Australian Hass avocados have received provisional access to the Indian market. New access was granted after Australia demonstrated that its high-quality avocados could meet India’s biosecurity and food import requirements.

10 trial shipments will be sent to India during the provisional access period. Full access will be granted if these shipments meet India’s import requirements.

New access was announced in a Joint Statement by the Australian Prime Minister and the Prime Minister of India on 11 March 2023.

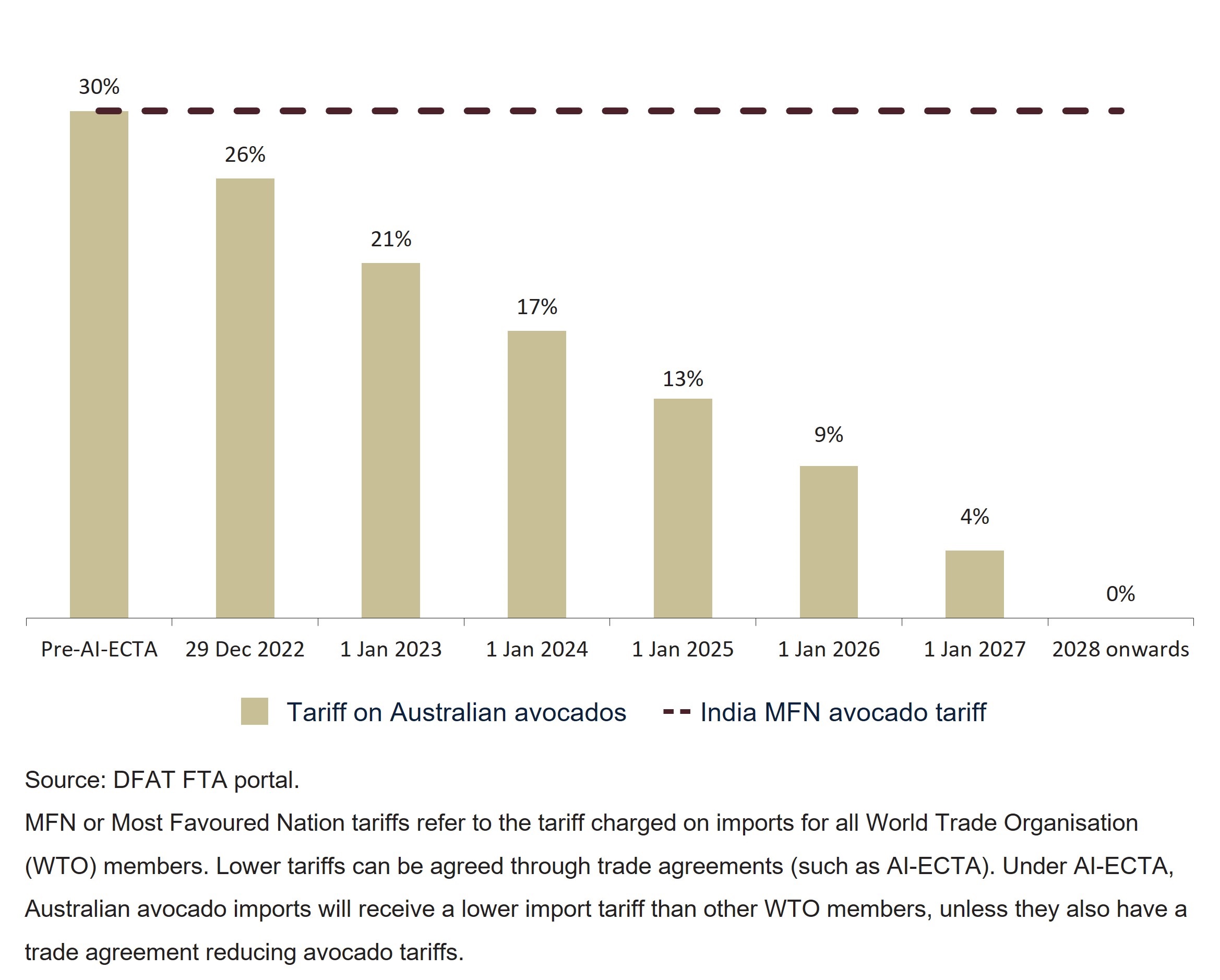

New access comes after Australia secured reduced tariffs on a range of horticulture products through the Australia-India Economic Comprehensive Economic Partnership Agreement (AI-ECTA) (see Table 1). Under AI-ECTA, Australian avocados have a tariff rate advantage over India’s key avocado suppliers (New Zealand, the EU and Peru).

