This product contains the latest Total Factor Productivity (TFP) estimates for Australian broadacre and dairy farms. These estimates are produced using ABARES farm survey data from 1977-78 to 2023-24. The data is presented by industry, state and region.

Productivity is an important measure of Australian farm performance. It shows how efficiently inputs (labour, capital, land, materials and services) are used to produce outputs (crops, wool, and livestock) over time. Growth in the ratio of outputs produced to inputs used translates to improved profitability and competitiveness for farmers.

In the long term, estimates of productivity reflect changes in farm business scale and management practices, and technological progress. However, short-term estimates of productivity are often highly volatile, and influenced by seasonal conditions and other temporary factors. Readers should be cautious when interpreting conventional agricultural productivity estimates over short time periods.

To account for short-term volatility in conventional productivity estimates caused by variation in climatic conditions, ABARES has produced climate-adjusted productivity estimates from 1988-89 to 2023-24. These estimates are produced using the ABARES farmpredict model, however an interim approach has been used for 2022-23 and 2023-24 while farmpredict undergoes maintenance.

Key findings

- The headline productivity index for broadacre decreased from 2022-23 to 2023-24. This short term decline was mainly due to hot and dry conditions impacting crop output in Western Australia.

- Long-run national productivity growth in the broadacre industries averaged 1.0% per year from 1977-78 to 2023-24.

- Dairy industry productivity growth averaged 1.2% per year from 1978-79 to 2023-24.

July 2025 update

The ABARES Productivity Data Dashboard now includes headline estimates for 2023-24. In addition, this latest release retrospectively adjusts the 2022-23 estimates after improvements to underlying data quality. These data changes mainly relate to the reclassification of some farm records (e.g. from sheep to cropping). Minor retrospective adjustments are expected for the 2022-23 and 2023-24 climate-adjusted productivity series pending maintenance being finalised on farmpredict.

This PowerBI data dashboard may not meet accessibility requirements. For more information about the contents of this product contact ABARES.

ABARES publishes estimates of climate-adjusted total factor productivity (TFP) alongside conventional or ‘unadjusted’ TFP statistics. Climate-adjusted productivity estimates are derived from ABARES farm survey data combined with the farmpredict model - a machine learning-based microsimulation model of Australian broadacre farms.

Farmpredict generates synthetic counterfactual farm level data for broadacre farm inputs and outputs, under a range of climatic conditions. For example, the model can estimate the inputs and outputs of agricultural production for a farm in particular year, had it experienced the climatic conditions that existed in a different year. See more information about the farmpredict model.

Synthetic farm-level results are calculated across a range of years to generate an estimate of a particular farm’s performance under ‘average’ climate conditions. TFP estimates are then generated from the synthetic data using the standard methodology for generating farm-level agricultural productivity estimates (as outlined in Zhao et al. (2012)).

Whilst year-to-year climate conditions vary significantly, Australia post-2000 has experienced a deteriorating climatic trend, specifically through hotter and drier than average seasonal conditions. Climate-adjusted productivity estimates are an important measurement tool because they largely remove the impacts of both annual variations and the trend in climate conditions, thereby revealing the underling pattern of productivity growth in Australian agriculture.

The growth in climate-adjusted agricultural productivity for Australia’s broadacre agriculture industry has been gradual and positive over the three decades since 1988-89. This growth reflects improvements in productivity over time that farmers have achieved through investing in new technologies and adopting new practices in production.

Climate-adjusted TFP estimates are available from 1988-89 onwards for the broadacre industry. The estimates are also available for the broadacre sub-industries (cropping, beef, sheep, sheep-beef, and mixed livestock-cropping), and are available at national and state level geographies. ABARES provides updates to the series on an annual basis.

Climate-adjusted productivity estimates are designed to serve as a key measure of farm performance. As the estimates largely remove climate-induced volatility, they should be used as the preferred measure of assessing technological progress in Australian agriculture, particularly over shorter time periods.

Industries

The TFP numbers are calculated for each of the following:

- All Broadacre industries

- Cropping industry

- Mixed crop-livestock industry

- Sheep industry

- Beef industry

- Dairy industry

States & Regions

The TFP numbers are calculated by industry at the national level, as well as by industry & by state, or by industry & by region.

