Author: Linden Whittle

Introduction

For the Australian forest and wood processing sectors, 2019–20 has been a tumultuous year. Beginning in September 2019, bushfires burnt across eastern and southern Australia, affecting large areas of both native forests and commercial plantations. This was followed shortly after by the COVID-19 pandemic which resulted in governments around the world, including Australia, instigating unprecedented restrictions to mitigate its spread.

Source: ABARES

The bushfires and COVID-19 are likely to have compounding effects on the industry in the short term. Some forest managers will need to increase harvesting operations in order to salvage fire-affected trees over the next 12 months. At the same time, domestic and international recessions resulting from COVID-19 lock-down measures are expected to reduce residential construction activity, significantly reducing demand for sawnwood and wood-based panel products.

Uncertainty around the extent of damage to production forest from the bushfires, and the potential duration and severity of the COVID-19 pandemic, mean that many of these impacts are highly uncertain.

[expand all]

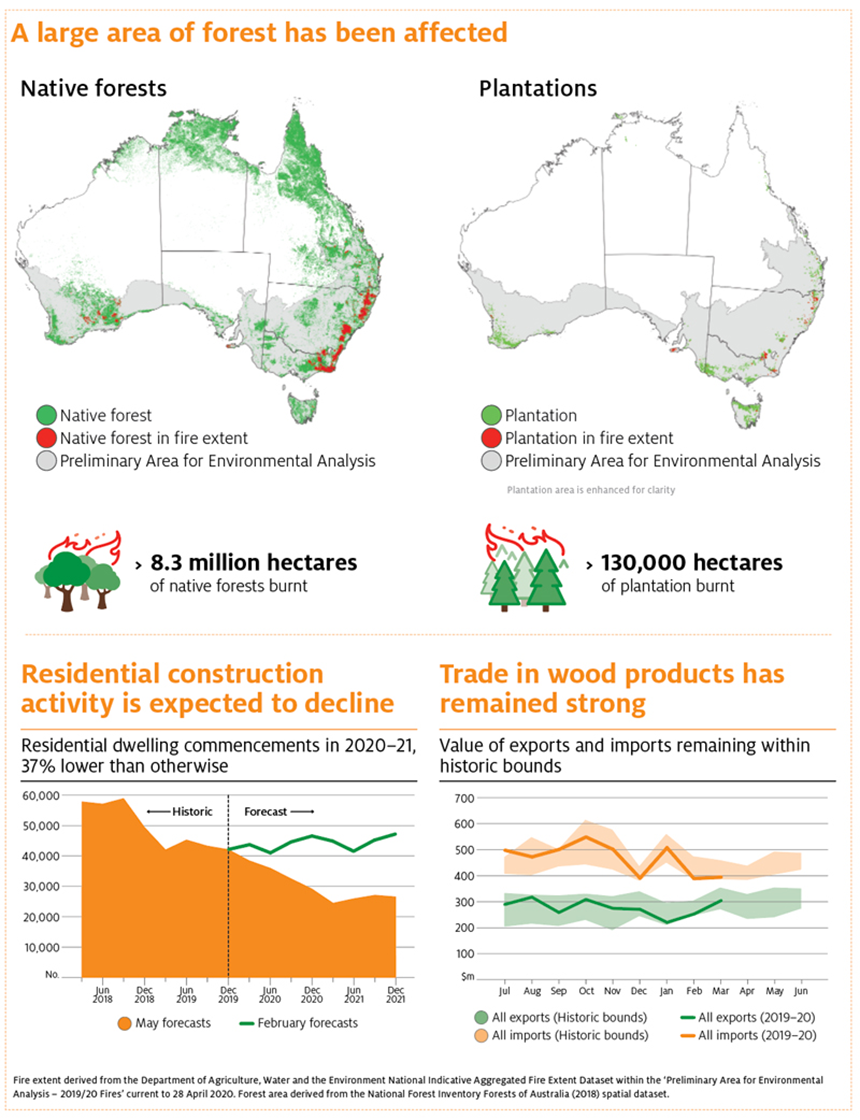

The extent of the bushfires is vast

While Australia has always had bushfires, the 2019–20 summer bushfire season was one of the most extensive in recorded history. As of 28 April 2020, around 8.5 million hectares of forests were potentially affected by the bushfires, comprising 8.3 million hectares of native forests, 130,000 hectares of commercial plantations and 22,000 hectares of other forests. The impacts of the fires within the fire extent are variable, with some areas being burnt less severely than others.

