Download Full Report and Data

This report contains ABARES forecasts for the value, volume and price of Australia’s agricultural production and exports to 2028–29.

Outlook and commodity summaries

The summary sections below provide and outline of updates for the March 2024 quarter. Further information on these topics is available in the Full Report and Data section above.

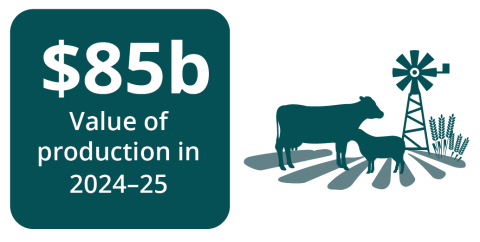

- Value of agricultural production forecast to rise by 6% to $85 billion in 2024–25.

- Improving seasonal conditions relative to 2023–24 to support crop production values.

- Saleyard prices for livestock to recover in 2024–25 from sudden increase in domestic supply in 2023-24.

- High global demand for livestock production to support rising international prices.

- Average farm cash income to recover from large drop in 2023–24, rising by 47% in 2024–25.

Download this report: Overview (PDF 3.9 MB)

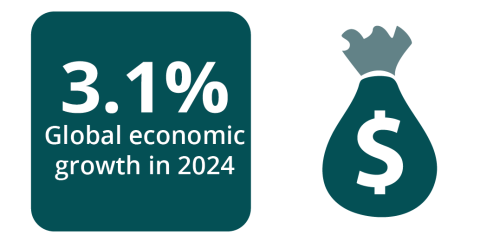

- Global economic prospects to remain subdued in 2024 reflecting sluggish consumption growth.

- Strong population and income growth in Asia to support aggregate food consumption over the outlook.

- The Australian Dollar is assumed to appreciate over the medium term.

- Global supply chain disruptions a risk for higher farm input prices.

Download this report: Economic Overview (PDF 3.9 MB)

- Global crop production in 2023–24 projected to remain above 2022–23 levels despite extreme heat in the northern hemisphere, El Niño and positive Indian Ocean Dipole impacts in the south.

- Australian 2023–24 crop production improved in the east since the December 2023 Agricultural Commodities Report (PDF - 3.8 MB).

- Above average summer 2023–24 rainfall and subsequent build-up of soil moisture reserves in eastern Australia is expected to provide a strong incentive for planting ahead of the 2024–25 winter crop season.

Download this report: Seasonal Conditions (PDF 3.9 MB)

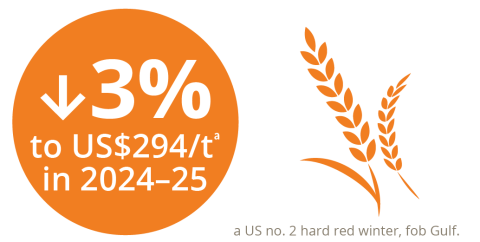

- Value of Australian wheat production in 2024–25 to increase to $10.4 billion, driven by higher production.

- Value and volume of wheat exports to remain above historical average in 2023–24 and 2024–25.

- Australian wheat production to increase to above average levels in 2024–25 under expectation of improved seasonal conditions.

- World production and consumption of wheat to increase over the medium term.

Download this report: Wheat (PDF - 3.9 MB)

- Value of coarse grain production to increase by 5% to $5.1 billion in 2024–25.

- Value of coarse grain exports to decrease by 9% to $3.9 billion in 2024–25.

- World coarse grain prices expected to soften in 2024–25, reflecting increased global production.

- Value of coarse grain production over the medium term to fluctuate with changes in seasonal conditions.

Download this report: Coarse Grains (PDF - 3.9 MB)

- Value of canola production to increase by 7% to $4.1 billion in 2024–25.

- Value of canola exports to decrease by 7% to $3.5 billion in 2024–25.

- Australian canola export price is forecast to fall by 1% in 2024–25, averaging $508 per tonne.

- Global oilseed prices to fall over the medium term as growth in global oilseed supply outpaces demand.

Download this report: Oilseeds (PDF - 3.9 MB)

- Value of Australian sugar production to remain steady in 2024–25 at $2.2 billion.

- Value of Australian sugar exports to decline by 1% in 2024–25 to $3.2 billion.

- More favourable climate conditions to lead to slightly higher Australian sugar production in 2024–25.

- Global sugar prices to fall from elevated levels in 2023–24, reflecting growing world production.

Download this report: Sugar (PDF - 3.9 MB)

- Value of wine grape production to fall by 2% to $926 million in 2024–25.

- Value of wine exports to fall by 3% to $1.8 billion in 2024–25.

- Declining demand for wine and high existing stocks weighing on prices, both domestically and globally.

- National prices to fall by 4% for red wine grapes and 1% for white wine grapes in 2024–25.

