February 2023

Strong global prices led to a record $4.5 billion in sheepmeat exports in 2021–22. The long-term global outlook for sheepmeat is strong, supported by growing global demand and a continued move towards high-value lamb products.

Record Australian sheepmeat exports in 2021–22

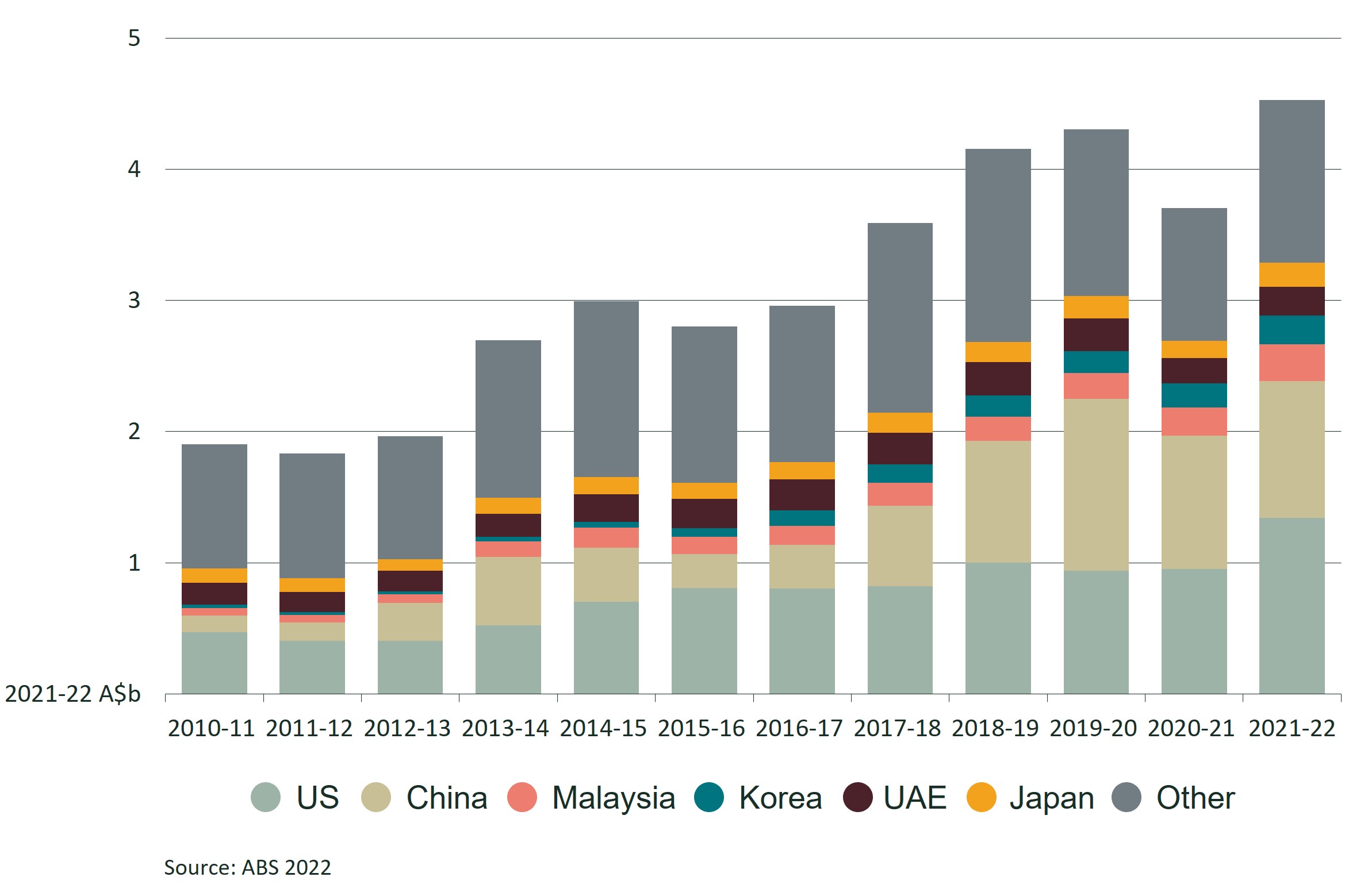

- Australia exported a record $4.5 billion of sheepmeat in 2021–22.