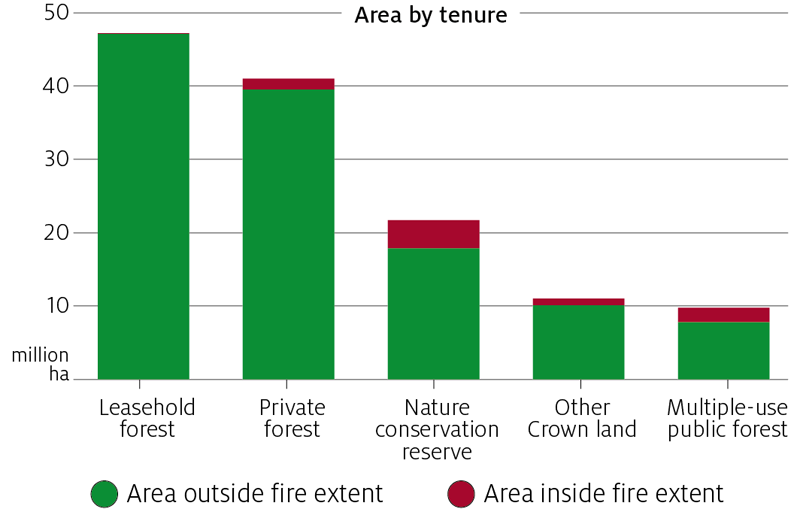

A large area of native forests designated for timber production is likely to be affected

At the national level, around 2.0 million hectares of multiple-use public native forests (20% of Australia’s total multiple-use public native forests) and 1.5 million hectares of private native forests (3.6% of Australia’s private native forests) fell within the extent of the fires (Figure 1). Native forests on other tenures such as conservation, leasehold (in most jurisdictions), and other Crown land are either excluded from harvesting or typically not used for timber production.

New South Wales and Victoria are the most affected jurisdictions, with 25% and 19% respectively of all native forests in these jurisdictions within the fire extent. In New South Wales, almost half (45%) of the total area of multiple-use public native forests and 17% of private native forests were in the fire extent. In Victoria, around 29% of multiple-use public native forests and 6% of private native forests were in the fire extent.

Commercial plantations have also been hit hard in some jurisdictions

While the area of plantations in the fire extent is much smaller than that of native forests, it represents a significant proportion of Australia’s commercial plantation estate. Furthermore, plantations generate a much greater volume of wood, on a per hectare basis, so even a small area of plantations impacted by the fires could have significant implications for log supply.

In New South Wales, around 71,000 hectares of softwood plantations (23% of that estate) and 21,000 hectares of hardwood plantations (24% of that estate) fell within the fire extent (Figure 2). The plantation estate in South Australia was potentially impacted proportionately more, with around 12,000 hectares of hardwood plantations (almost one third of that estate) located inside the fire extent.

Softwood harvest volumes are likely to increase in the short term while hardwood volumes decrease

There remains a great deal of uncertainty regarding the damage caused by the fires and potential salvageable volumes. The extent to which fire-affected trees can be harvested depends on the severity of the fires and the types of logs harvested. For example, if they are not severely burnt, sawlogs may still be processed by domestic sawmills and pulplogs may still be chipped to produce packaging and industrial paper and paperboard products. However, for printing and writing paper uses, pulplogs generally cannot have any degree of fire damage.

Softwood plantation harvesting operations will increase

While pine trees can withstand low intensity fires, they tend to be less resilient to fire than native species. Furthermore, there is a smaller window for the recovery of fire-affected pine trees (12 to 18 months) before deterioration and pest incursions render the timber uncommercial (NSW Forestry Corporation 2020b).

Nevertheless, many of the sawlogs from fully grown fire-affected softwood stands are expected to be salvageable. NSW Forestry Corporation has significantly increased the number of harvesting crews operating and expects harvest rates to be two to three times higher than normal in some fire-affected regions (Tumut and Adelong Times 2020).

Softwood pulplogs that are not severely affected by fires can also be salvaged, as most softwood pulplogs harvested in Australia are used to produce packaging and industrial paper and paperboard products. These applications are able to utilise logs with a small charcoal content.

Many fire-affected hardwood pulplogs may be lost

Hardwood pulplogs are typically used in the production of high-end paper and paperboard products (such as printing and writing paper). Most of the hardwood pulplogs harvested in Australia come from plantations and are exported for processing overseas (ABARES 2019). While some trees with minimal damage may recover and be used in their typical applications, many pulplogs that are more severely affected could become uncommercial. There are few alternative end uses for hardwood pulplogs, as they are unsuitable for producing sawnwood, and softwood pulplogs are preferred for most paper and paperboard products other than printing and writing paper (hardboard is an exception). This poses some challenges for the sector with many of the fire-affected hardwood pulplogs at risk of being unsalvageable. However, while these impacts may be substantial in some regions they are likely to be minor at the national level, with less than 4% of the national hardwood plantation estate affected by the fires.

