The Australia-United Kingdom Free Trade Agreement (A-UKFTA) entered into force on 31 May 2023.

Under the agreement, tariffs on Australian sugar exports into the UK will be fully eliminated on 1 January 2031. Annual duty-free quotas during the tariff elimination period will also improve market access for Australian exporters.

The first full quota year (100,000 tonnes) commences in October 2024. If filled, the tariff free quota could see the value of Australian sugar exports to the UK reach A$74 million, up from effectively A$0 over the past five years.

Implications for Australian exporters

The A-UKFTA provides Australian sugar exporters with their best access since the UK joined the European Economic Community (EEC) in 1973.

The A-UKFTA provides Australian exporters with tariff-free access for 100,000 tonnes of sugar in the first full year (2024). Exports outside this quota will be subject to the UK’s Most Favoured Nation (MFN) tariff rate of £280/tonne. UK sugar processors will benefit from higher supply of raw sugar for processing. This will support the UK sugar processing industry and domestic sugar production.

Australia’s tariff-free quota will increase by 20,000 tonnes each year before reaching 220,000 in 2030 (Table 1). Tariffs and the quota on Australian sugar exports will be eliminated from 2031 onwards. These changes will immediately lift the commercial viability of the UK as a market for Australian sugar exports.

Table 1 Australia tariff-free export quota to the UK

| Year | Tonnes |

|---|---|

| 2023a | 26,959 |

| 2024 | 100,000 |

| 2025 | 120,000 |

| 2026 | 140,000 |

| 2027 | 160,000 |

| 2028 | 180,000 |

| 2029 | 200,000 |

| 2030 | 220,000 |

| 2031 onwards | Unlimited |

| a2023 pro rata amount. Total quota is 80,000 Source: Australia-UK FTA, Annex 2B |

|

History of Australian sugar exports to the UK

Before the UK’s accession to the EEC in 1973 (the precursor to the European Union), the UK was a major market for Australian sugar. Around one-third of all Australian sugar exports were to UK sugar refineries.

