The US Department of Agriculture's recent report on chickpeas has highlighted Australia as the world’s largest exporter. What else can the data show for Australia’s chickpea trade, and how do Australia’s other pulse crops measure up?

Pulses are an important and multi-purpose crop. They can be planted as a profitable break crop to improve soil quality and to manage pests and weeds. Globally, they are touted as a key crop to combat food insecurity and malnutrition because they are affordable, drought-resistant, and have a long shelf-life. Some types of pulses, such as lupins, are also an important source of animal feed.

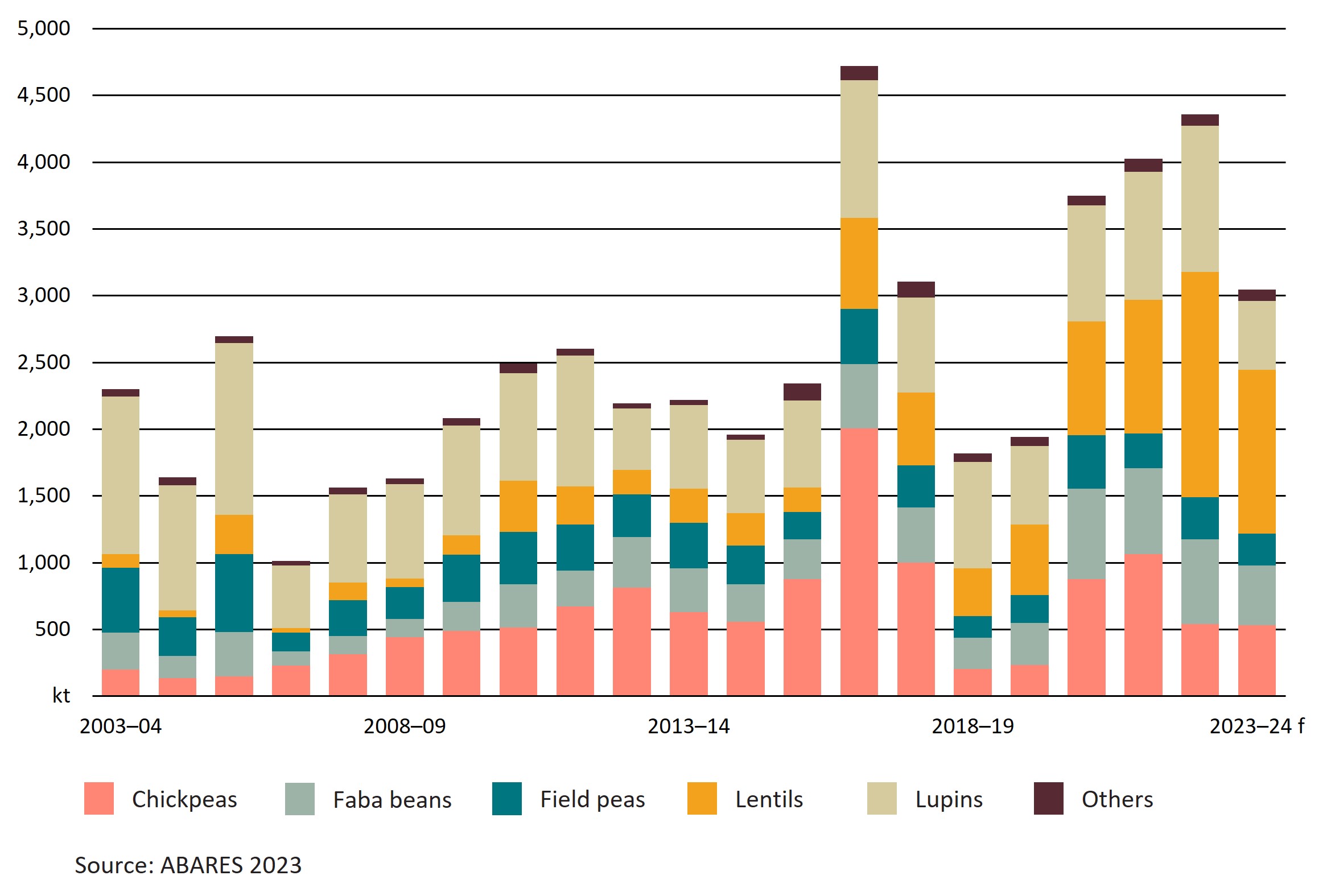

Different pulse crops are produced across Australia, and can be rotated with wheat, barley, canola, and oats. Australia’s total pulse production increased by 140% by volume between 2018–19 and 2022–23 to reach 4.4 million tonnes (ABARES/ABS 2023), though the 2023–24 crop is forecast to decrease due to drier conditions.

Australia as a key global exporter of pulses

Australia is a major global exporter of pulses (UN Comtrade 2023). In 2022, Australia was the world’s:

- largest exporter of chickpeas (US$357m).

