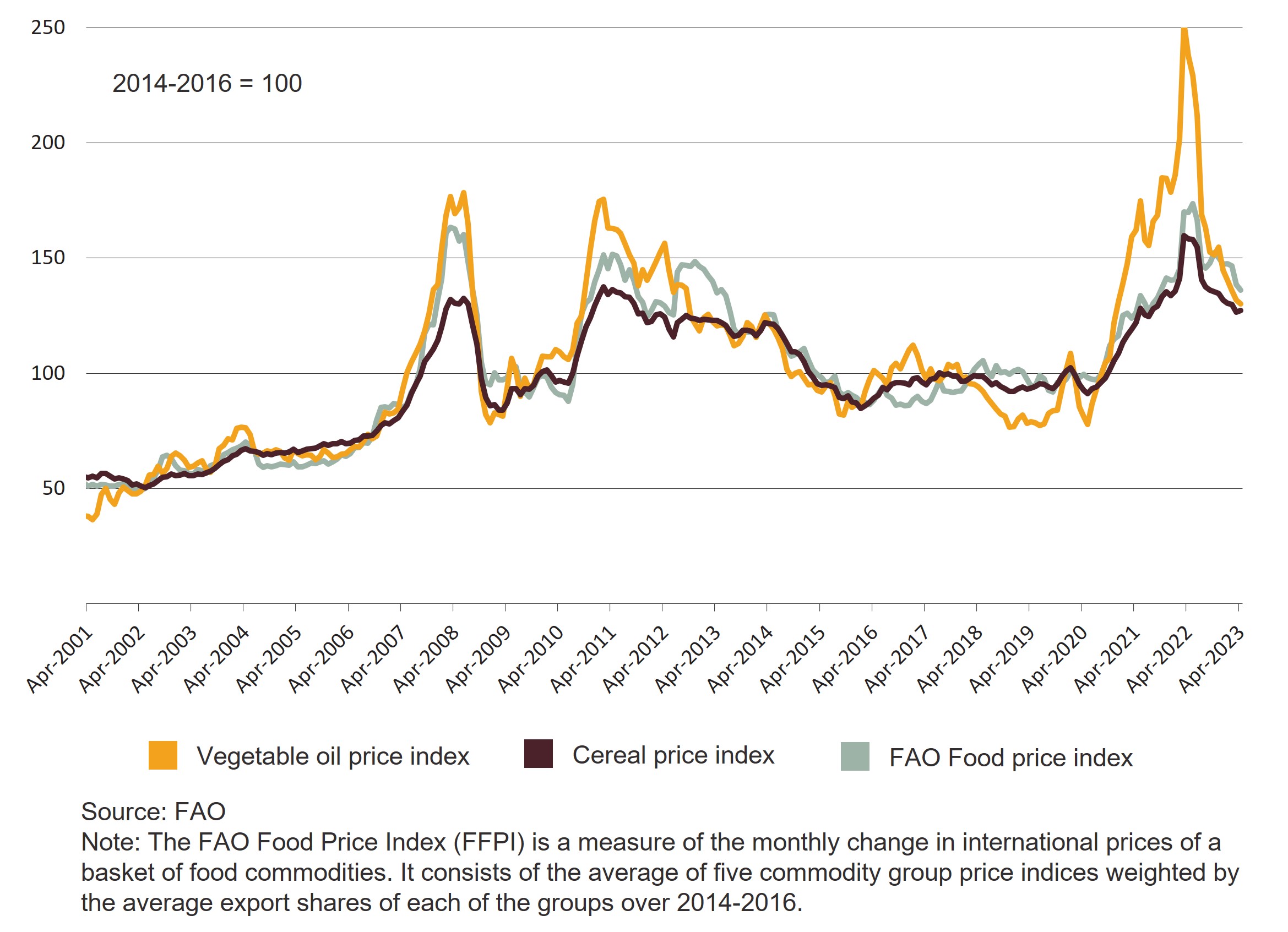

According to the Food and Agriculture Organization’s (FAO) food price index, the price of vegetable oils and cereals fell again in April. Prices are now well below the records of 2022, but remain relatively high by historical standards (Figure 1).

This article explores the key drivers of recent price volatility for vegetable oils and cereals.

