The Australia-United Kingdom Free Trade Agreement (A-UKFTA) entered into force on 31 May 2023

The A-UKFTA eliminates tariffs on Australian dairy exports to the UK over 6 years (Table 1) and provides immediate access to duty-free quotas during the transition period.

This will provide more opportunities for Australian exporters in the UK’s US$3.8 billion dairy import market.

Implications for Australian dairy products exporters

Before the A-UKFTA, Australian dairy products entered the UK market under the most-favoured-nation (MFN) import duty of GBP£0.80/100kg to GBP£185/100kg. These tariffs made Australian dairy products more expensive to import, reducing their competitiveness in the UK market.

On entry into force, the A-UKFTA will provide Australian dairy exporters with access to tariff free quotas (Table 1). The tariff rate on exports outside of these quotas will gradually reduce each year. In 2028 (year 6) all Australian dairy exports will enter the UK tariff free.

In-quota exports from Australia will no longer have a tariff disadvantage relative to dairy products from the EU and Switzerland. Australia will also have similar access to other major dairy exporters, such as New Zealand and Canada, and better access than producers in the United States.

Exporters should visit the Department of Agriculture, Fisheries and Forestry UK and EU quota webpage to apply to export dairy products to the UK.

| Year | Milk, cream, yoghurt and wheya | Butterb | Cheese and curdc |

|---|---|---|---|

| 2023d | 11,781 | 3,240 | 14,137 |

| 2024 | 20,000 | 7,000 | 30,000 |

| 2025 | 20,000 | 8,500 | 36,000 |

| 2026 | 20,000 | 10,000 | 42,000 |

| 2027 | 20,000 | 11,500 | 48,000 |

| 2028 | Unlimited | Unlimited | Unlimited |

a0401, 0402, 0403, 0404 (excluding 0404.10.48);b0405;c0406.

d2023 pro rata amount.

Source: A-UKFTA Section 2B; DAFF UK dairy quota

Australian dairy product exports to the UK

The UK was Australia’s major trading partner before the early 1970s. Australia’s trade with the UK reduced significantly after the UK joined the European Economic Community (EEC), now the European Union (EU). After the UK joined the EEC, tariffs on Australian dairy products increased while EEC members received preferential access.