- Record exports were primarily caused by strong increases in the average Australian export price of lamb (+21%) and mutton (+19%), compared to the previous three-year average.

- The US is Australia’s largest sheepmeat market by value, China is Australia’s largest sheepmeat market by volume.

- Australia (34%) and New Zealand (37%) are the largest global exporters of sheepmeat.

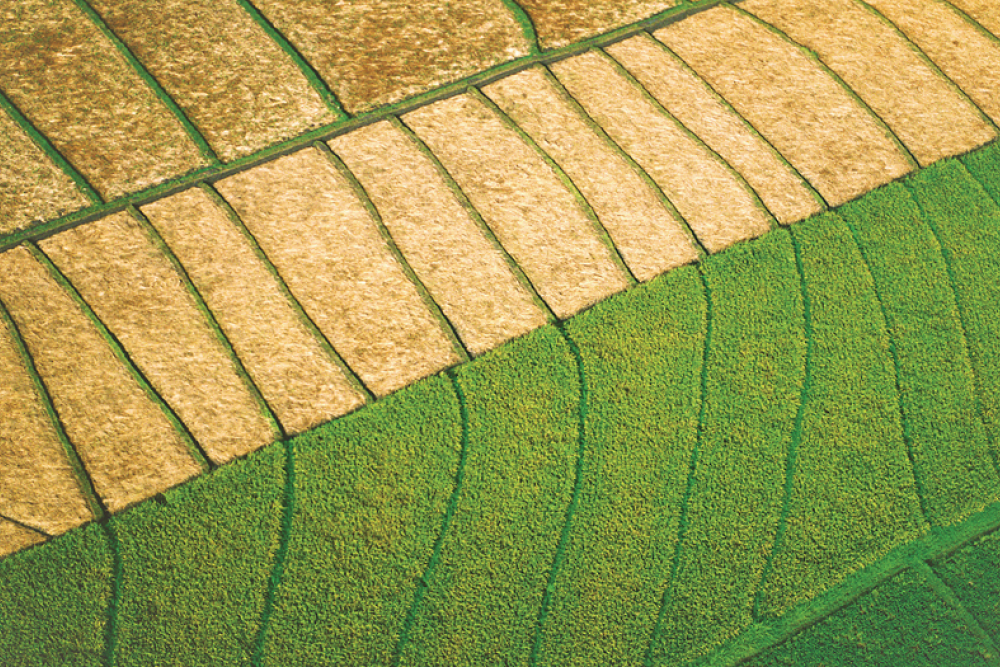

Figure 1: Australian sheepmeat exports by destination

Price the major driver of increased industry value