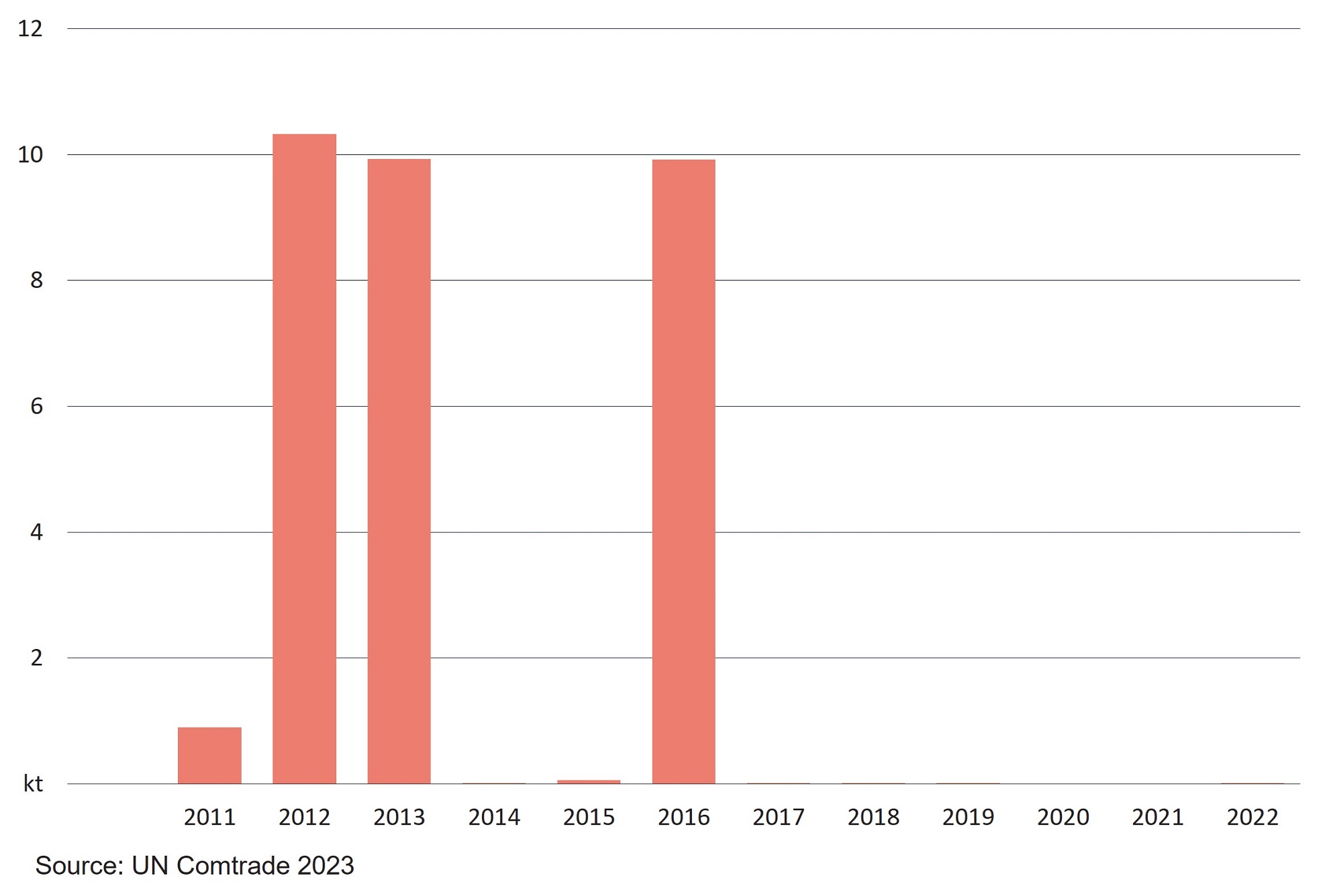

Since the UK’s accession to the EEC/EU, Australian sugar exports to the UK have been limited and sporadic (Figure 1 ). Sporadic Australian sugar exports to the UK have reflected relatively high-tariffs, lack of commercial viability within-quota export volumes, and post-Brexit quota reallocation between the UK and EU.

Figure 1 – UK raw sugar imports from Australia

Australian sugar exports to the UK have faced relatively high tariffs, as they have been subject to the common tariff shared by all EEC/EU members. Before A-UKFTA, Australia could export up to 9,925 tonnes of sugar per year at a tariff rate of €96/tonne (the in-quota rate). Exports above this amount were subject to the out-of-quota tariff of €339/tonne. Within-quota and out-of-quota tariffs added around 18% and 64% to the price of Australian sugar respectively.

The low within-quota volume reduced the viability of Australian exports and complicated transport options, given 9,925 tonnes of sugar amounts to only around 25-50% of a ship’s cargo. The pre-A-UKFTA within-quota was last filled in 2016 when Australia exported 9,925 tonnes of raw sugar to Tate & Lyle Sugars in London.

Post-Brexit quota allocation to EU27 countries also made Australian sugar exports to the UK more expensive. The entire 9,925 tonne sugar quota was allocated to EU27 countries as part of the UK’s withdrawal process from the EU at the World Trade Organisation (Article XXVIII process). This meant Australian sugar exports to the UK were subject to the UK’s MFN rate of £280 (+241% more than the within-quota price and around 53% above the current global sugar price).

¹This is based on the EU’s WTO commitments.