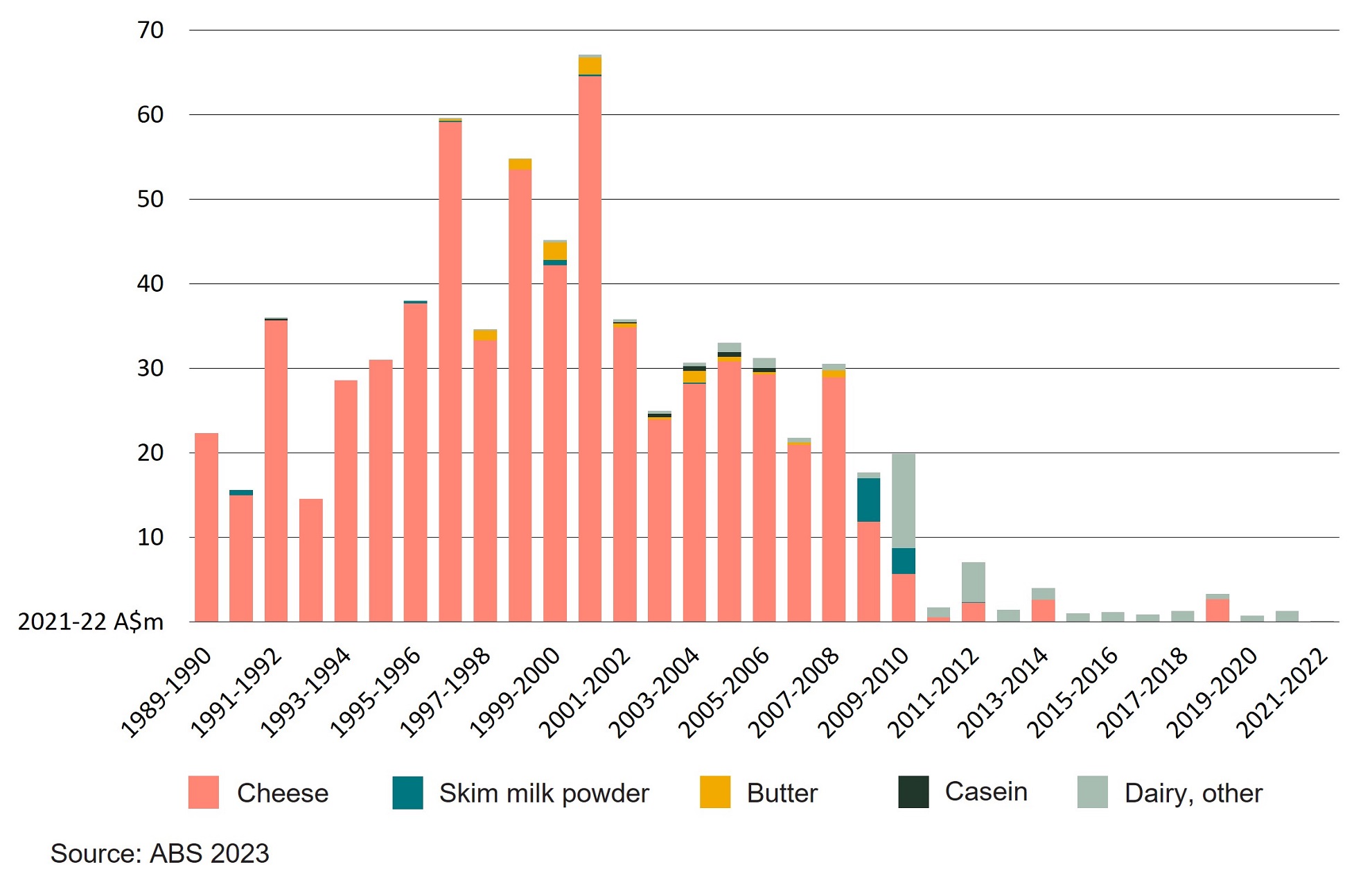

Cheese was Australia’s main dairy export to the UK (Figure 1). Exports of cheese peaked at $65 million in 2000–01 (in 2021–22 Australian dollars). This represented 4% of total Australian cheese exports.

Cheese exports to the UK have fallen over the last two decades. This has been caused by the reorientation of Australian trade towards Asia and the close trading relationship between the EU and the UK.

Figure 1 – Value of Australian dairy product exports to the UK, 1989–90 to 2021–22

