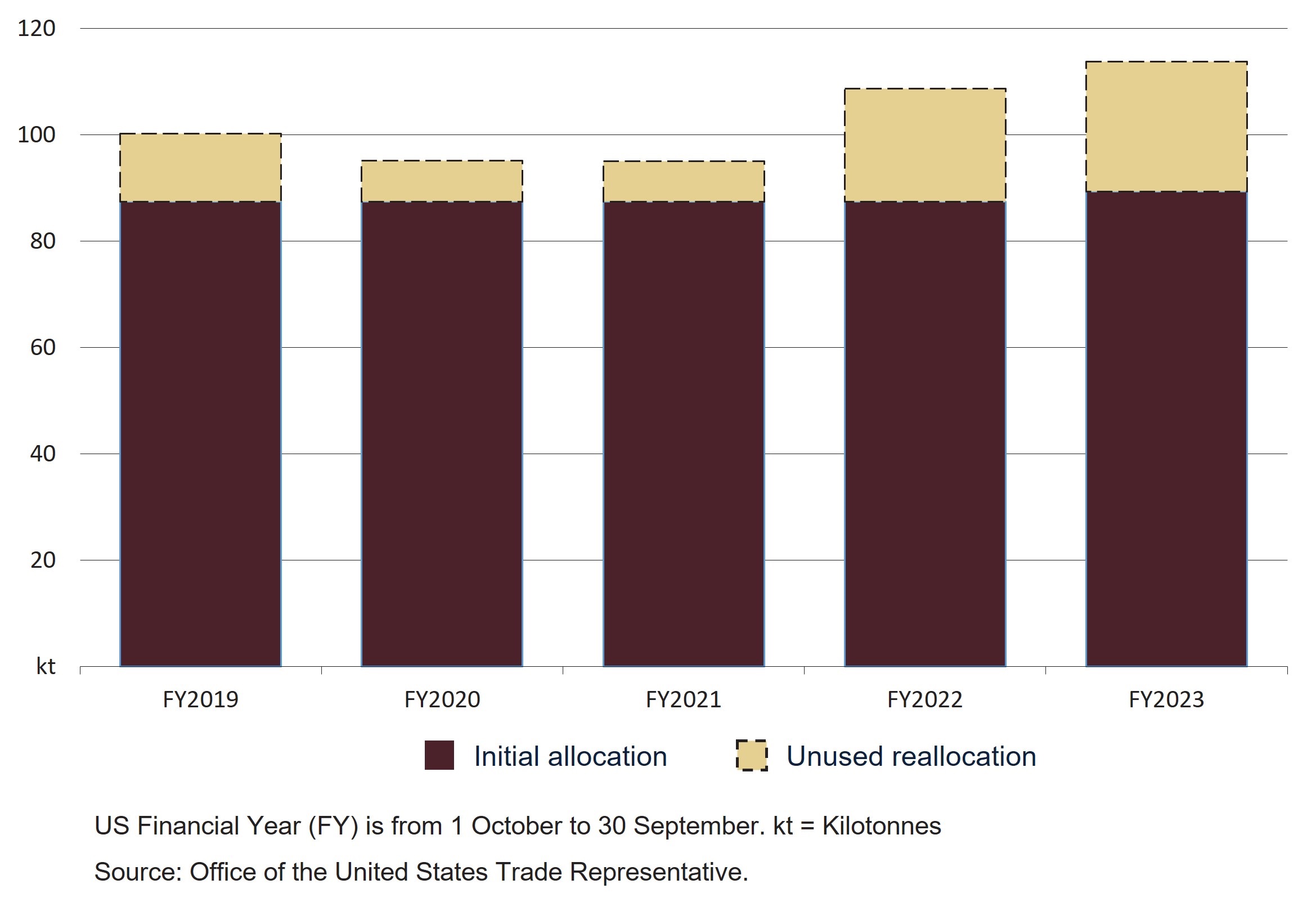

On 13 March 2023, the Office of the US Trade Representative announced the reallocation of unused quotas under their imported raw sugar tariff-rate quota (TRQ). Australia was allocated an additional 24,479 tonnes (11% of the unused quota balance). This is in addition to the initial allocation of 89,293 tonnes allocated in July 2022 for FY2023 (Oct 1 – 30 Sep).