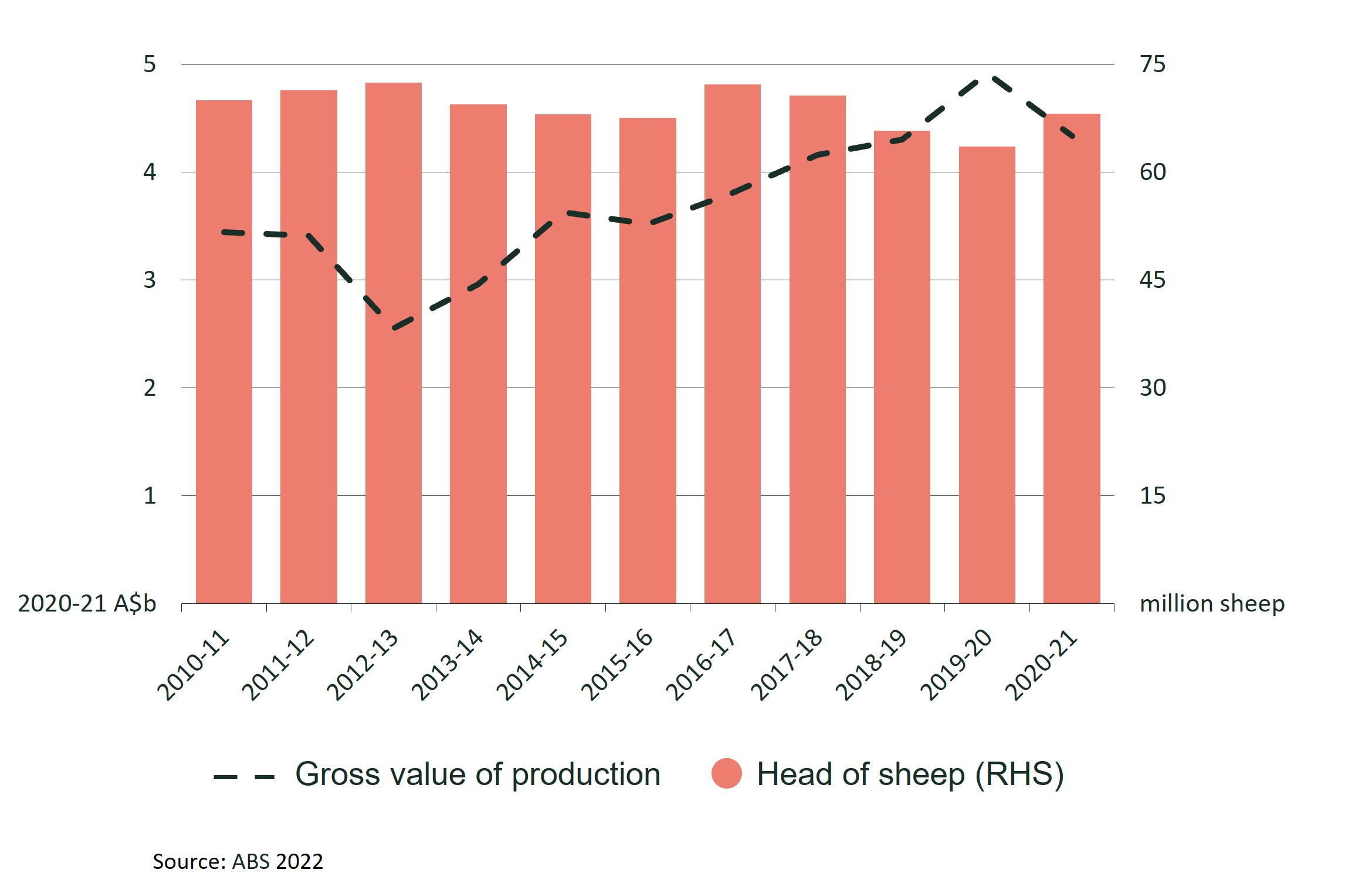

- Despite relatively stable sheep stocks, the value of Australian sheepmeat production has risen steadily over the past decade.

- In 2020–21 dollars, the value of Australian sheep production increased from $3.4 billion in 2010–11 to $4.3 billion in 2020–21.

- This was due to strong global meat prices and a shift towards exporting lamb, rather than mutton.

- Australia’s sheepmeat production is expected to increase in 2022–23, however prices are expected to fall from the high levels seen in 2021–22 (ABARES 2022).

