Farm-to-retail price spread and farm share of the retail price are high-level indicators of the cost structure of a food supply chain.

Farm-to-retail price spread and farm share of the retail price are high-level indicators of the cost structure of a food supply chain.

Farm share is the proportion of farm value in the retail price of a food item purchased at a retail store.

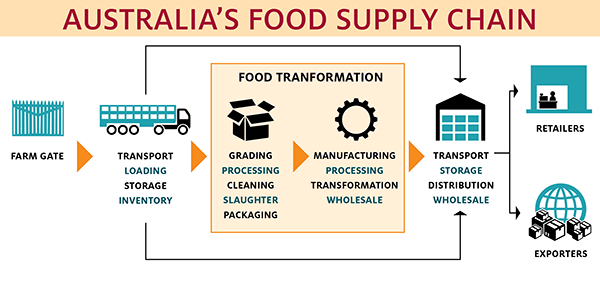

The farm-to-retail price spread is the difference between the retail price and farm value at a given point in time. The farm-to-retail price spread includes payments for value-added services beyond the farm gate that are needed to transform a raw product into a retail product.

They include transport, processing and retailing costs. Movements in farm share and price spread are analysed because a decline in farm share or an increase in price spread could signify a change in the level of competition in one or more sectors of a food supply chain.

Few studies systematically analyse movements in farm share or price spread in Australia over the long term.

Despite this, some price data are available in Australia that could be used to estimate long-term trends in farm share and price spread.

Although these data have some limitations, ABARES has investigated the potential to estimate farm share and price spread over longer periods by applying the United States Department of Agriculture Economic Research Service’s (US DA ERS) methodology to Australian data, using the sugar and beef industries as examples.

[expand all]

Farm share and price spread in Australia’s beef supply chain

Overview

This study uses a case study approach to demonstrate the potential to estimate farm shares and price spreads in Australia using a relatively simple methodology developed by the United States Department of Agriculture Economic Research Service. In this instance, the methodology has been applied to Australian beef price data.

Key Points

- The study demonstrates that data is available that allows an analysis of farm share and price spread for beef sold at domestic retail outlets and to export markets.

- The analysis shows that trends in farm share of the retail price and the farm-to-retail price spread were relatively flat between 1970-71 and 2015-16. It also shows that trends in farm share of the export price and the farm-to-export price spread were flat between 1996-97 and 2015-16.

- If it is assumed that the emergence of market power beyond the farm gate is likely to be reflected in a sustained widening in price spread or a sustained decline in farm share, then these results suggest that there has been no obvious change in market power within the beef industry over the this period.

Read the full report

| Document | Pages | File size |

|---|---|---|

Farm share and price spread in Australia's beef supply chain DOCX  |

27 | 3.2 MB |

Farm share and price spread in Australia's beef supply chain PDF |

27 | 1.3 MB |

If you have difficulty accessing these files, please visit web accessibility.

Farm share and price spread in Australia’s sugar supply chain

Overview

This study uses a case study approach to demonstrate the potential to estimate farm shares and price spreads in Australia using a relatively simple methodology developed by the United States Department of Agriculture Economic Research Service. In this instance, the methodology has been applied to Australian sugar price data.

Key Points

- The study demonstrates that data is available that allows an analysis of farm share and price spread for raw sugar exports and refined sugar sold at retail outlets.

- The analysis shows that trends in farm shares of retail and export prices were relatively flat between 1984-85 and 2014-15. So too were trends in farm-to-retail and farm-to-export price spreads.

- If it is assumed that the emergence of market power beyond the farm gate is likely to be reflected in changes in trends in farm share and price spread, then these results suggest that there has been no obvious change in market power within the sugar industry over this period.

Read the full report

| Document | Pages | File size |

|---|---|---|

Farm share and price spread in Australia's sugar supply chain DOCX |

30 | 3.1 MB |

Farm share and price spread in Australia's sugar supply chain PDF |

30 | 1.9 MB |

If you have difficulty accessing these files, please visit web accessibility.

Farm-to-retail price spread and farm share in food supply chains: background paper

Overview

This report examines Australian and international experience in monitoring farmgate and retail prices for food products. It also outlines a simple methodology to monitor farm shares and farm-to-retail price spreads for food products, and investigates the potential to apply the methodology to Australian data.

Key Points

- The food retail sector in Australia is highly concentrated while there is increasing consolidation in the food processing sector. There is some concern that this could lead to farmers receiving lower prices and consumers paying higher prices than would be the case in a perfectly competitive market.

- The paper reviews local and international research in monitoring movements in farm and retail prices for food products, outlines a simple methodology to monitor farm shares and farm-to-retail price spreads for food products, and investigates the potential to apply the methodology to Australian data.

- The review of international research found significant variation across countries in the importance they place on food price monitoring and analysis. Research has consistently found that the more processed food products are, the lower the farm share, and that farm shares have generally been declining over time.

- The review also found that the United States Department of Agriculture Economic Research Service (USDA ERS) is a world leader in analysing prices in food supply chains. The paper outlines a relatively simple methodology used by the USDA ERS to monitor changes in farm shares and farm-to-retail price spreads for food products.

- While there are limitations with the USDA ERS approach, an increase in farm-to-retail price spread or a decrease in farm share of the retail price could be a useful early indicator that competition issues are emerging within a supply chain. However, additional analysis will always be required to confirm whether the cause was an increase in market power because these changes can occur for a number of reasons, including differences in productivity in different sectors or input prices increasing at a faster rate in the retail sector than in the farm sector. Unfortunately, there is generally a lack of data that will allow a breakdown in marketing costs to facilitate this analysis.

- One option for additional research is to replicate another methodology developed by the USDA ERS, which uses input-output data to decompose costs and profits between different sectors within a supply chain and to estimate returns to primary factors, including capital and labour. This type of analysis would be more expensive than the high-level analysis described in this paper but it would also be more informative than the farm share/price spread analysis in identifying the range of factors influencing prices, and lead to a more informed debate about the various factors influencing prices, including market power.

Read the full report

| Document | Pages | File size |

|---|---|---|

Farm-to-retail price spread and farm share in food supply chains: Background paper DOCX  |

50 | 1.4 MB |

Farm-to-retail price spread and farm share in food supply chains: Background paper PDF  |

50 | 1.7 MB |

If you have difficulty accessing these files, please visit web accessibility.

Definitions of farm share pricing concepts

Retail price

Retail price is the amount consumers pay for a food item in retail grocery stores.

Farm value

Farm value is the payment farmers receive for the farm product equivalent of a retail food item sold to consumers.

Farm share

Farm share is the proportion of the amount consumers pay for a the food item in retail grocery stores that farmers receive.

Farm-to-retail price spread

Farm-to-retail price spread is the difference between the retail price and the value of farm inputs used to produce a food item.