Implications for Australian agricultural exporters

The Australian Government is working with the avocado industry to facilitate the ten-shipment trial.

If full access is granted, avocado orchards and packhouses seeking to export to India will be required to become accredited properties under the Export Control Act 2020.

Interested exporters should contact Avocadoes Australia and continue to monitor for further Australian Government announcements.

Table 1 - Key AI-ECTA for Australian horticultural exporters

| Product | Pre-AI-ECTA | AI-ECTA outcome |

|---|---|---|

| Almonds (in shell) | Rs35/kg | TRQ 34,000a tonnes/year with 50% tariff reduction |

| Almonds (shelled) | Rs100/kg | TRQ 34,000 tonnes/year with 50% tariff reduction |

| Avocados, cherries, berries and olives | 15-30% | 7-year phasing to elimination |

| Cashew (in shell), hazelnuts (shelled/in shell), chestnuts (shelled/in shell), pistachios (shelled) and macadamias (shelled/in shell) | 10-30% | 7-year phasing to elimination |

| Garlic/peas | 30%/100% | 7-year phasing to 50% tariff reduction |

| Onions, shallots, leeks, cabbages, lettuce, asparagus, artichokes, aubergines, spinach, celery and cucumbers | 30% | 7-year phasing to elimination |

| Oranges and mandarins | 30% | TRQ 13,700 tonnes/year with 50% tariff reduction |

| Pears | 30% | TRQ 3,700 tonnes/year with 50% tariff reduction |

| Strawberries, figs, apricots, kiwi fruit, lychees | 15-30% | 7-year phasing to 50% tariff reduction |