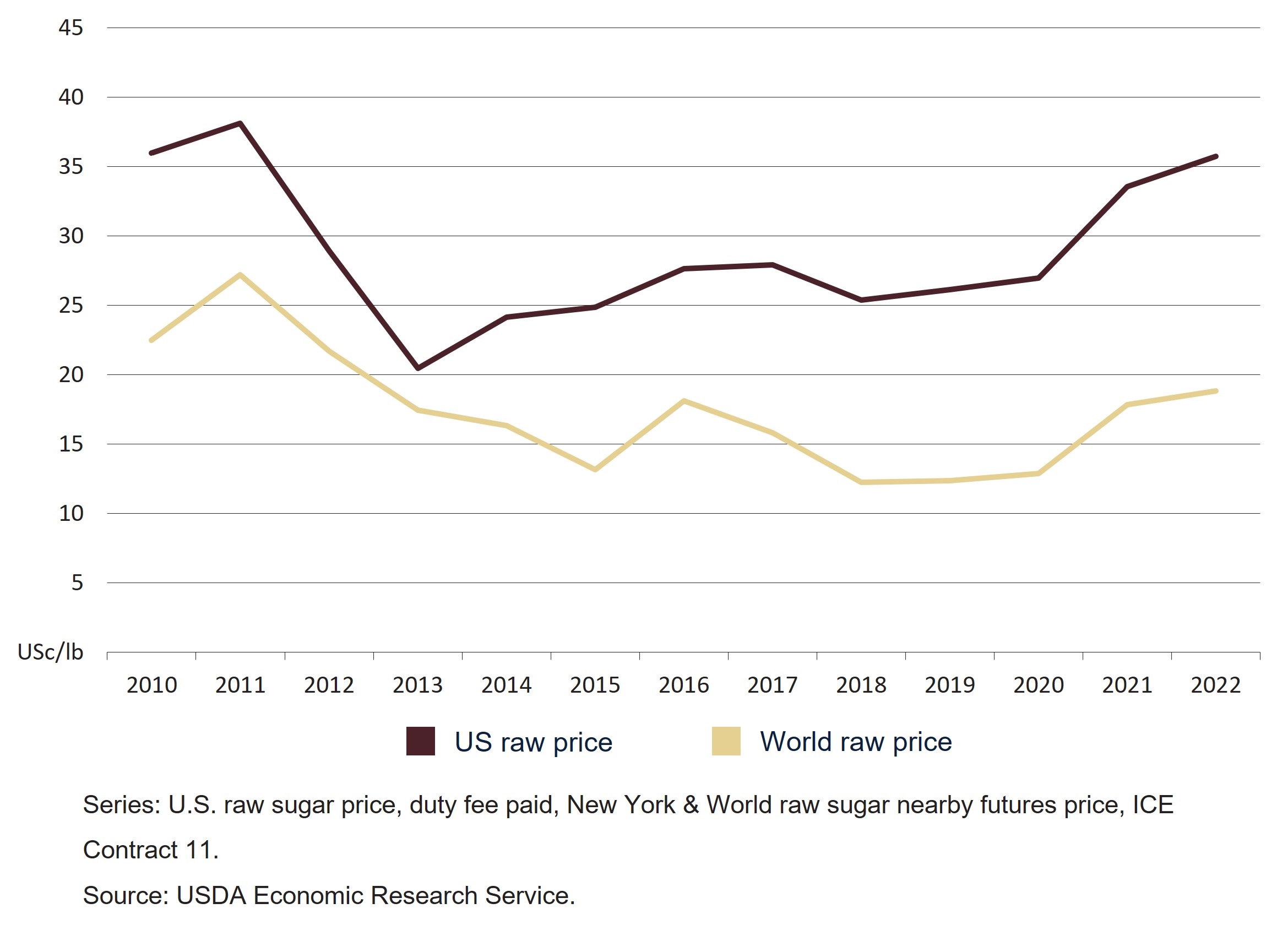

Due to domestic policy settings, the US government maintains a minimum price for sugar. This generally keeps the US raw sugar price well above the world benchmark. Over the past decade, the average US raw sugar price was over 75% above the world price (refer Figure 1).

While Australia exports a relatively small amount of sugar to the US (less than 2% of all export volumes), it remains a lucrative market due to the significant price premium.

Figure 1 - US and World raw sugar prices

Overview of the US raw cane sugar TRQ

As part of the WTO Uruguay Round agreements, the US is required to import a minimum of 1,117,195 metric tonnes of raw sugar at zero or low-tariff rates annually. The US maintains a TRQ that is allocated to 40 countries based on historical trade shares between 1975–1981.

The Dominican Republic, Brazil and the Philippines are the three largest quota holders, representing over 40% of all raw sugar allocated under the TRQ (Australia is the fourth largest at 8%).

In advance of each fiscal year (October 1), the USDA publishes the annual quota volumes available to quota holders. The United States Trade Representative reallocates unused quota allocations based on discussions with those countries that do not intend to fill their initial quota allocation. These announcements tend to occur between February and June each year.

Over the past few years, Australia has received an initial allocation of 87,402 tonnes under the TRQ. However, for FY2023, Australia received an additional 1,891 tonnes (89,293 tonnes in total). This is because Nicaragua was removed from the WTO TRQ (refer Figure 2).

Australia consistently fills it’s TRQ allocation in the US due to the significant price premium received above the global average.

Figure 2 - Australian raw cane sugar allocation under US WTO TRQ

Overview of Australian sugar exports

Australia exports 3—4 million tonnes of sugar each year, valued at A$1.5 billion to A$2.5 billion (Source: ABARES 2023).

Australia is the world’s fourth largest exporter of raw sugar, behind Brazil, Thailand, and India (Source: USDA 2022).

Most Australian sugar is produced in Queensland, with a small proportion produced in northern New South Wales. Sugar is Queensland’s second largest agricultural export, with more than 80% of sugar produced for export as bulk raw sugar (Source: ASMC 2022).

