Download Full Report and Data

This report contains ABARES forecasts for the value, volume and price of Australia’s agricultural production and exports to 2024–25.

Outlook and commodity summaries

The summary sections below provide and outline of updates for the September 2024 quarter. Further information on these topics is available in the Full Report and Data section above.

- Gross value of agricultural production forecast to rise by 4% to $86.2 billion in 2024–25.

- Livestock and livestock product production values to increase driven by strong global demand.

- Crop production values to rise despite lower global grain and oilseed prices.

- Agricultural exports to be $68.5 billion in 2024–25, with increased livestock values.

- Input pressures expected to ease in 2024–25 supporting a rebound in farm incomes in some regions.

Download this report: Overview (PDF - 4.7 MB)

- Global economic prospects to improve in 2025 as interest rates ease.

- Chinese household consumption to remain weak in 2025 as fiscal support targets industrial production.

- Australian consumer spending to increase with growth in household disposable income.

- Australian dollar assumed to average US67 cents over 2024–25.

- Input pressures expected to ease for Australian agricultural businesses.

Download this report: Economic Overview (PDF - 4.7 MB)

- Average to above average winter rainfall has boosted soil moisture levels across much of Queensland, New South Wales and Western Australia, providing an improved outlook for 2024–25 winter crop yield potentials.

- In contrast, winter-to-date rainfall totals in southern New South Wales, Victoria and across the southern South Australia have only been sufficient to support a delayed establishment and below average yield expectations for 2024–25 winter crops, with minimal improvements in stored soil moisture levels.

- Favourable global production outcomes are anticipated from wetter than normal conditions observed across most northern hemisphere grain and oilseed producing regions.

Download this report: Seasonal Conditions (PDF - 4.7 MB)

- Gross value of Australian wheat production to increase to $10.7 billion in 2024–25, driven by higher production.

- Value and volume of wheat exports to fall with falling prices and exportable supplies.

- World wheat prices continue easing, reflecting high global supply and subdued demand.

Download this report: Wheat (PDF - 4.7 MB)

- Gross value of barley production to increase 4% to $3.7 billion in 2024–25 driven by increased volumes.

- Gross value of sorghum production forecast to fall 2% to $912 million as a result of lower prices.

- Australian coarse grain production to remain above the long-term average supported by favourable seasonal conditions.

- Increased global supply of coarse grains has led to falling international and domestic prices.

- Coarse grain export volume and value to fall in 2024–25 but remain above long-term averages.

Download this report: Coarse Grains (PDF - 4.7 MB)

- Gross value of oilseed production to fall to $3.3 billion in 2024–25.

- Australian canola prices are forecast to fall due to large South American and US soybean harvest.

- Australian production volumes to fall in 2024–25 due to lower area planted.

- Global biofuel policies have been impacting oilseed pricing dynamics.

Download this report: Oilseeds (PDF - 4.7 MB)

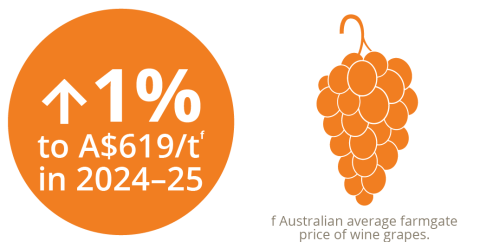

- Gross value of wine grape production forecast to increase 1.5% in 2024–25 to $888 million.

- Value of wine exports to rise 5% in 2024–25 to $2.4 billion, following removal of China’s import tariffs.

- Average wine grape price to rise 1% to $619 per tonne in 2024–25, driven by premium varieties.

- Prices for red grape varieties in warm inland regions forecast to remain low.

- Wine grape production for crush to remain steady at 1.43 million tonnes in 2024–25.