a. Tariff rate quota

Snapshot of the Indian avocado market

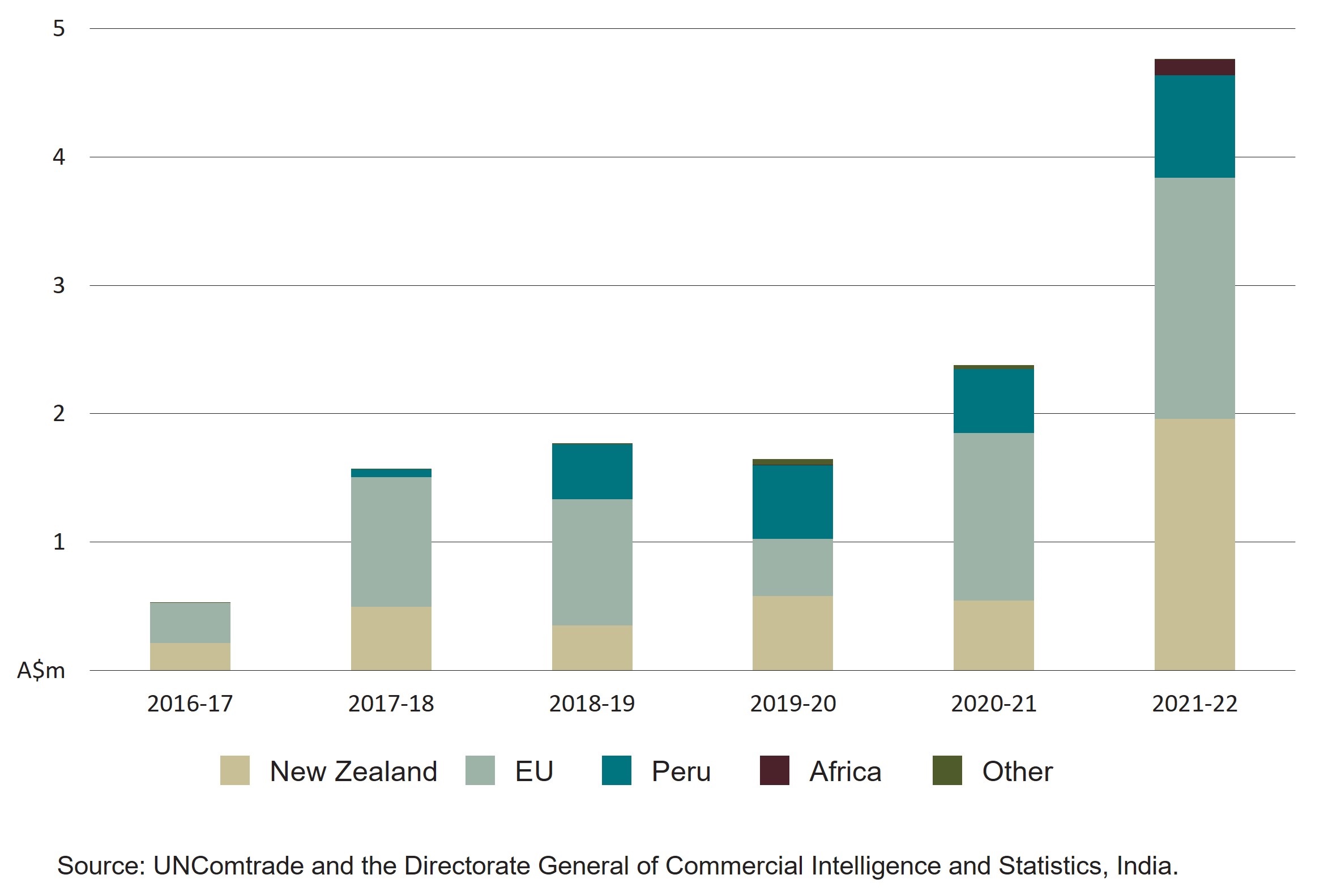

- India has a small but growing avocado import market. In 2021-22, India imported

A$4.8 million of avocados, up from A$2.4 million in 2020-21 and A$1.6 million in 2019-20 (Figure 1). - Imported avocados are a high-end product in India. They are most likely to enter the hospitality and food service sector.

- India imports avocados from New Zealand (41%), the EU (39%) and Peru (17%). All of these exporters are subject to India’s 30% Most Favoured Nation (MFN) import tariff. Under AI-ECTA, tariffs on Australian avocados have been reduced and will gradually decline to 0% (Figure 2).

- The average import unit price of New Zealand avocados in India in 2021-22 was A$4.81/kg. This is lower than the average unit import price of Australian avocados in Hong Kong (A$5.57kg) and Malaysia (A$5.54/kg) but similar to Singapore (A$4.84/kg).

- India does not produce avocados on a commercial scale.

¹ Indian financial year 1 April to 31 March

Figure 1 - Indian avocado imports 2016-17 to 2021-22

Figure 2 - Indian avocado import tariffs

Australian avocado industry overview

- In 2022, avocados were Australia’s seventh largest fruit crop, valued at A$363.8 million (HIAL 2022).

- Most Australian avocados are produced in Queensland (55%), Western Australia (27%) and New South Wales (11%)