New opportunities under A-UKFTA

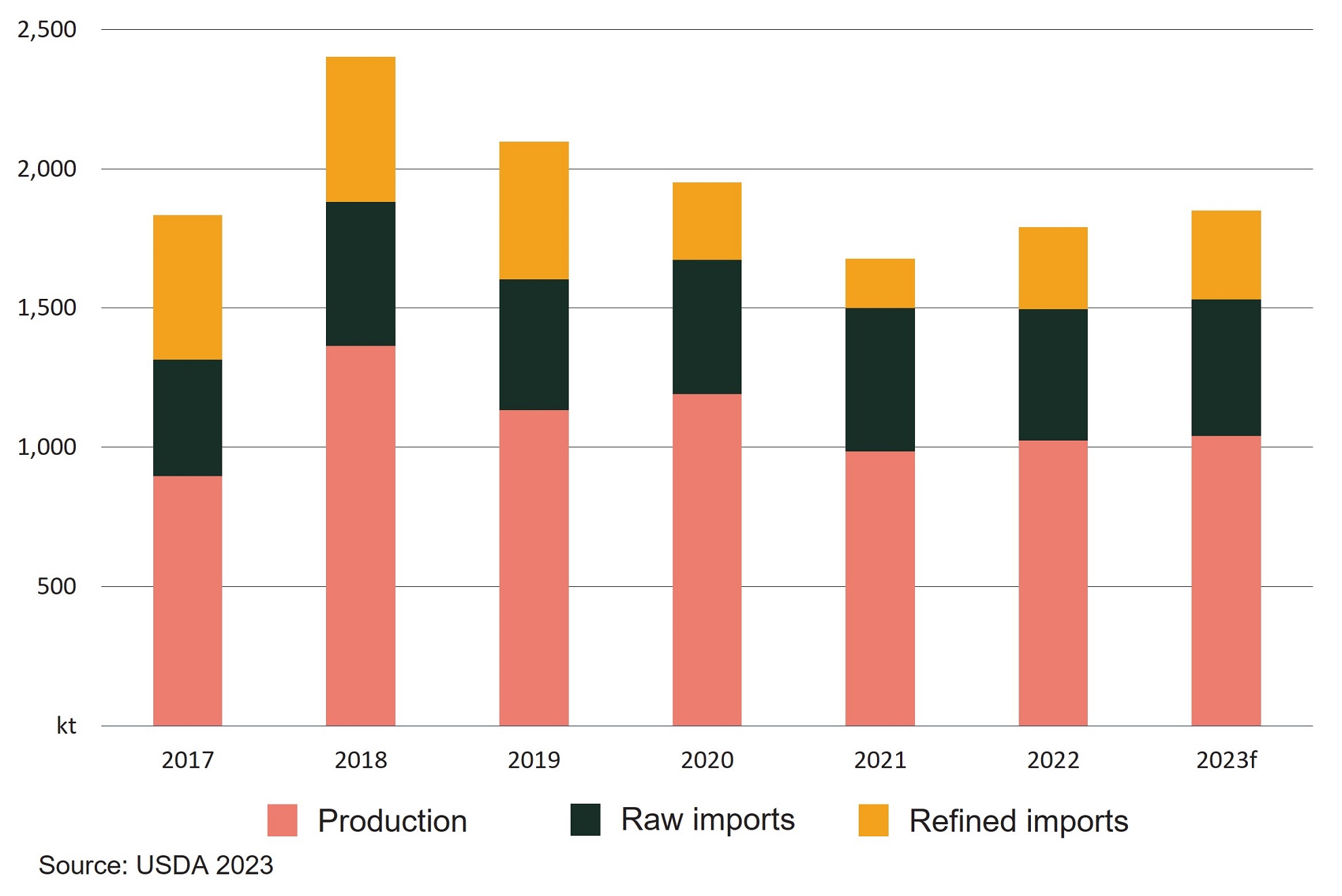

Between 2020 and 2022, the UK was the world 23rd largest sugar importer (USDA 2023). The UK imported an average of 739,000 tonnes of sugar (Figure 2), worth approximately US$353 million. The UK also produces approximately 1 million tonnes of sugar per year.

Reduced tariffs on Australian sugar will make the UK a commercially viable option for Australian exporters. If filled, Australia’s tariff free import quota to the UK could account for approximately 5% of Australia’s sugar exports and 30% of UK imports in 2030 based on current trade volumes.

The UK’s sugar processing sector will also benefit from an increased supply of high-quality sustainably produced raw cane sugar. This will help the UK’s sugar processing sector to better compete with EU processors. A stronger UK processing sector benefits UK sugar beet producers by ensuring the UK retains the capacity to produce sugar domestically.

Figure 2 – The UK sugar supply, domestic production, and imports (refined and unrefined)

Resources

More information about the Australian sugar industry is available here.

The Department of Foreign Affairs and Trade has guidance material and business guide about the A-UKFTA.

Further information on the Australian Government’s management and allocation of the UK sugar quota is available here.

Austrade has more information about the UK market.

The Australian Government’s network of Agriculture Counsellors provided information for this article. More information about the Agriculture Counsellor network, including contact details, are available on the Department of Agriculture, Fisheries and Forestry website.

Go further, faster with Austrade

Go to Austrade’s Go Global Toolkit to learn the export basics, find the right markets and understand market requirements.

Connect with us

Follow our @AusAgTrade Twitter account for all your #TradeTips and Market Intel.

Subscribe to our monthly Agriculture Market Intelligence Insights newsletter