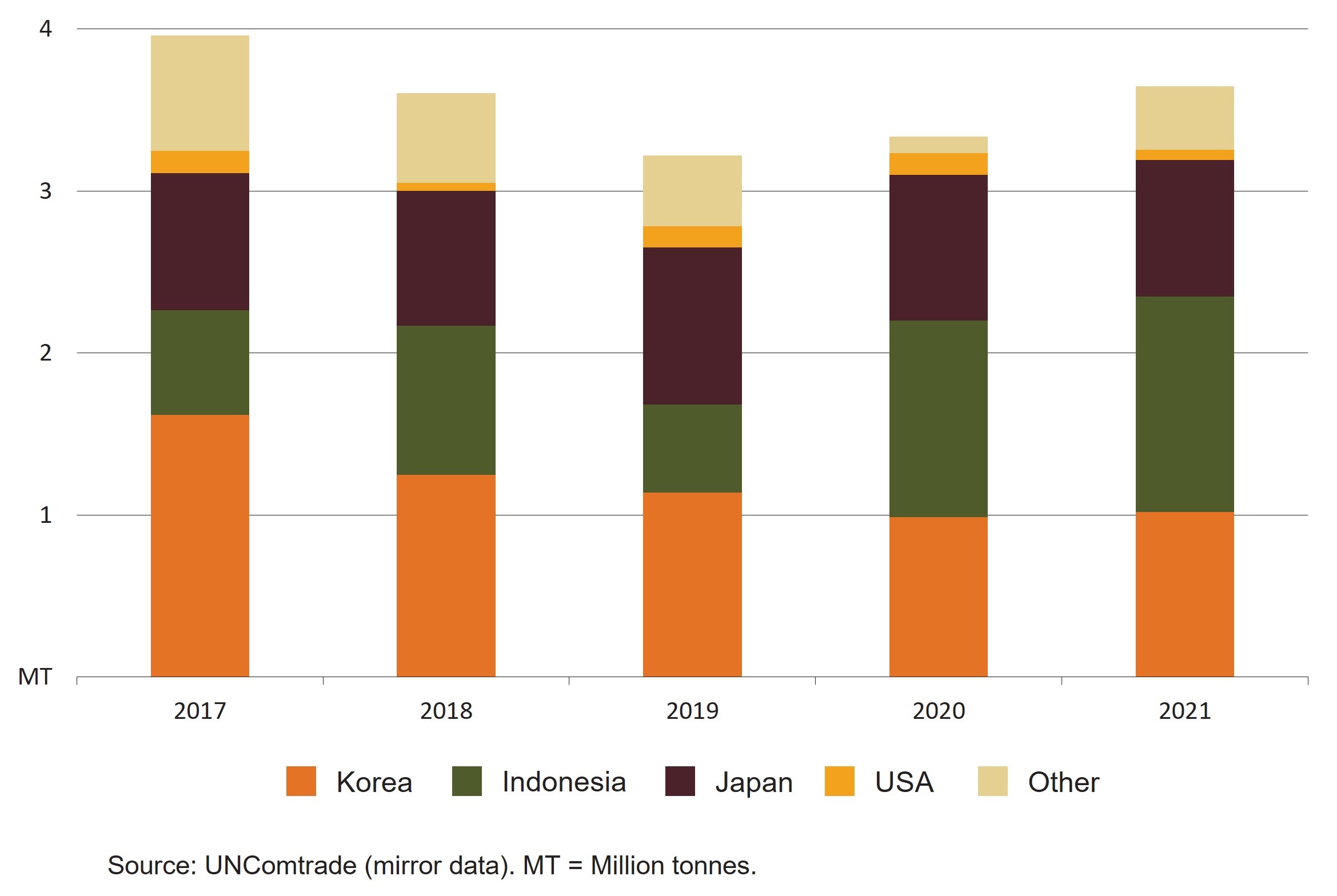

Indonesia, the Republic of Korea and Japan imported 85% of Australia’s raw sugar over the past 5 years (refer Figure 3).

The US is a small sugar market for Australia (approximately 2% of exports). However, the average unit export price is around US60 cents/kg, compared to US40 cents/kg in Australia’s Asian markets.

Australia exports around 100,000 tonnes to the US at the basic in-quota tariff rate of roughly US1.5 cents/kg, however, there is limited commercial viability outside of this quota, due to an out-of-quota rate of US33.9 cents/kg.

In FY2022-23, ABARES expect the value of Australian sugarcane production to rise by 29% to

$1.9 billion (Source: ABARES 2023).

Figure 3 - Major importers of Australian sugar (calendar year)

Resources

Austrade has more information on the US market for Australian businesses.

The WTO’s Import Licensing Procedures has information about US import requirements for sugar exporters. Certificates of quota eligibility must accompany imports from any country with an allocation.

The Australian Government’s network of Agriculture Counsellors provided information for this article. More information about the Agriculture Counsellor network, including contact details, is available on the Department of Agriculture, Fisheries and Forestry website.

This article was also published as an Austrade Insight.

Connect with us

Follow our @AusAgTrade Twitter account for all your #TradeTips and Market Intel.

Subscribe to our monthly Agriculture Market Intelligence Insights newsletter