAN countries (Figure S1 ). FTAs lower trade barriers by, for example, reducing the tariff imposed on Australia’s citrus exports in the importing country.

Figure S1 Market access and Australia's production and exports of oranges and mandarins, 2000–01 to 2021–22

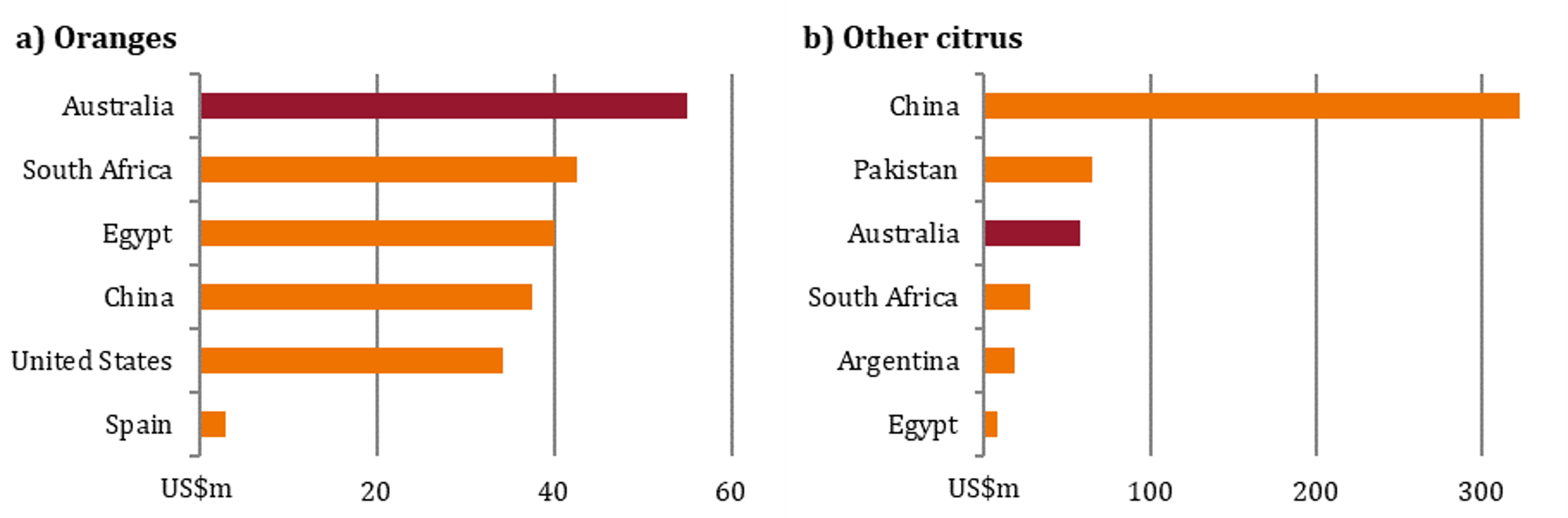

In 2019 Australia was the world’s tenth largest citrus exporter and, given its geographic proximity to Asia, was a key source of citrus imports to ASEAN countries. Australia was the second largest source of citrus imports to ASEAN countries overall the largest source of oranges and the third largest source of other citrus fruit (Figure S2).

Figure S2 Value of citrus imports to ASEAN countries, top 6 countries of origin, 2019

Source: United Nations Statistics Division 2021

Increased citrus trade over the past decade has been built on enhancing Australia’s reputation for providing high-quality and safe fresh citrus fruit during the southern hemisphere’s citrus-growing season. The citrus trade enhances consumer choice and nutrition security in ASEAN countries, facilitating the shift from a high reliance on rice toward a balanced diet that includes more fresh fruit and vegetables. This commodity-specific case study follows an introductory ABARES report, released in July 2021, which developed a framework for analysing key drivers across a paddock-to-plate spectrum.

- Growth in Australia’s citrus production and exports (the ‘paddock’) – key drivers were productivity growth and the fall in the value of the Australian dollar. Productivity growth was underpinned by reliable access to key inputs (particularly water, labour, and chemicals) and shipping, as well as good policy. The citrus industry has also switched toward citrus fruits and varieties to meet consumer demand growth for high-quality fresh fruit, particularly oranges and mandarins, and has adopted innovative production practices to improve yields of these citrus types. For example, there has also been a greater focus on producing better quality fruit through different cultivation practices (more investment in pruning and thinning).

- Market access, and biosecurity and industry self-regulation systems (trade enablers) – Australia’s trade links with the 10 member countries of ASEAN have been strengthened through mechanisms such as the Agreement establishing the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA) that came into force between 1 January 2010 and 10 January 2012. Biosecurity reforms, particularly the move towards Industry Authorised Officers to perform certain regulatory activities, replacing the traditional government inspection model, have increased the international competitiveness of Australia’s citrus industry. Notably, since the formation of Citrus Australia in 2008, a strong self-regulation model has emerged with, for example, the introduction of fruit quality standards in 2011.

