Record demand and disrupted supply chains have led to high prices and delays for agricultural machinery imports. Strong agricultural production and ongoing high shipping costs will keep machinery prices elevated in 2022-23.

Machinery imports are important for Australian agriculture

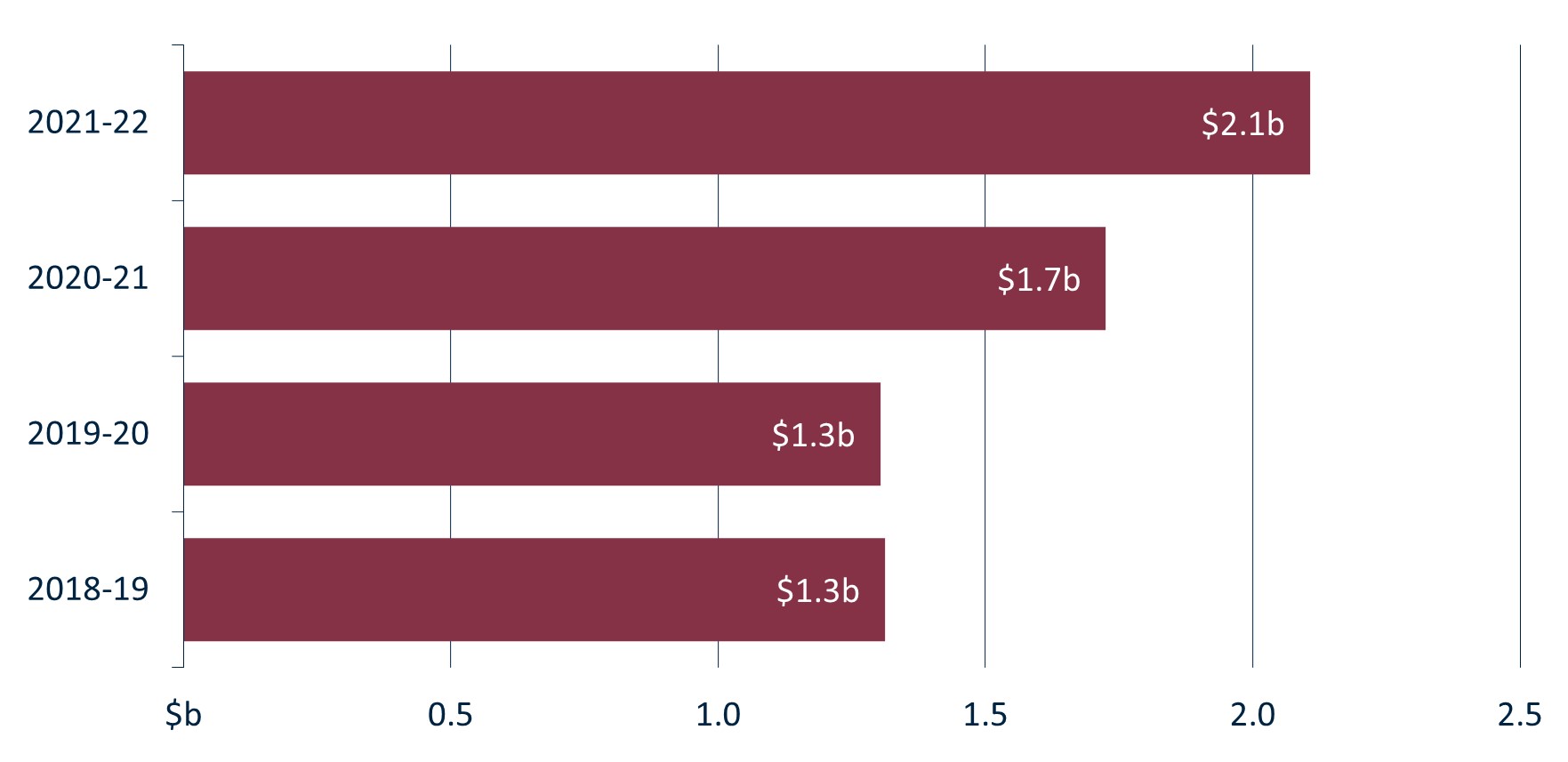

- Between 2019-20 and 2021-22, Australia imported an average of $1.7 billion of agricultural machinery each year.[1]

- Harvesters and threshers ($493m) and machinery to prepare soil ($200m) were the largest import categories.