Australia agricultural industry regions are depicted below:

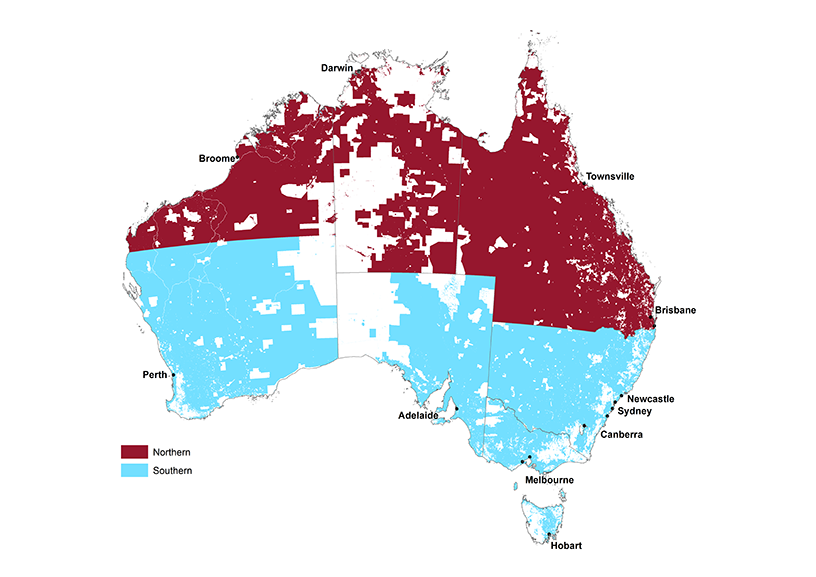

Beef industry regions, based on Meat and Livestock Australia regions

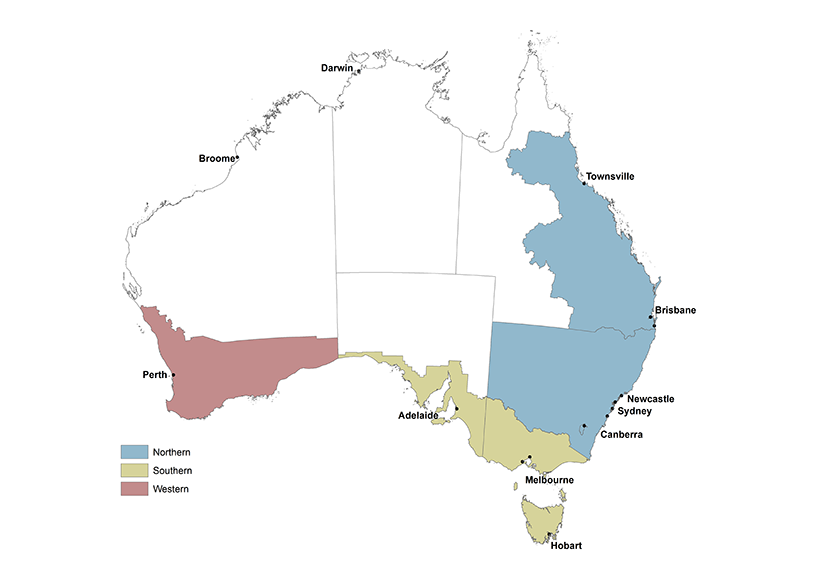

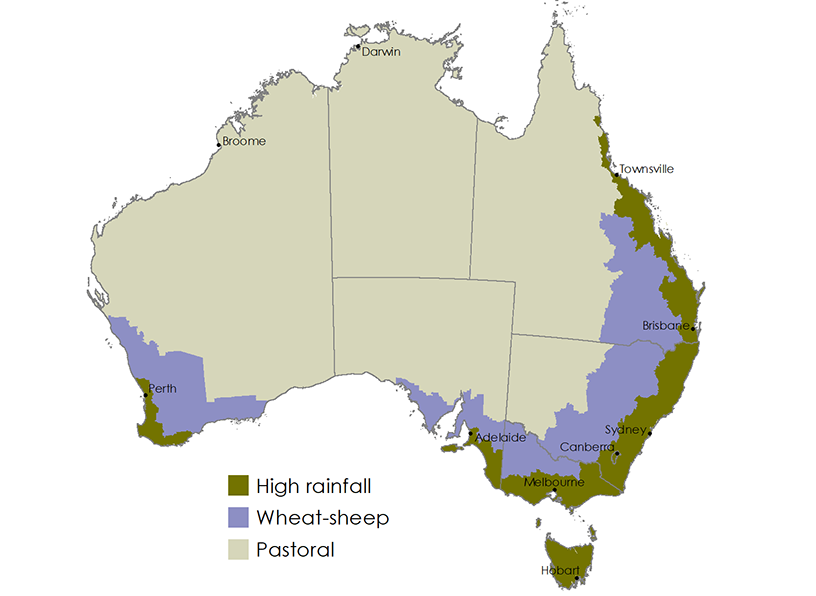

Cropping and mixed industry regions, based on Grains Research and Development Corporation regions

Sheep industry regions, based on ABARES broadacre regions

For more detailed definition of Agricultural industry regions, visit Farm surveys definitions and methods.