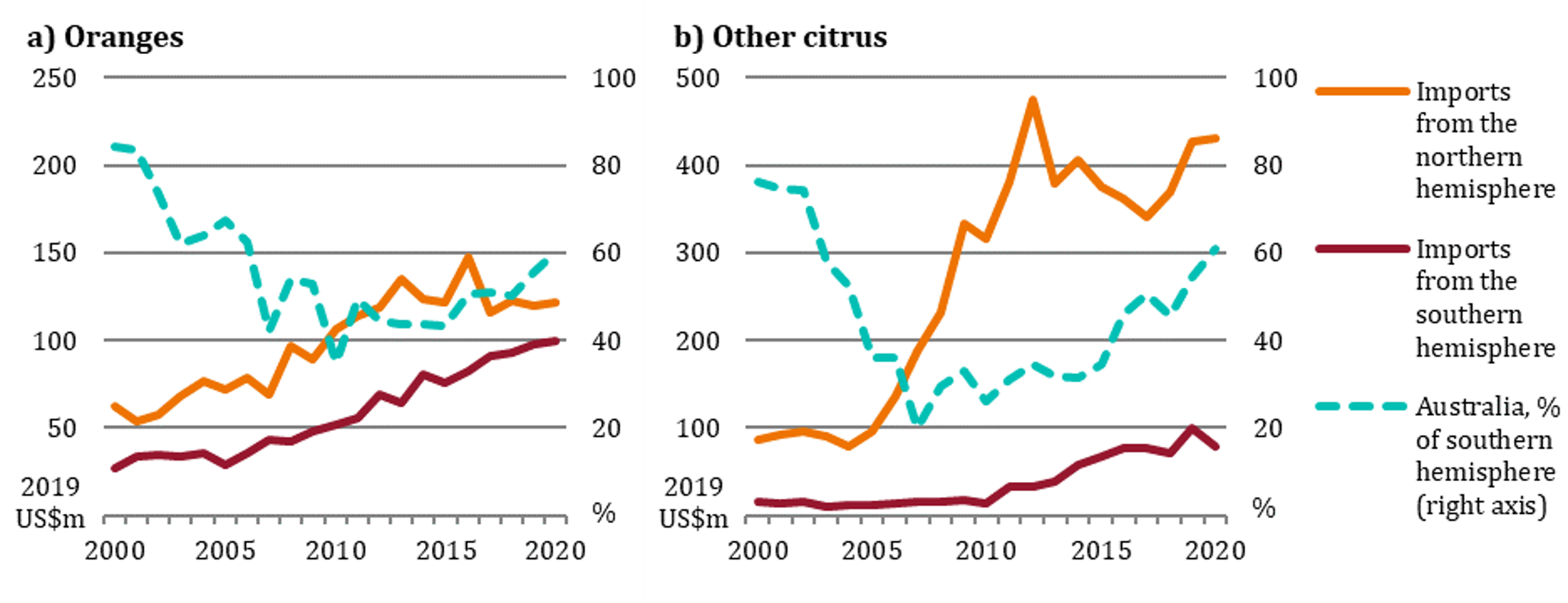

- Growth in citrus imports to ASEAN countries (the ‘plate’) – over the past decade, the gap between southern and northern hemisphere trade with ASEAN countries has narrowed for oranges, but remains large for other citrus fruit (Figure S3). In 2019 (representative year), southern hemisphere countries accounted for 45% of total ASEAN imports of oranges but only 19% of total ASEAN imports of other citrus fruit (indicating significant potential for future growth for other citrus fruits during the southern citrus-growing season). Key drivers of increased citrus imports from southern hemisphere countries were income growth, changes in consumer preferences (particularly important for other citrus) and population growth, while higher citrus import prices somewhat limited import demand growth. Income growth was the result of long-term economic development and urbanisation trends in ASEAN countries, which should also contribute to future demand growth, including for citrus imports from Australia.

Figure S3 Value of orange and other citrus imports to ASEAN countries, by hemisphere, 2000 to 2020

This case study identifies the complementary roles of government and industry regulation frameworks for achieving export expansion. Biosecurity reform and the strengthening of the citrus industry’s self-regulation model since 2008 have been particularly important developments.

There are important lessons from the citrus industry’s experience for Australia’s other horticultural industries. Importantly, Asia is a net food importer and average consumption per person of fresh fruit and vegetables is still relatively low in this region. Australia’s horticultural industries have considerable potential to expand export supply chains over the medium to longer term to deliver more high-quality fresh produce to consumers in overseas markets, particularly in the Asian region.