Imports of dairy products by the UK

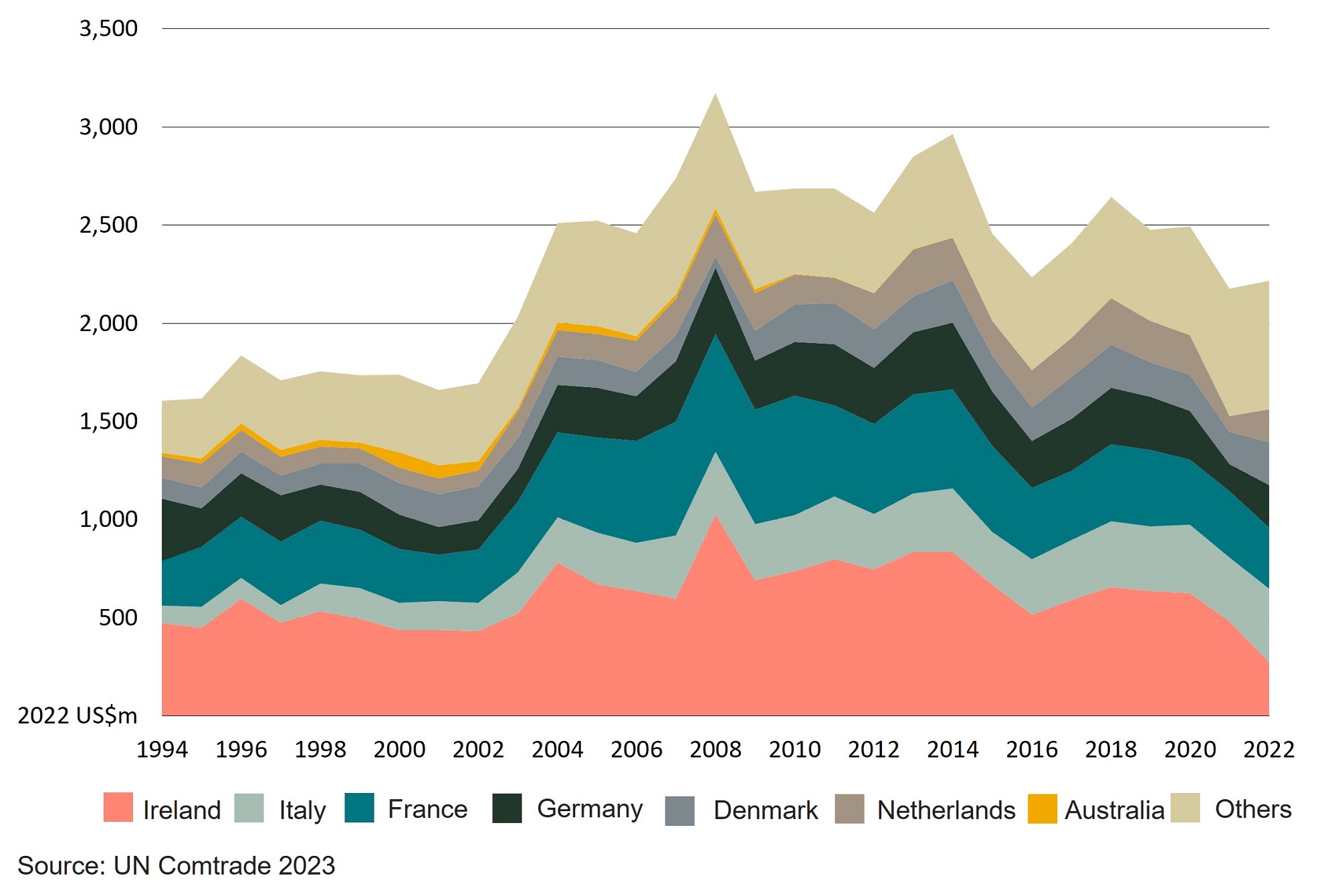

Between 2020 and 2022, cheese made up 60% of the UK’s US$3.8 billion dairy import market (yearly average). This was followed by milk and cream (13%) and butter and other fats (9%) (UNComtrade 2023).

UK cheese imports peaked in 2007 and fell sharply in 2008. Imports has been relatively stable since with a sharp fall in 2016 and the last two years (Figure 2).

Ireland (20%), Italy (15%), France (14%), Germany (9%) and Denmark (8%) were the major suppliers of cheese by value to the UK between 2020 and 2022. Cheese imports from non-European countries, including Australia, are limited (UN Comtrade 2023).

Figure 2 – UK imports of cheese from the world, 1994 to 2022

Australian dairy industry

Dairy is Australia’s third largest rural industry with a farmgate production value of $4.9 billion in 2021–22. Australia has a total dairy herd of 1.3 million cows, which produce around 8.6 million litres of milk.

Milk is produced in commercial quantities in all Australian states. In 2021–22 about 64% was produced in Victoria, predominately in Warrnambool, Gippsland and Shepparton.