The impacts on native forest log supply are uncertain

Some native species, such as eucalypts, are very resilient to the impacts of wildfire, with a number of sites already showing signs of recovery. Where these trees need to be harvested as a result of the fires, the recovery window can be multiple years after the fire.

Given the extent of the bushfires, it is expected to take some time for forest managers and state agencies to fully assess the impacts of the fires on their native forest estates. In assessing these impacts, native forest managers must also take into account stricter conditions that apply when harvesting fire-affected native forest areas (compared to plantations). These conditions are intended to protect and maintain wildlife habitat, forest flora, water quality and biodiversity across the landscape (NSW Forestry Corporation 2020c) and will add to the complexity of assessing the damage and required salvage operations.

Due to the greater restrictions on salvaging native forests affected by fires, it is likely that the salvage rate will be lower than that of plantations. NSW Forestry Corporation (2020c) estimates that around 60% of the native forest area managed by the corporation for timber production was affected by fires, but only a small proportion of these fire-affected areas will see selective harvesting take place.

Residential construction is expected to decline, reducing domestic demand for sawnwood and panels

The national and global economic outlooks are pessimistic

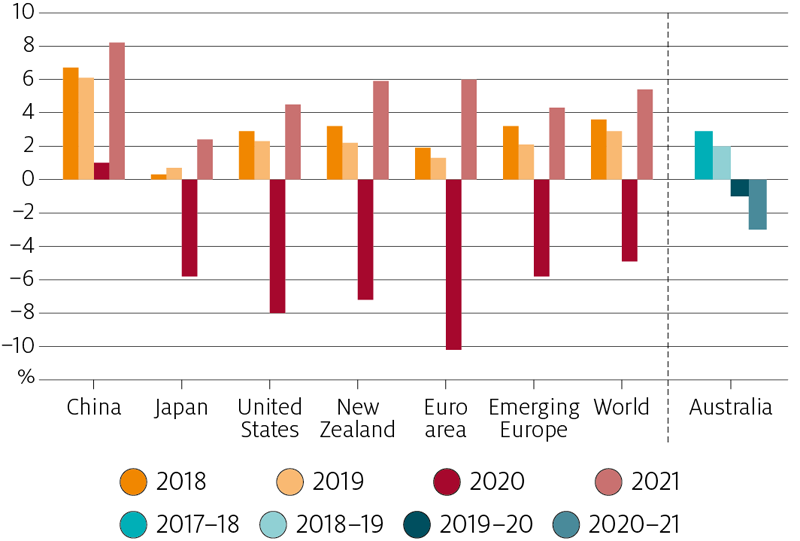

The restrictions put in place to mitigate the spread of COVID-19 will have significant impacts on the Australian and international economies. The Reserve Bank of Australia (RBA 2020) has predicted a 3% decline in Australian GDP in 2020–21. Looking more broadly, the International Monetary Fund (IMF 2020) has predicted a global recession with Gross Domestic Product (GDP) falling by 8.0% in advanced economies and 4.9% globally in 2020 (Figure 3).

Residential commencements are expected to fall significantly

Of particular concern for the forest and wood processing industry are the potential short-term impacts on residential construction activity. Residential construction is the single largest user of softwood sawnwood products in Australia, and accounts for a significant proportion of the demand for wood-based panel products.

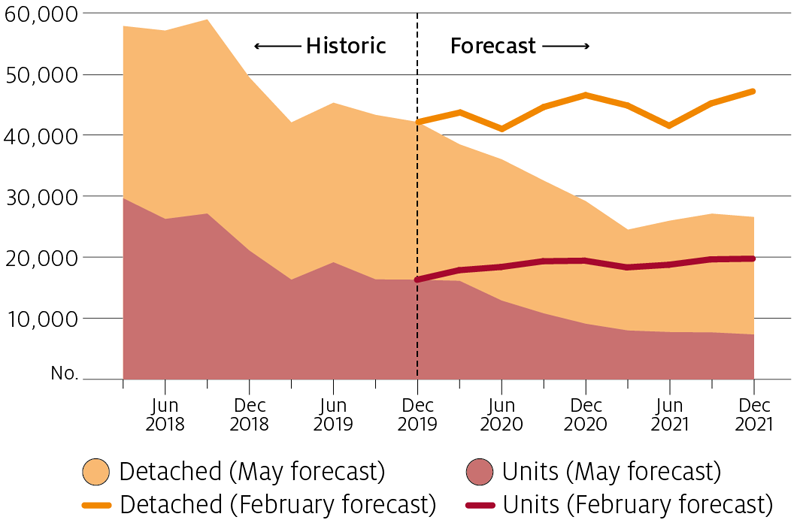

In May 2020, the Housing Industry Association (HIA) updated their medium-term forecasts of new dwelling commencements in light of the recent developments around COVID-19 (Figure 4).