Figure 2: Australian sheepmeat production and sheep numbers

Lamb continues to dominate sheepmeat exports

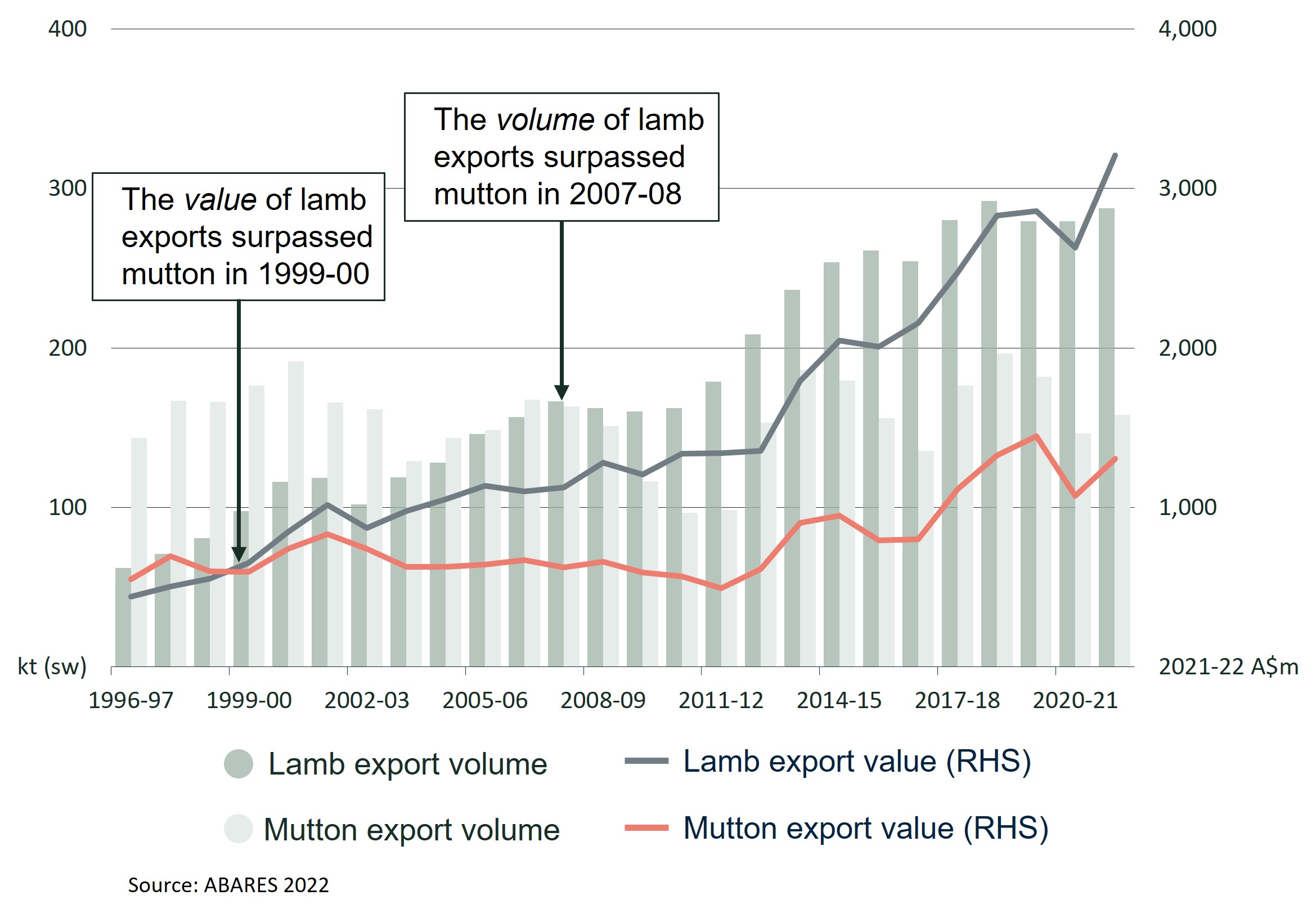

- Lamb has become the dominant Australian sheepmeat export.

- In the late 1990s and early 2000s, Australia’s sheep flock was adjusting to the collapse of the wool reserve price scheme. This led producers to sell older wool sheep as mutton and switch to lamb production and/or cropping.

- Global demand for lamb, particularly in wealthy countries, has also grown strongly over the past two decades.

- Producers have adjusted to the new conditions and lamb exports are now approximately double the value of mutton.

Figure 3: Australian sheepmeat exports 1996-97 to 2021-2

Strong outlook for global sheepmeat consumption

- The OECD-FAO expects global sheepmeat consumption to increase from 15.9 million tonnes (MT) in 2021 to 18.1 MT in 2031 (+15%).

- Demand will be driven by increased overall meat consumption in developing countries and increased consumer familiarity with sheepmeat in developed countries.

- Australian exporters will benefit from increased global demand and recent trade agreements with the UK and India.

Download

February 2023 – Australian sheepmeat export snapshot (PDF 249KB)

February 2023 – Australian sheepmeat export snapshot (DOCX 170KB)

Connect with us

Follow our @AusAgTrade Twitter account for all your #TradeTips and Market Intel.

Subscribe to our monthly Agriculture Market Intelligence Insights newsletter