- largest exporter of broad beans (US$249m).

- second largest exporter of lentils (US$752m), after Canada.

- fourth largest exporter of mung beans (US$98m).

- fifth largest exporter of peas (US$86m).

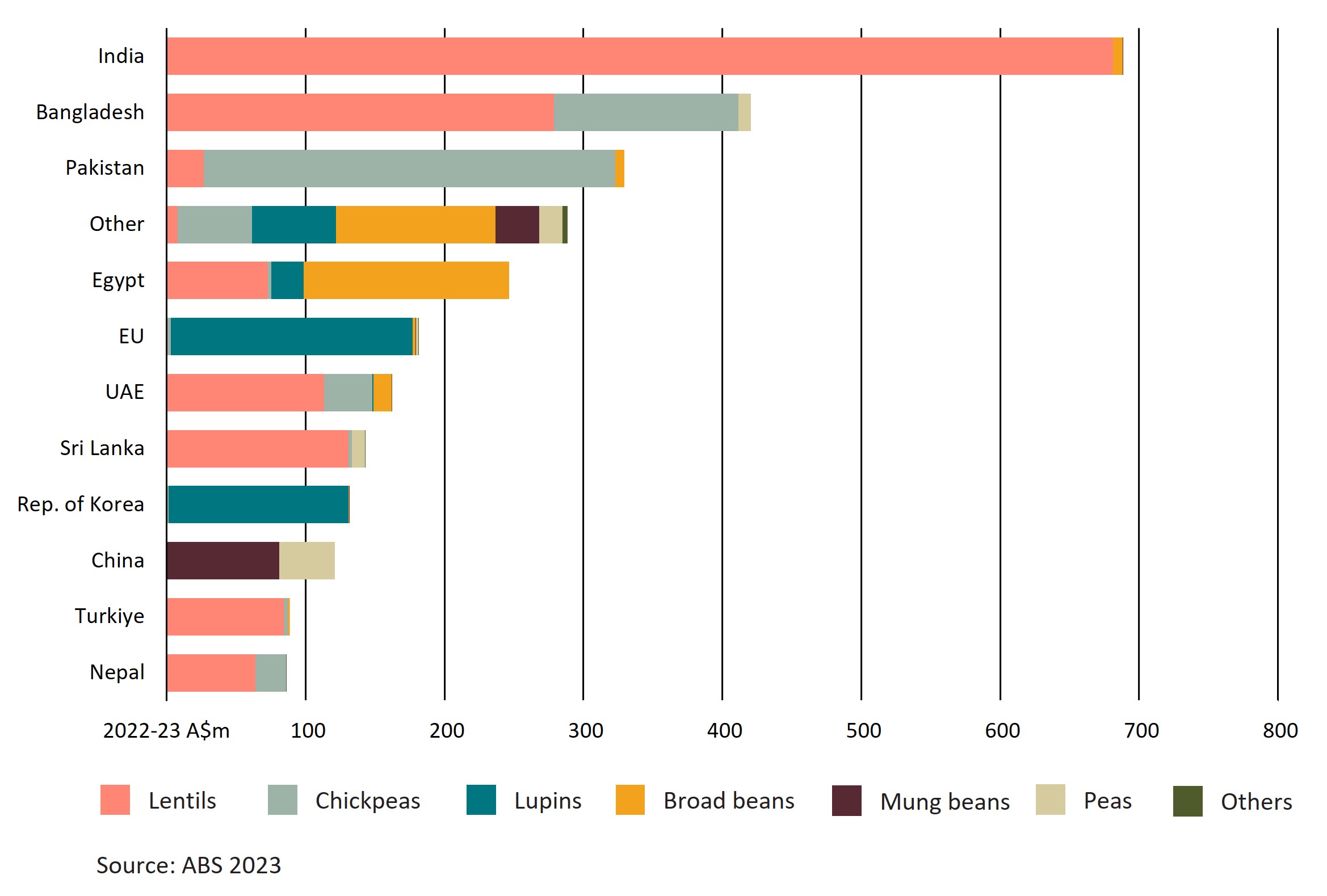

In 2022–23, most Australian chickpeas were exported to Pakistan (54%) and Bangladesh (24%) on a value basis (Figure 1). Other notable Australian pulse markets in 2022–23 were broad beans to Egypt (50%), lentils to India (47%) and Bangladesh (19%), mung beans to China (72%), and lupins to the EU (45%).

The global pulse market has grown at an average annual rate of 1.7% over the past decade (OECD-FAO 2023). The OECD-FAO projects that per capita consumption of pulses will continue to grow in all regions of the world. This is driven by the health and environmental benefits of pulses, which can be used as a meat substitute or processed into ready-to-eat snack foods.