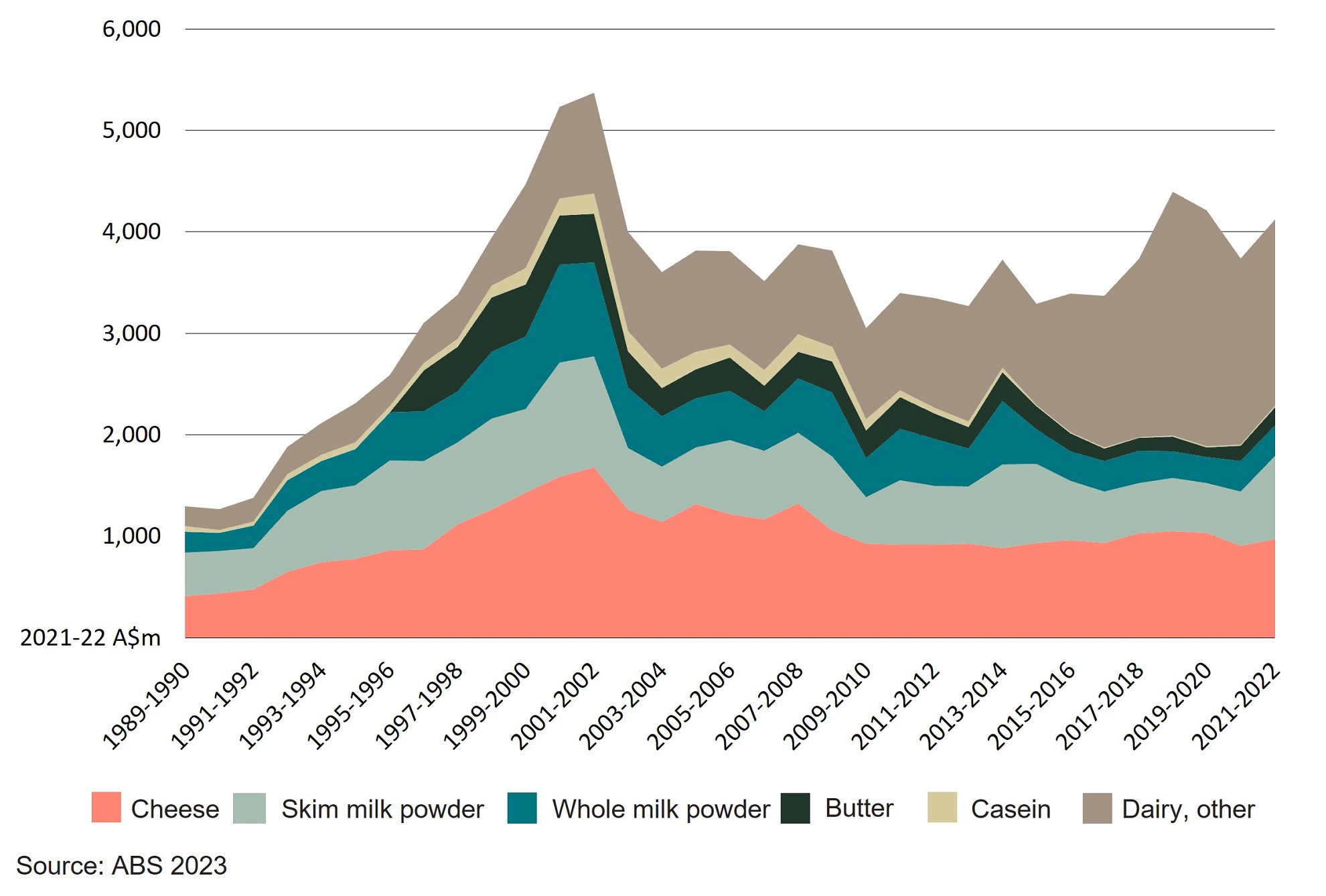

Australian dairy products export increased sharply from early 1990s and fell in early 2000s following industry deregulation. Exports were relatively stable between 2009–10 and 2015–16 and have begun to trend up since 2016–17 (Figure 3).

Most of Australia’s dairy exports go to the Asian region. Between 2019–20 and 2021–22, China (40%), Japan (11%), Indonesia (6%), Malaysia (6%) and Singapore (5%) accounted for more than two-thirds of the value of dairy exports.

Between 2019–20 and 2021–22, Australia exported an average of A$4 billion of dairy products each year (Figure 3). Cheese accounted for 24% of exports, followed by skim milk powder (15%), whole milk powder (7%) and butter (4%). Other dairy products, including infant and non-infant food preparations, comprised the remaining 50% of total export value.

Figure 3 - Value of Australian dairy export by product type, 1989–90 and 2021–22

Resources

The Department of Foreign Affairs and Trade has guidance material and a business guide about the A-UKFTA.

Austrade has more information about Doing business in United Kingdom.

The Australian Government’s network of Agriculture Counsellors provided information for this article. More information about the Agriculture Counsellor network, including contact details, are available on the Department of Agriculture, Fisheries and Forestry website.

Go further, faster with Austrade

Go to Austrade’s Go Global Toolkit to learn the export basics, find the right markets and understand market requirements.

Connect with us

Follow our @AusAgTrade Twitter account for all your #TradeTips and Market Intel.

Subscribe to our monthly Agriculture Market Intelligence Insights newsletter