The latest forecasts show a continued decline in residential dwelling commencements to March 2021. Early indicators provide some support for these predictions with private home sales declining 23.2% in March (Reardon 2020). This represents a significant downward revision in earlier forecasts released in February 2020, which had commencements increasing over the next two years. Specifically, the expected number of total commencements for the 2020–21 financial year are 37% lower than previously expected, with forecasts of units and detached house commencements reduced by 53% and 25%, respectively. The vast majority of these reductions can be attributed to COVID-19 related restrictions (Geordan Murray, personal communication, 2 June).

Source: HIA (2020)

Demand for sawnwood and wood-based panels are expected to decline

The expected decline in residential dwelling commencements has fuelled concerns that demand for sawnwood could decline by almost 50% over the next 6 months (AFPA 2020). Several mills, such as those owned by AKD Softwoods, are reducing production and cutting staff (ABC 2020). Demand for wood-based panels for interior use is also likely to decline.

However, sawnwood is not only used in the construction of new houses and units but also used in renovations, landscaping and furniture manufacturing. Wood-based panels are also used in renovations. The extent to which demand for sawnwood and wood-based panels decline will, therefore, also depend on the degree to which these activities may be affected.

Trade remains strong but this may change

The combined impacts of the bushfires and COVID-19 on trade in forest and wood products is complex. In the short term, trade appears to have been relatively unaffected by either the bushfires or COVID-19. However, many of the impacts may take several months or longer to flow through.

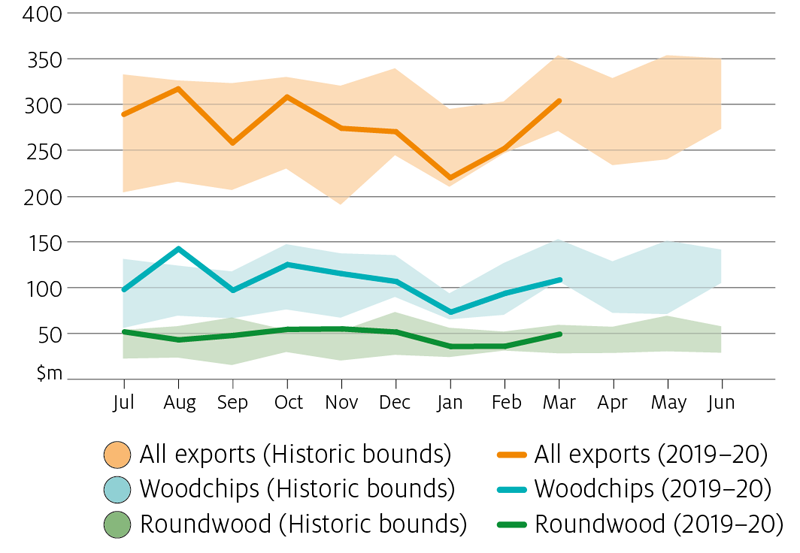

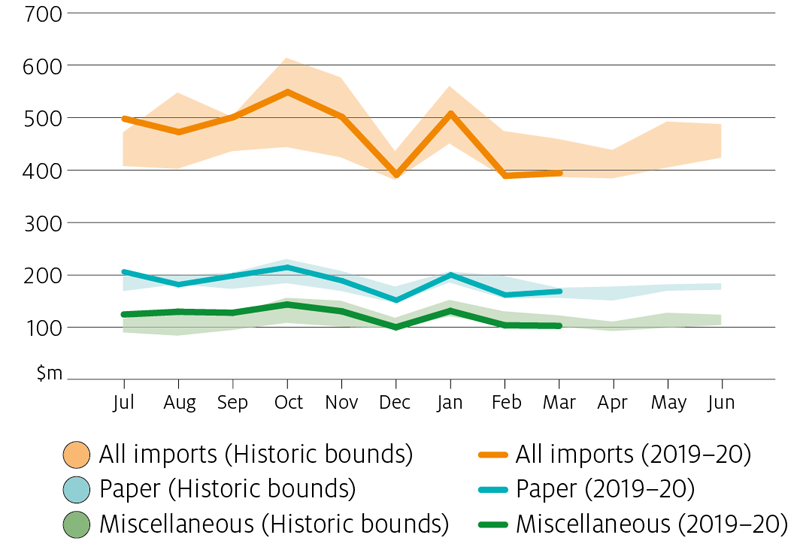

Trade has not been affected yet

While the total value of forest and wood-product exports in January and February were low compared to the previous five years, exports recovered in March, and were still within the historic range (Figure 5). The total value of forest and wood-product imports in December, February and March were also at the low end of the range of values observed over the last five years, but still within the historic bounds (Figure 6).