Figure 1 – Value of Australia’s major pulse exports by destination in the 2022-23 FY

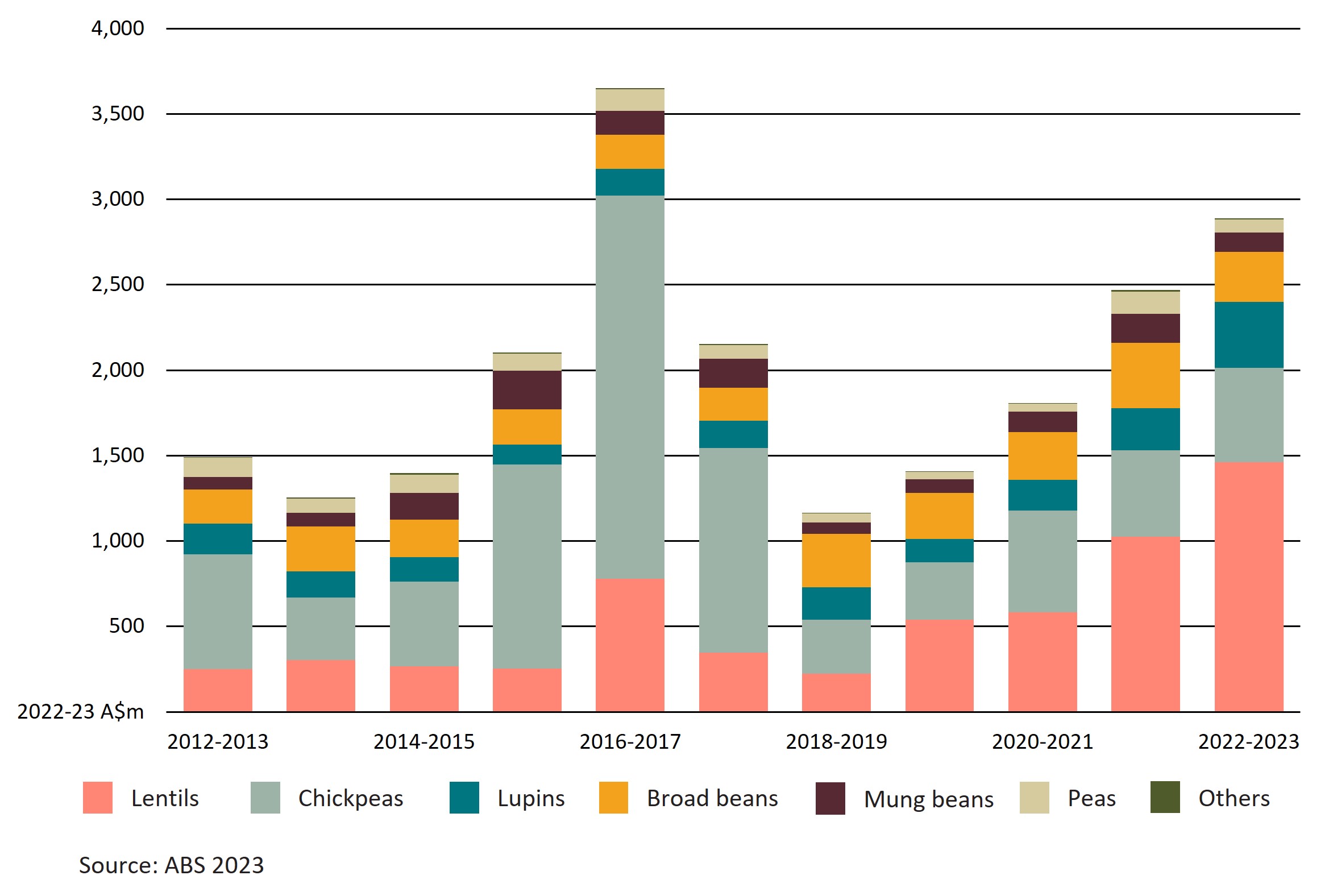

Australia’s exports of pulses have grown steadily over the past five years, increasing +148% in value. The greatest increases have been in lentils, chickpeas and lupins (Figure 2).

Figure 2 – Value of Australia’s pulse exports to the world by type, 2012-13 to 2022-23

Australia’s major competitors for pulse exports

In 2022, the top three exporters of chickpeas, were Australia (23%), India (15%), and Canada (13%). For lentils, they were Canada (44%), Australia (20%), and Türkiye (14%) (Table 1).

Australia’s primary competitor for pulses is Canada, which also exports chickpeas to Pakistan. Over the past three years, Australia’s average unit export price for chickpeas to Pakistan was US$578/tonne compared to Canada’s at US$718/tonne, giving Australia a price advantage (UN Comtrade 2023). Australia also exports chickpeas to the United Arab Emirates (UAE), which is a major export market for India, another competitor. India and the UAE have a Comprehensive Economic Partnership Agreement that supports their bilateral trade, providing India an advantage to the UAE market despite India’s average export unit price for chickpeas to the UAE being higher than Australia’s (US$794/tonne and US$511/tonne, respectively).