Download this report: Wine (PDF - 3.9 MB)

- Value of horticultural production to reach a new record of $17.8 billion in 2024–25.

- Value of horticultural exports to rise by 11% to $4.0 billion in 2024–25.

- Production volumes to increase in 2024–25, driven by more favourable seasonal conditions.

- Increasing world and domestic demand supporting growth in horticulture value over the outlook.

Download this report: Horticulture (PDF - 3.9 MB)

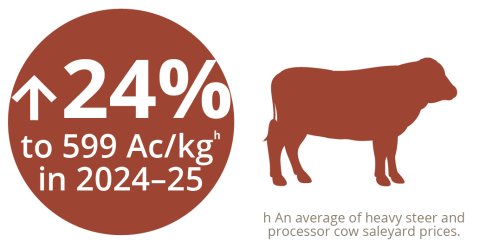

- Value of beef, veal and live cattle production to rise by 25% to $15.7 billion in 2024–25.

- Value of beef and live cattle exports to increase by 6% to $13.0 billion in 2024–25.

- Beef export prices to rise in 2024–25.

- Saleyard prices expected to rise in 2024–25, reflecting increased restocker demand.

- Value of beef production over the medium term to fluctuate with changes in seasonal conditions.

Download this report: Beef and veal (PDF - 3.9 MB)

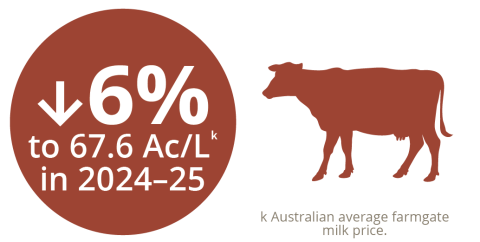

- Value of milk production to fall by 7% to $5.5 billion in 2024–25.

- Value of dairy product exports to remain stable at $3.0 billion in 2024–25.

- World demand to rise by more than world supply in 2024–25.

- Farmgate milk prices forecast to fall by 6% to 67.6 cents per litre in 2024–25.

- Value of milk production falling over outlook period as milk production and farmgate prices decline.

Download this report: Dairy (PDF - 3.9 MB)

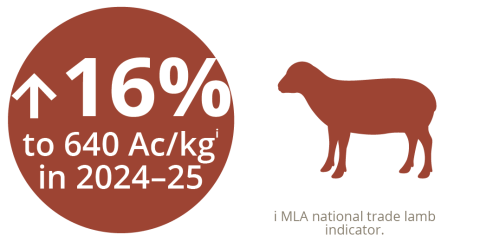

- Value of sheep meat and live sheep production to rise by 21% to $4.4 billion in 2024–25.

- Value of sheep meat exports to increase by 24% to $4.1 billion in 2024–25.

- Export prices to rise in 2024–25.

- Saleyard prices expected to rise in 2024–25, reflecting increased restocker demand.

- Value of sheep meat production over the medium term to fluctuate with changes in seasonal conditions.

Download this report: Sheep meat (PDF - 3.9 MB)

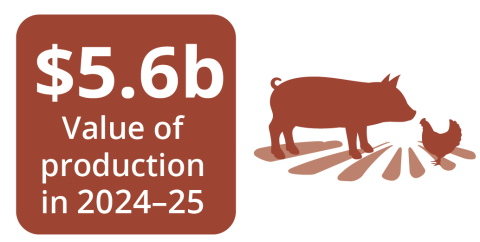

- Value of poultry meat production to increase by 2% to $3.9 billion in 2024–25.

- Value of pork meat production to increase by 2% to $1.7 billion in 2024–25.

- Value of egg production to fall by 1% to $1.3 billion in 2024–25.

- Domestic demand for pork and poultry meat to grow but their share of meat consumption to stabilise.

Download this report: Pigs, Poultry and Eggs (PDF - 3.9 MB)

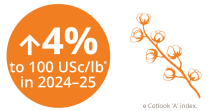

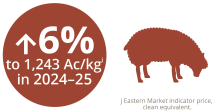

- Value of Australian wool production and exports to rise in 2024–25.

- Value of Australian cotton production and exports to fall in 2024–25.

- Global prices of natural fibres to rise moderately in real terms to 2028–29.

- Value of Australian wool and cotton production to rise in real terms to 2028–29.

Download this report: Natural Fibres (PDF - 3.9 MB)

- Despite some improvements in weather and farm prices since December, average broadacre farm cash incomes are still expected to be well below average in 2023–24 at $131,000.

- Broadacre farm cash incomes are likely to increase in 2024–25, with a mean forecast of $192,000.

- Higher forecast farm incomes in 2024–25 are being driven by potential improvements in growing conditions for winter crop production, and forecast increases in beef and sheep prices.

- However, these factors are being offset by lower forecast crop prices and expected increases in farm costs tied to increased production.

Download this report: Farm Performance (PDF - 3.9 MB)