Source: ABS (2020)

The impact on exports could be delayed

One possible explanation for the resilience of trade is that China (Australia’s largest buyer of raw timber and fibre products) has continued to accept log and woodchip exports from Australia, despite reduced manufacturing activity. The demand for Australian exports may fall as Chinese manufacturers draw down on these stocks instead of importing.

There could also be further declines in exports if demand for Chinese manufactured wood products falls as a result of reduced economic activity in other countries and regions such as the United States, Japan and Europe.

Similarly, the impacts of the bushfires may not yet have flowed through to aggregate trade statistics. For the first few months of 2020, many forest managers have been in the process of taking stock of the impacts of the bushfires. Until salvage operations commence in full, and begin to generate additional volumes of logs, exports are likely to remain steady.

Putting it all together

Domestic market opportunities will be limited, making the sector more reliant on export markets over the coming months

The need to harvest fire-affected trees over the coming months will produce a much larger volume of logs than normal. With limited opportunities to sell these logs in the domestic market, growers may look to export markets. However, this comes at a time when the demand for Australian forest products in all key export markets is likely to be subdued.

The extent to which growers will rely on export markets depends on the degree to which domestic processors can take additional logs. Growers may consider transporting logs further distances than normal for processing, but many of the salvaged sawlogs may simply not be suitable for domestic processing. For example, softwood sawlogs not fully mature (less than 25 years old) are generally not large enough for domestic sawmills (NSW Forestry Corporation 2020a). It is also expected that the supply of pulplogs in the coming months will exceed that which can be processed domestically in the short term (NSW Forestry Corporation 2020a).

In response to the forecast decline in residential construction activity some mills have temporarily closed, and others have reduced activity. This demonstrated reluctance of sawmills to build up log or sawnwood inventories will further reduce the volume of salvage logs that can be processed in the short term. Theoretically, salvaged logs may be stored in appropriate facilities until domestic processors have the capacity to process them, but it is likely to be more profitable to export these logs if possible.

Export prices may fall, but domestic prices will likely remain stable if the downturn is short-lived

A global recession is likely to reduce demand for many wood products, especially those used in construction. This, combined with an increase in roundwood and woodchip exports from Australia, due to the bushfires, could put downward pressure on international prices and specifically prices received for Australian logs and fibre. However, even in the absence of increased supply, the prices received are likely to be lower due to the smaller diameter of sawlogs and lower quality of pulplogs.

Changes in international prices for roundwood and fibre are unlikely to affect domestic prices in the immediate future as most forest managers and processors have long-term supply agreements in place. While these agreements allow for annual renegotiation of prices, international prices are only one of many factors that are used to determine log costs.

Log supply will be lower in the medium to long term

In the medium to long term, the age profile of softwood plantations, particularly in New South Wales, will change significantly as fire-affected areas are replanted. Changes in this supply may have implications for the structure and competitiveness of the domestic processing industry. In the coming months, ABARES will undertake a comprehensive spatial survey of plantation growers which should provide a more accurate indication of the potential impacts of the bushfires on long-term log supply.

References

ABC (2020), Australia's largest sawmill stands down workers as housing construction sector prepares for slow down, May 7

ABS 2020, 5368.0 - International Trade in Goods and Services, Australia, Mar 2020, May

AFPA 2020, AFPA forecasts a calamitous decline in housing construction: urgent recovery package needed, Australian Forest Products Association, media release, April 22

HIA 2020, Housing Predictions and Forecast, May

IMF 2020a, World Economic Outlook, April 2020: The Great Lockdown, April

IMF 2020b, World Economic Outlook, June 2020: A Crisis Like No Other, An Uncertain Recovery, June

NSW Forestry Corporation 2020a, Tumut begins export program for fire-affected timber as fire recovery ramps up, Media Release, April 8

NSW Forestry Corporation 2020b, 2020 bushfire recovery, accessed 26 May

NSW Forestry Corporation 2020c, Harvesting timber from fire-affected native forests, accessed 26 May

RBA 2020, Statement on Monetary Policy – May 2020, May

Reardon, T, 2020, New home sales decline by 23.2 per cent in March, Conversation Article.

Tumut and Adelong Times, 2020, Timber industry’s race against the clock.