- Approximately 60% of Australia’s agricultural machinery demand is met by imports (IBISWorld 2021).

- This includes imports of whole products, such as tractors, and components that are used in Australia’s domestic machinery manufacturing industry.

[1] ”Agricultural machinery” is defined as selected items from Harmonized System chapter 84.

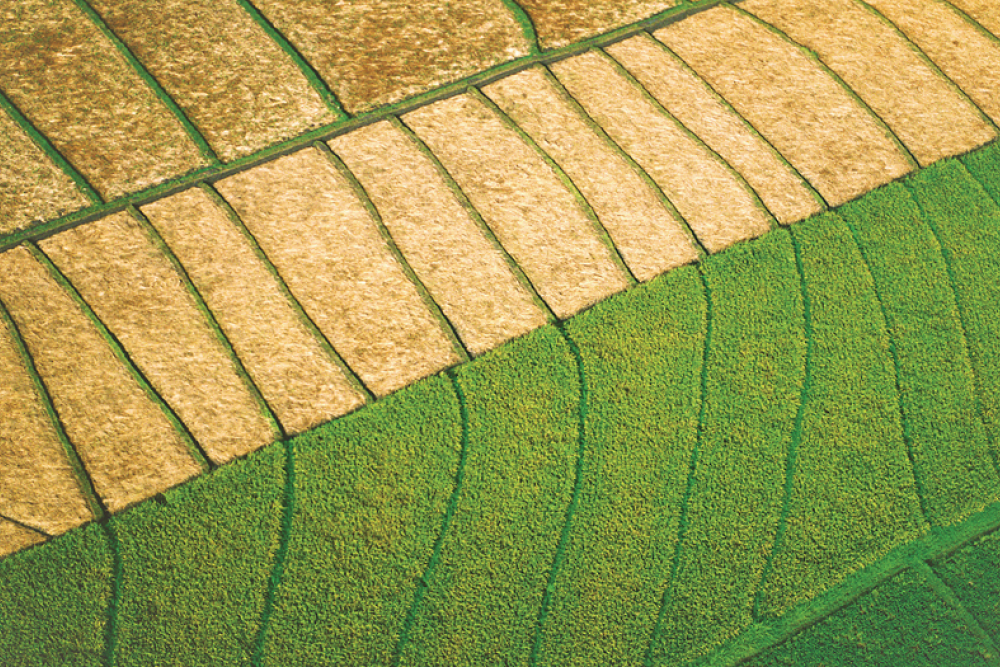

Figure 1: Australian agricultural machinery imports

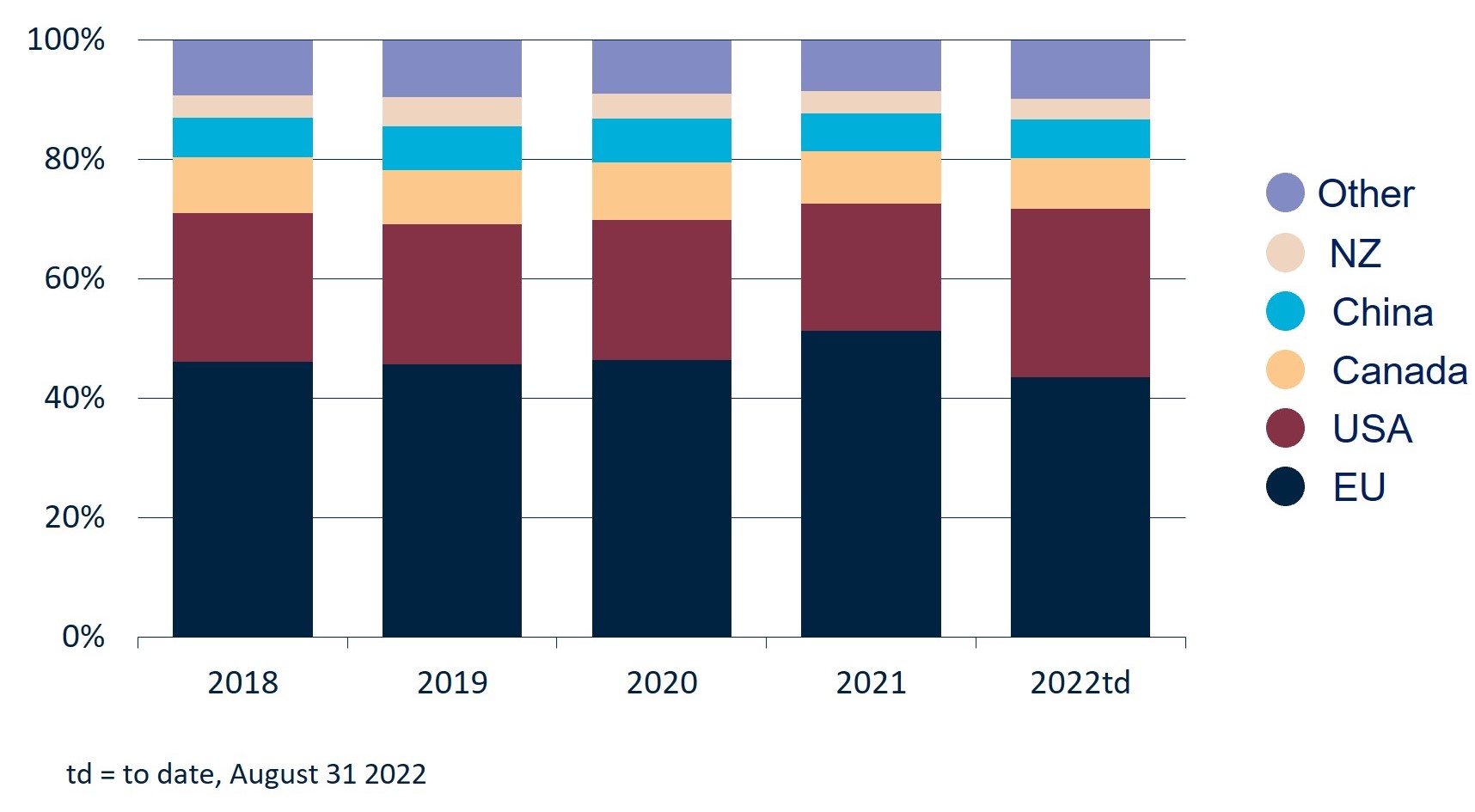

Figure 2: Share of Australian agricultural machinery imports by country

Demand for agricultural machinery is at record levels

- Australia imported a record $2.1 billion of agricultural machinery in 2021-22. This was a 46% increase on the previous 3-year average. July and August 2022 also saw record import values.

- According to the Tractor Machinery Association of Australia, machinery demand has been at levels not seen since the late 1970s/early 1980s.

- High demand is being driven by strong agricultural production and prices, and the Australian Government’s Temporary Full Expensing (TFE) program, which includes tax incentives for eligible capital expenses.