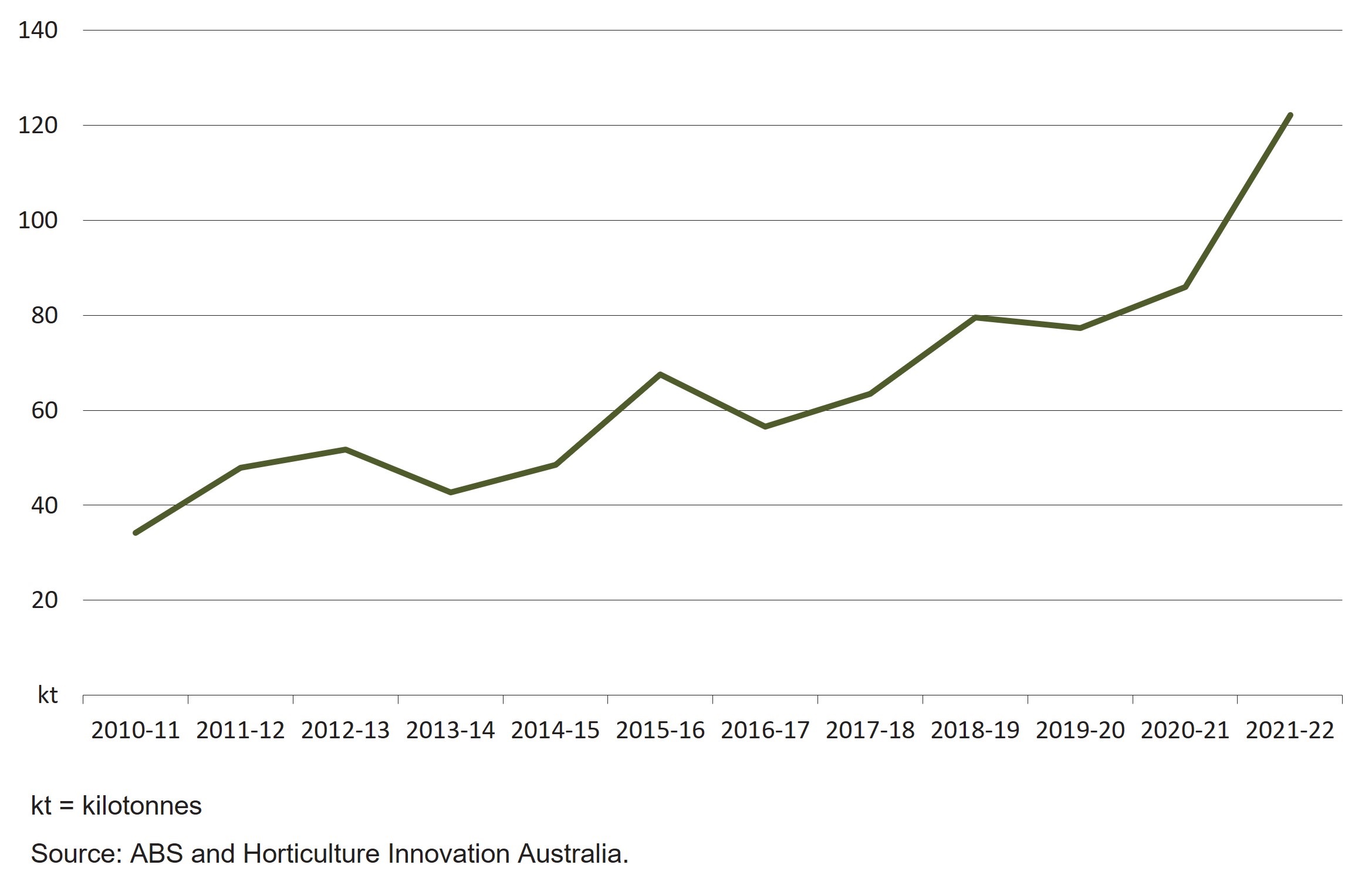

- Between 2010–11 and 2021-22, Australian avocado production increased from 34,000 tonnes to 122,000 tonnes (+151%) (Figure 3). Production is expected to continue increasing as new plantings mature.

- Increased production, particularly in Queensland, led to a record A$55.1 million of avocado exports in 2022.

- Hong Kong, Singapore and Malaysia are Australia’s major avocado markets. Producers are seeking to establish new markets, including in Japan and now India.

- Australia is a relatively modest avocado exporter. Mexico (54%) and Peru (16%) have the major share of global avocado markets (Source: UN Comtrade 2023).

Figure 3 - Australian avocado production

Resources

More information about the benefits of AI-ECTA, including key tariff reductions, is available on the Department of Foreign Affairs and Trade website.

Austrade has more information on the Indian economy and doing business in India.

The Manual of Importing Country Requirements has information about Indian import requirements for agricultural exporters.

The Australian Government’s network of Agriculture Counsellors provided information for this article. More information about the Agriculture Counsellor network, including contact details, is available on the Department of Agriculture, Fisheries and Forestry website.

This article was also published as an Austrade Insight.

Connect with us

Follow our @AusAgTrade Twitter account for all your #TradeTips and Market Intel.

Subscribe to our monthly Agriculture Market Intelligence Insights newsletter