Figure 1 FAO vegetable oils and cereals price indexes, April 2001 to April 2023

Implications for Australian agricultural exporters

Consecutive years of high prices global commodity prices and above average rainfall will likely lead to record Australian oilseed and cereal exports in 2022–23 (ABARES 2023).

Falling prices and the likely return of drier conditions are likely to see the value of exports fall in 2023–24.

Farm costs, such as fuel, fertiliser and freight, have risen substantially over the last 2 years. If these costs remain high while global food prices fall, Australian farm profitability is likely to decrease.

Many farm businesses have used the last 2 years to improve their financial position. They are already planning for changing conditions in 2023–24 (ABARES 2023).

Drivers of vegetable oil and cereal price rises from mid–2020 to mid–2022

Food prices rose steadily between mid–2020 and early 2022. Poor growing conditions in some key Northern Hemisphere production regions drove the initial price rises. Significant increases in logistics and fertiliser costs after the initial phase of the COVID-19 pandemic also increased food prices.

Russia’s invasion of Ukraine compounded already high food prices, particularly through disruptions to global trade in vegetable oils and cereals. Prior to the invasion, Ukraine was one of the world’s largest exporters of sunflower oil and meal, barley, wheat and corn. In the immediate aftermath of the invasion, it was unclear whether any of these products would enter global markets.

Export restrictions on food and fertiliser also played a role. At their peak in May 2022, export restrictions affected approximately 17% of global food exports (IFPRI 2023). This raised fears that escalating restrictions could jeopardise global food security, as occurred during the 2007–08 global food crisis (ABARES 2022).

Why vegetable oil and cereal prices been falling since mid–2022

Global food production was strong, despite challenging conditions

Production conditions are the main driver of food prices. Three consecutive La Niña events led to reduced crop production in the European Union, US and Canada. However, good conditions in other regions, including in Australia’s wheat belt, helped prevent systemic global shortages.

High prices encouraged production

High global prices encouraged farmers to increase production. For example, good seasonal conditions and the prospect of high vegetable oil prices are expected to lead to a record Australian canola crop of 8.3 million tonnes in 2022–23 (ABARES 2023). This dynamic, repeated at scale across the world, has helped drive prices down.