Download this report: Wine (PDF - 4.7 MB)

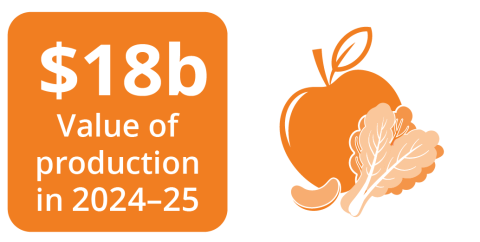

- Gross value of horticulture production to reach a record high of $17.8 billion in 2024–25.

- Domestic production and export volumes to rise, driven by higher yields for fruit and nuts.

- World demand for fruit and nuts to increase, driven by high value markets like China, Japan and Korea.

- World supply of fruit and nuts to rise, reflecting improved growing conditions for major producers.

Download this report: Horticulture (PDF - 4.7 MB)

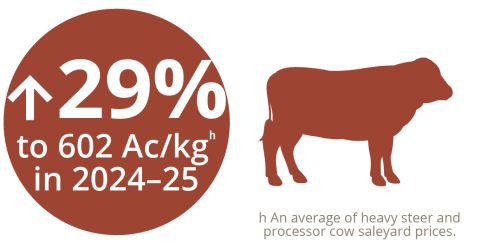

- Gross value of production to rise by 19% to $16.3 billion in 2024–25 driven by higher prices and production.

- Domestic production and export volumes to increase as the Australian cattle herd reaches production maturity.

- Global beef demand to rise driven by the United States, leading to higher beef export prices.

- Global beef supply to fall with lower production in the United States and Brazil.

Download this report: Beef and veal (PDF - 4.7 MB)

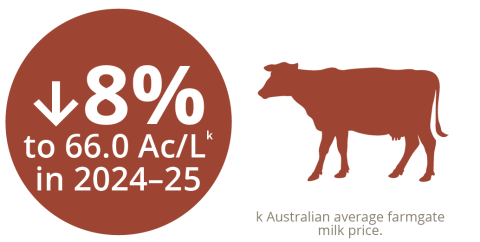

- Gross value of milk production to fall by 10% to $5.5 billion in 2024–25.

- Farmgate milk prices to fall, reflecting a lower incentive to secure supply. Global prices to rise as demand increases by more than supply.

- Domestic dairy production to fall by 1% to 8.3 billion litres in 2024–25.

- Value of dairy product exports to fall by 7% to $3.1 billion in 2024–25.

Download this report: Dairy (PDF - 4.7 MB)

- Gross value of sheep meat and live sheep production to rise by 18% to $5.2 billion in 2024–25.

- Lamb and sheep saleyard prices to rise with improved saleyard demand.

- Value of sheep meat and live sheep exports to rise by 17% to $5.7 billion.

- Strong export demand supporting prices and lamb turn-off despite improved seasonal conditions.

- Rising world demand for sheep meat expected to outweigh higher world supply.

Download this report: Sheep meat (PDF - 4.7 MB)

- Gross value of wool production to fall in 2024–25 down by 3% to $2.7 billion.

- Gross value of cotton production to fall in 2024–25 down by 13% to $2.7 billion.

- Australian wool prices to fall by 2% in 2024–25 reflecting subdued global demand.

- World cotton prices to fall by 6% in 2024–25 as rising global supply outpaces growth in demand.

- Value and volume of wool and cotton exports to fall in 2024–25; inventories to rise.

Download this report: Natural Fibres (PDF - 4.7 MB)

- Average broadacre farm business profits forecast to increase by $81,000, up to $24,000 in 2024–25 driven by improving weather conditions and higher livestock prices.

- Cropping farms are expected to have another profitable year, with production outpacing easing commodity prices.

- Livestock farm profits are forecast to increase driven by higher prices, but remain below historical averages.

- Profitability is expected to be strong across northern Australia and much of New South Wales, while drier conditions and relatively low mutton prices contribute to lower profits in southern regions.

Download this report: Farm Performance (PDF - 4.7 MB)