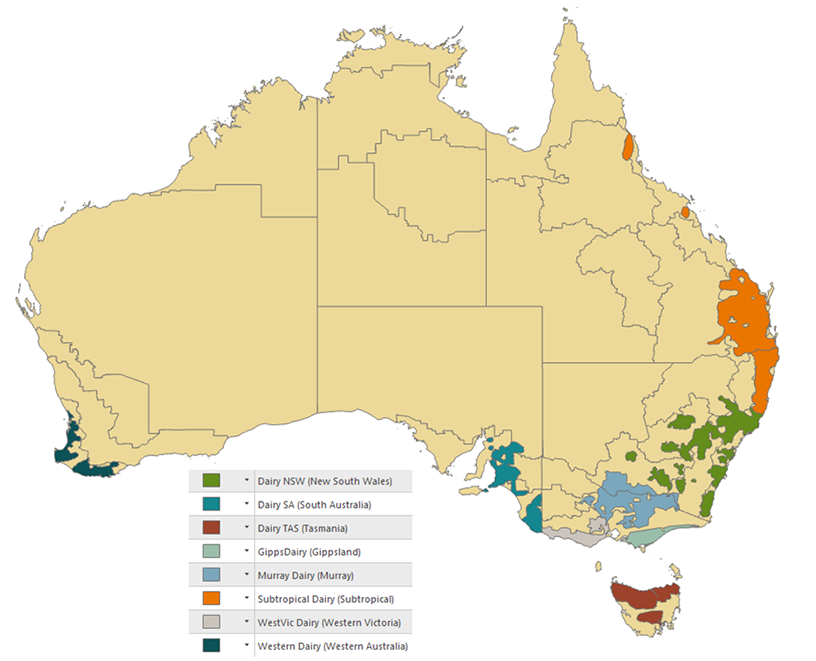

Dairy industry regions, based on Dairy Australia regions

For more detailed definition of Agricultural industry regions, visit Farm surveys definitions and methods.

Download

Supporting data - Australian Broadacre Productivity, 2023-24 data dashboard (XLSX 70 KB)

If you have difficulty accessing this file, visit web accessibility for assistance.

Further reading

Chancellor, W & Boult, C 2024, Australia’s farm productivity slowdown – why it matters, and what it means for policy makers, ABARES Insights, Canberra, July. CC BY 4.0 DOI: https://doi.org/10.25814/dcvj-7934

Chancellor, W. and Greenville, J. 2025, The ‘multi-speed’ industry: Dairy productivity in the spotlight, ABARES Insights, Canberra, November. CC BY 4.0 DOI: https://doi.org/10.25814/4hhw-m486

Nossal, K (2011), From R&D to productivity growth: Investigating the role of innovation adoption in Australian agriculture. Rural Industries Research and Development Corporation.

Nossal, K. and Gooday, P (2009), Raising productivity growth in Australian agriculture. Australian Bureau of Agricultural and Resource Economics (ABARE).

Harris, D (2011), Victoria's dairy industry: an economic history of recent developments, report prepared for the Department of Primary Industries, Victoria and Dairy Australia Ltd, Melbourne, October.

Hughes, N, Lawson, K, and Valle, H (2017), Farm performance and climate: Climate-adjusted productivity for broadacre cropping farms, ABARES research report 17.4, Australian Bureau of Agricultural and Resource Economics and Sciences, Canberra.

Jackson, T (2010), Harvesting productivity: a report on the ABARE–GRDC workshops on grains productivity growth, ABARE research report 10.5 prepared for the Grains Research and Development Corporation, Australian Bureau of Agriculture and Resource Economics, Canberra, April.

Jackson, T, Dahl, A & Valle, H (2015), 'Productivity in Australian broadacre and dairy industries' in Agricultural commodities: March quarter 2015, Australian Bureau of Agricultural and Resource Economics and Sciences, Canberra.

Knopke, P, O'Donnell, V & Shepherd, A (2000), Productivity growth in the Australian grains industry, ABARE research report 2000.1 for Grains Research and Development Corporation, Australian Bureau of Agricultural and Resource Economics, Canberra.

OECD (2001), Measuring Productivity - OECD Manual: Measurement of Aggregate and Industry-level Productivity Growth, OECD Publishing, Paris.

Sheng, Y, Gray, E & Mullen, J (2011), Public investment in R&D and extension and productivity in Australian broadacre agriculture, ABARES conference paper 11.08 presented to the Australian Agricultural and Resource Economics Society, 9–11 February 2011, Melbourne.

Sheng, Y, Mullen, J.D and Zhao, S (2016), Has growth in productivity in Australian broadacre agriculture slowed? A Historical View. Ann Agric Crop Sci. 2016; 1(3): 1011.

Zhao, S, Sheng, E, and Gray, E (2012) ‘Productivity of the Australian Broadacre and Dairy Industries: Concept, Methodology and Data’, Chapter 4 in Fuglie K., S. L. Wang and E. Ball (eds.) Productivity Growth in Agriculture: An International Perspective, GAB International, Wallingford (UK) and Cambridge, MA (USA) 2012.

Zammit, K and Howden, M (2020), Farmers’ terms of trade: Update to farm costs and prices paid, ABARES research report 20.3, Australian Bureau of Agricultural and Resource Economics and Sciences, Canberra.