Exports have continued to flow out of Ukraine

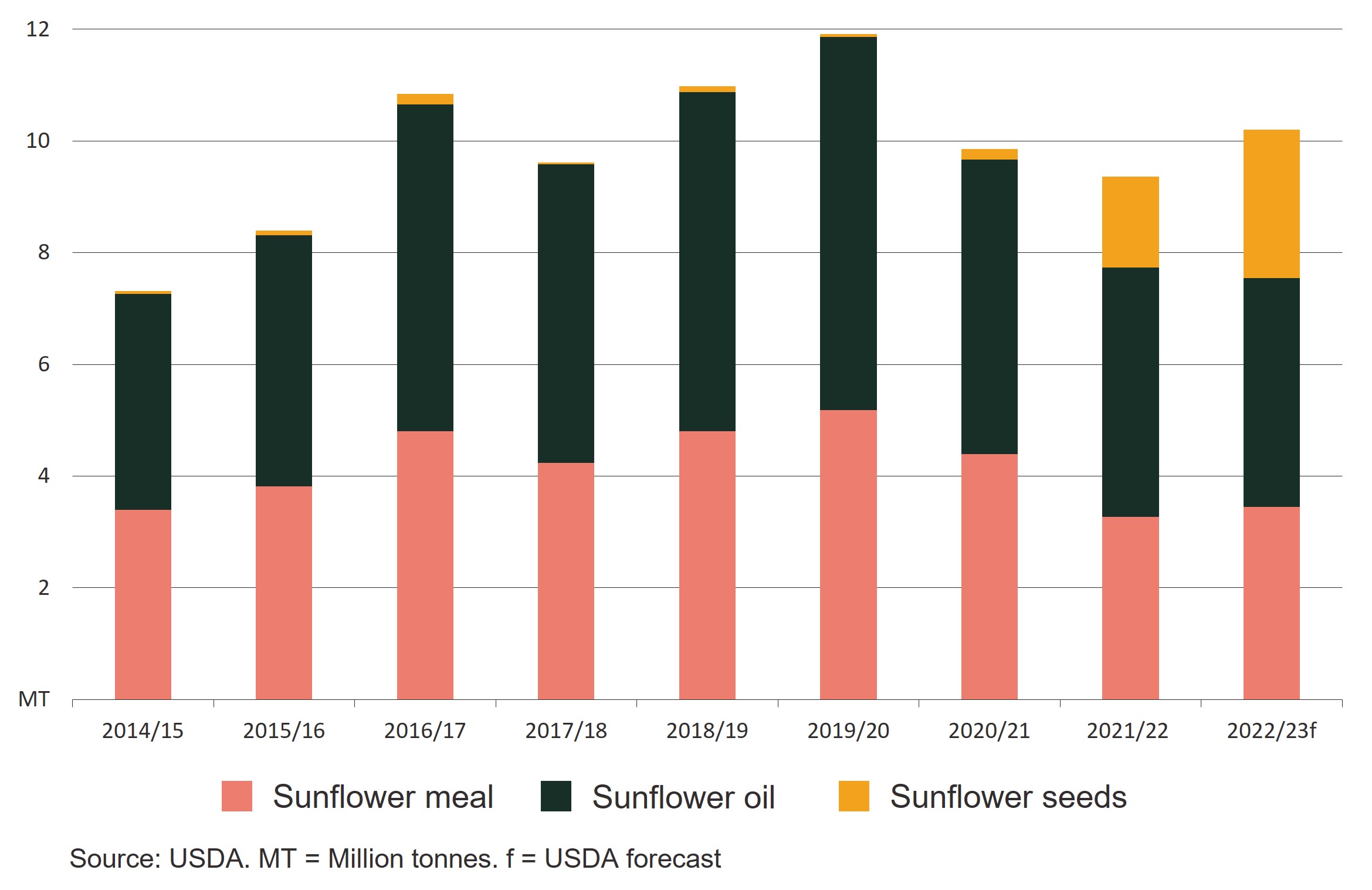

The establishment of the Black Sea Grain Initiative (BSGI) and ‘solidarity lanes’ through EU countries allowed Ukraine to export bulk commodities. For example, some of Ukraine’s sunflower crop was exported as seeds through Europe, rather than as oil and meal via sea freight (Figure 2). This avoided a ‘worst-case’ scenario and contributed to falling oilseed and cereals prices from April–May 2022 onwards.

Figure 2 - Ukrainian sunflower product exports 2014–15 to 2022–23 (marketing year)

Global food trade flows showed a high-degree of resilience

The immediate effect of Russia’s invasion of Ukraine was high market volatility as importers scrambled to secure key foodstuffs and inputs. However, global trade adjusted relatively quickly once the situation became more stable.