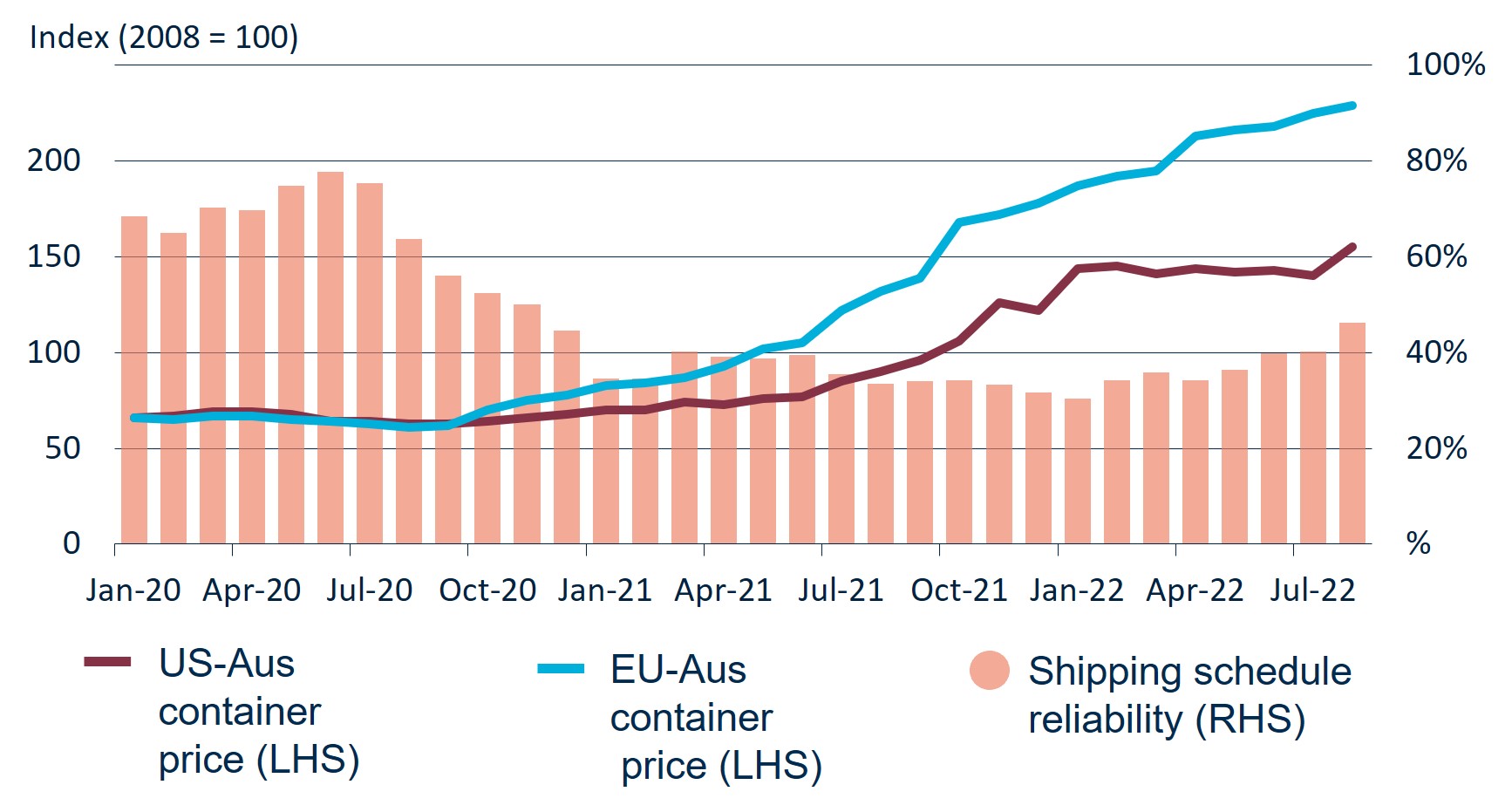

Figure 3: Shipping container price index for US and Europe routes to Australia and global shipping schedule reliability

Machinery imports are seasonal and cyclical

- Agricultural machinery imports spike in winter each year. This is when farmers use revenue from the previous year’s crop to invest in machinery for the upcoming harvest season.

- Good seasonal conditions are closely correlated with increased machinery purchases. The return of the La Niña weather cycle has led to increased demand for agricultural machinery.

Machinery imports have been affected by supply chain disruptions

- Between July 2020 and January 2022, global shipping reliability fell. Reliability has begun to improve in recent months.

- Shipping container prices from the US and Europe to Australia have risen sharply since early 2021 and are continuing to rise.

- Turnaround times at ports in Australia and overseas have been affected by staff shortages and industrial action.

Outlook for machinery imports

Import statistics for July and August 2022 and market conditions indicate that both machinery demand and prices will remain high in 2022-23.

Supply – Shipping reliability is improving, but remains well below pre-COVID levels. The impact of COVID-19 lockdowns on factories in the US and EU has reduced, however lockdowns in China remain an issue.

Prices – A high US dollar and ongoing increases to shipping costs will put upward pressure on machinery import prices.

Demand – Despite recent floods, overall strong agricultural production will continue to drive demand. Farmers may also seek to make purchases prior to the scheduled end of the TFE program in June 2023.

Download

November 2022 – Snapshot of Australian machinery imports (PDF)

November 2022 – Snapshot of Australian machinery imports (Word)

Connect with us

Follow our @AusAgTrade Twitter account for all your #TradeTips and Market Intel.

Subscribe to our monthly Agriculture Market Intelligence Insights newsletter.