Australia competes with Canadian lentils in the Indian and the UAE markets. The average unit export prices for Australian and Canadian lentils have been comparable, however Canada is the world’s largest producer of lentils, positioning Canada as a consistent and reliable global supplier. In 2021, the volume of Canada’s lentil production was 88% higher than Australia’s (FAO 2023).

Most-Favoured-Nation (MFN) tariff rates for pulses are low for most markets, ranging from 0–5%. For example, the MFN rate for chickpeas is 0% for Bangladesh, and 3% for Pakistan. India’s MFN tariff rates for pulses are the exception and ranged from 30–70% in 2022.

The Australia-India Economic Cooperation and Trade Agreement (AI-ECTA), which entered into force at the end of 2022, has a range of outcomes for different types of pulses. For example, peas and chickpeas are excluded from the agreement and the MFN tariffs are still applied. Lentils can access a 50% reduction on the base MFN rate (30%) for an annual quota of 150,000 tonnes under AI-ECTA. In early 2022, the Indian government temporarily cut tariffs on lentils to zero for all trading partners until March 2024. While beneficial to Australian lentil exporters, they do not receive any tariff advantage against key export competitors such as Canada. Broad beans, kidney beans, and cow peas on the other hand enjoy a 0% tariff rate under AI-ECTA compared to the general 30% MFN rate.

Agreements like the China-Australia FTA, Korea-Australia FTA, and in some cases the Regional Comprehensive Economic Partnership (RCEP), allow a 0% tariff on pulses to these markets. More information on Australia’s trade agreements can be found using the Free Trade Agreement portal.

| Commodity | Top 5 exporters | Value of exports (US$m) |

Export market share (%) |

Top 3 destinations by value |

|---|---|---|---|---|

| Chickpeas | Australia | 357 | 23 | Pakistan (46%), Bangladesh (33%), Nepal (5%) |

| India | 225 | 15 | UAE (33%), Iran (12%), Sri Lanka (7%) | |

| Canada | 203 | 13 | Pakistan (24%), USA (20%), Syria (10%) | |

| Türkiye | 187 | 12 | Iraq (25%), Syria (9%), Italy (8%) | |

| Mexico | 140 | 9 | Algeria (46%), Türkiye (30%), USA (12%) | |

| Lentils | Canada | 1,639 | 44 | Türkiye (23%), India (18%), UAE (13%) |

| Australia | 752 | 20 | Bangladesh (37%), India (29%), UAE (10%) | |

| Türkiye | 537 | 14 | Iraq (43%), Sudan (15%), Egypt (4%) | |

| UAE | 390 | 10 | Iran (23%), Djibouti (23%), Saudi Arabia (14%) | |

| USA | 162 | 4 | Canada (31%), Mexico (12%), Sudan (12%) |

Australia’s pulse production has grown in recent years

Globally, Australia is a major producer of pulses (FAO 2023). In 2020–21, Australia was the:

- largest producer of lupins (866 kt).

- second largest producer of chickpeas (876 kt) after India.

- third largest producer of lentils (854 kt) after Canada and India.

- fourth largest producer of broad beans (510 kt).

- seventh largest producer of peas (339 kt).

Western Australia is by far the largest producer of lupins accounting for 84% of production in

2022–23 (ABARES 2023). Queensland produced 54% of Australia’s chickpeas, followed by New South Wales with 35%. South Australia produced 53% of Australia’s lentils, followed by Victoria with 44%. South Australia was also the largest producing state for faba beans (47%) and field peas (38%).

Over the past three years, the volume of Australia’s pulse production has increased with favourable cropping conditions and high rainfall (ABARES 2023). Relatively high prices for wheat and canola led growers to focus plantings on these crops over chickpeas in 2022–23. Chickpeas were experiencing relatively weak prices due to low demand in India and a surplus of Australian chickpeas from the previous season.

Production volumes are forecast to decrease in 2023–24 due to drier conditions, especially in the northern cropping regions, with the largest decrease likely to be in lupins (Figure 3). The planting area for chickpeas is forecast to increase by 20% as farmers look to mitigate the unfavourable rainfall outlook with drought-resistant crops.

Figure 3 – Volume of Australian pulse production by type, 2003-04 to 2023-24 (forecast)

Further information

Information on the Australian pulse industry is available from Grains Australia and the Grains Research and Development Corporation.

The Australian Government’s network of Agriculture Counsellors provided information for this article. More information about the Agriculture Counsellor network, including contact details, are available on the Department of Agriculture, Fisheries and Forestry website.

Go further, faster with Austrade

Go to Austrade’s Go Global Toolkit to learn the export basics, find the right markets and understand market requirements.