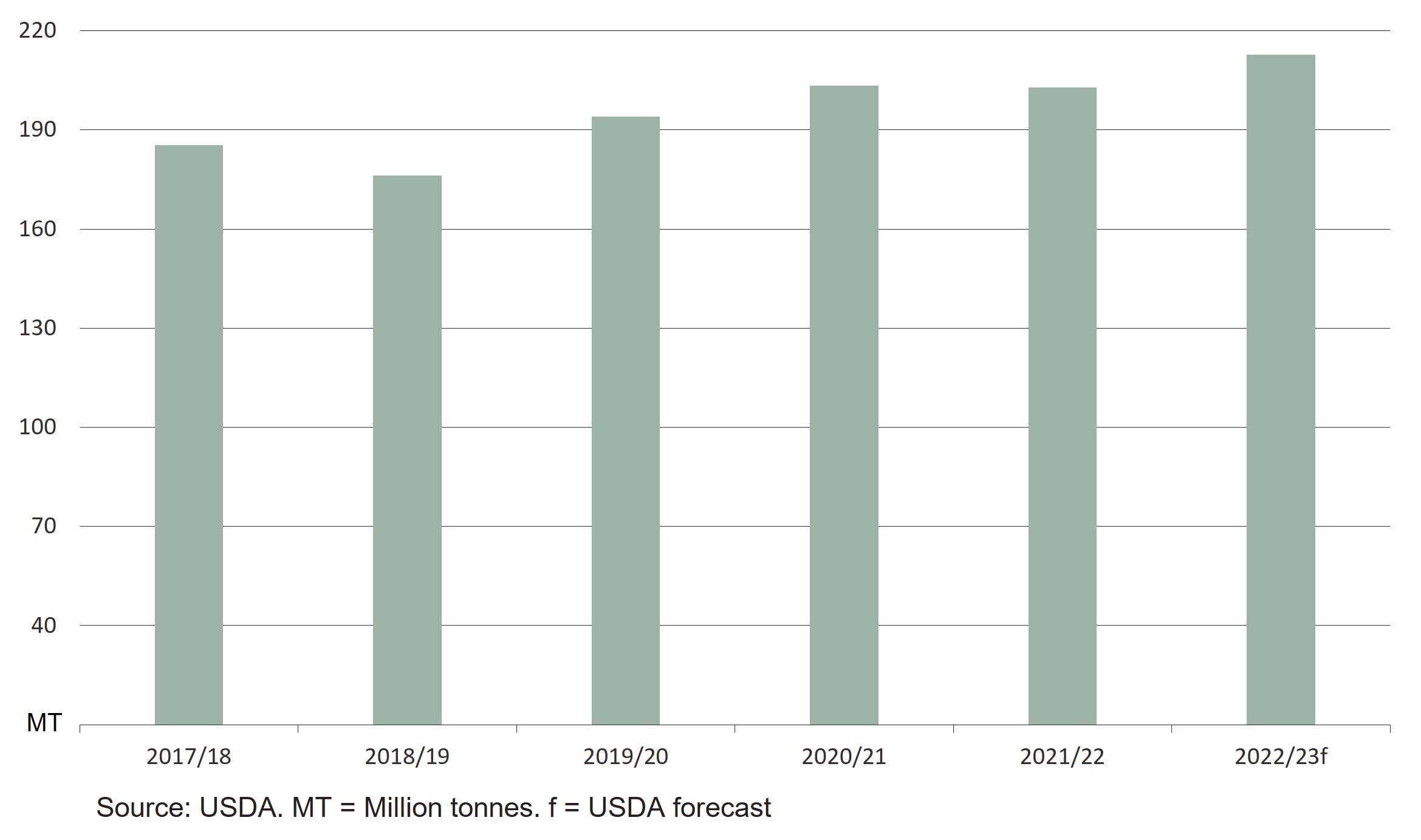

Importing countries found new sources and shipping companies adjusted their routes. As a result, despite the ongoing conflict, the volume of global wheat exports was steady in the 2021–22 marketing year. Exports are expected to increase by 9.8 million tonnes in 2022–23 (+5%) (USDA 2023) (Figure 3).

Figure 3 - Total volume of global wheat exports (marketing year)

Export restrictions didn’t escalate

Export restrictions were less impactful than initially feared. Indonesia was quick to remove restrictions on palm oil exports. India continued to export wheat to some countries, despite initially announcing an export ban.

Natural gas and oil prices moderated

Falling natural gas and oil prices translated into reduced fertiliser and diesel prices. This reduced production costs and prevented large drops in yield.

Where are we now?

At the end of April 2023, average global food prices were 27% higher than the FAO’s 2016–2017 baseline. Vegetable oil and cereal prices have continued to fall in 2023. However, some other product groups have risen. The price of sugar rose substantially in April. This caused the FAO’s overall food price index to rise for the first time since March 2022.

The likely return of the El Niño weather pattern will support increased crop production in some major producing countries, including the US and Brazil (FAO-GIEWS 2023). The FAO is forecasting record Russian cereals export in 2022–23 (FAO 2023).

If continued, the BSGI will help reduce price volatility and support the stability of the Ukrainian agriculture sector. While some exports are continuing, the Ukrainian agriculture sector is facing extreme challenges (USDA 2023). The cessation of the BSGI would increase global prices and put further pressure on Ukrainian agriculture.

While the flexibility of the global trading system has helped moderate prices, re-routing global trade to avoid conflict regions has the potential to reduce overall efficiency. This may contribute to higher prices in the long term as products are sourced from further afield and shipping companies build increased risk into their prices.

Like food prices, prices for fertiliser and diesel have fallen but remain relatively high. This article analyses the impact of energy prices on Australian farm inputs.

Resources

The Australian Government’s network of Agriculture Counsellors provided information for this article. More information about the Agriculture Counsellor network, including contact details, is available on the Department of Agriculture, Fisheries and Forestry website.

This article was also published as an Austrade Insight.

Connect with us

Follow our @AusAgTrade Twitter account for all your #TradeTips and Market Intel.

Subscribe to our monthly Agriculture Market Intelligence Insights newsletter