International government policies aimed at reducing greenhouse gas emissions and energy price volatility is driving biofuel demand. Australia is well-placed to provide key inputs to global biofuel production.

Global use of biofuels on the rise

- Over the past 3 decades, biofuels have become an increasingly important source of energy.

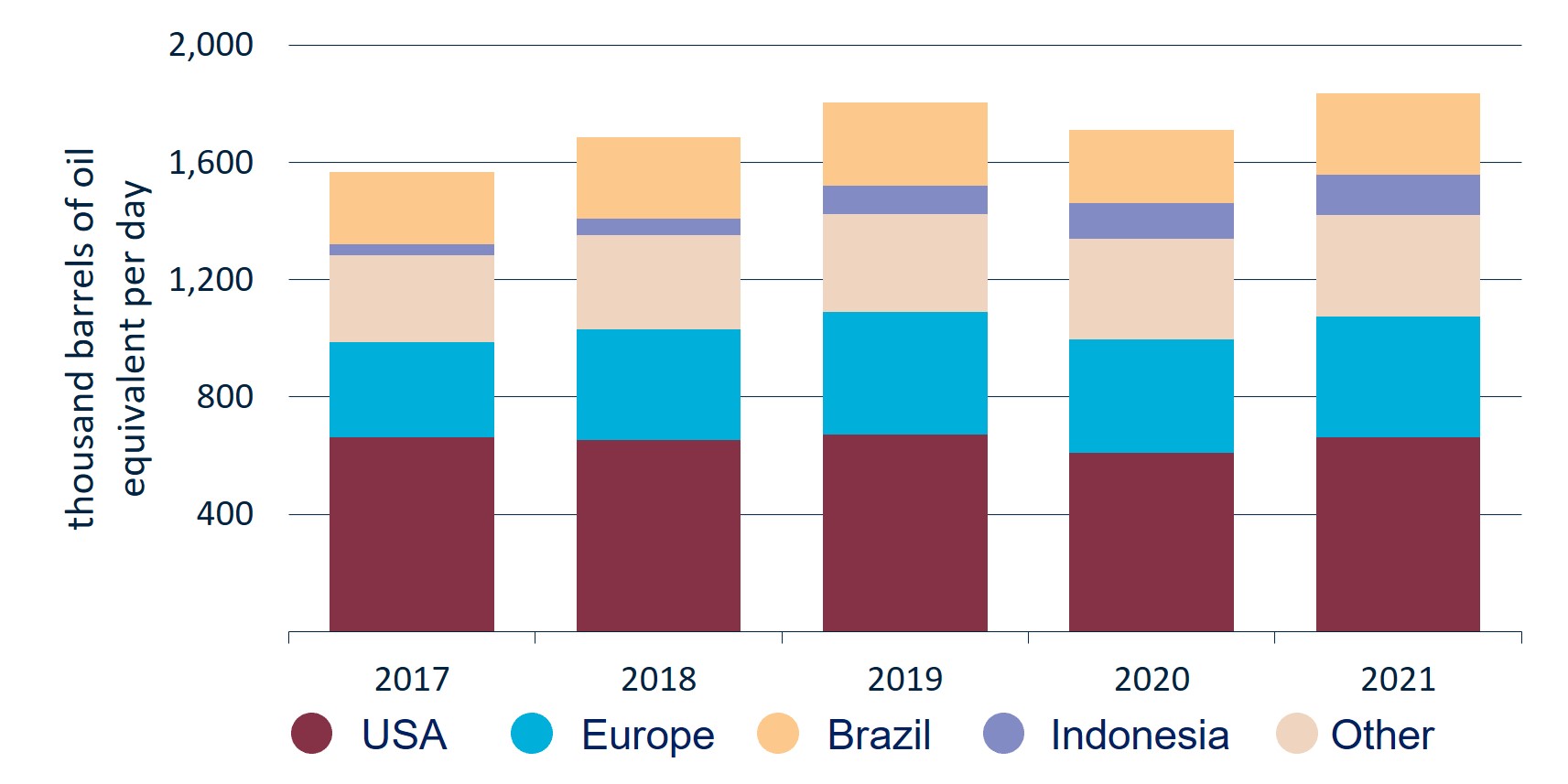

- Biofuel production has increased from 1.2 million barrels per day in 2011 to 1.8 million barrels per day in 2021 (an increase of 46%).

- In 2021, the USA, Brazil, Europe and Indonesia were the largest consumers of biofuel, accounting for 84% of global biofuel consumption.

- Over the next 5 years, the USA and Brazil will continue to lead global demand and production. Asia, particularly Indonesia, Malaysia and India, are expected to have the largest growth in demand.

Figure 1: World biofuel consumption

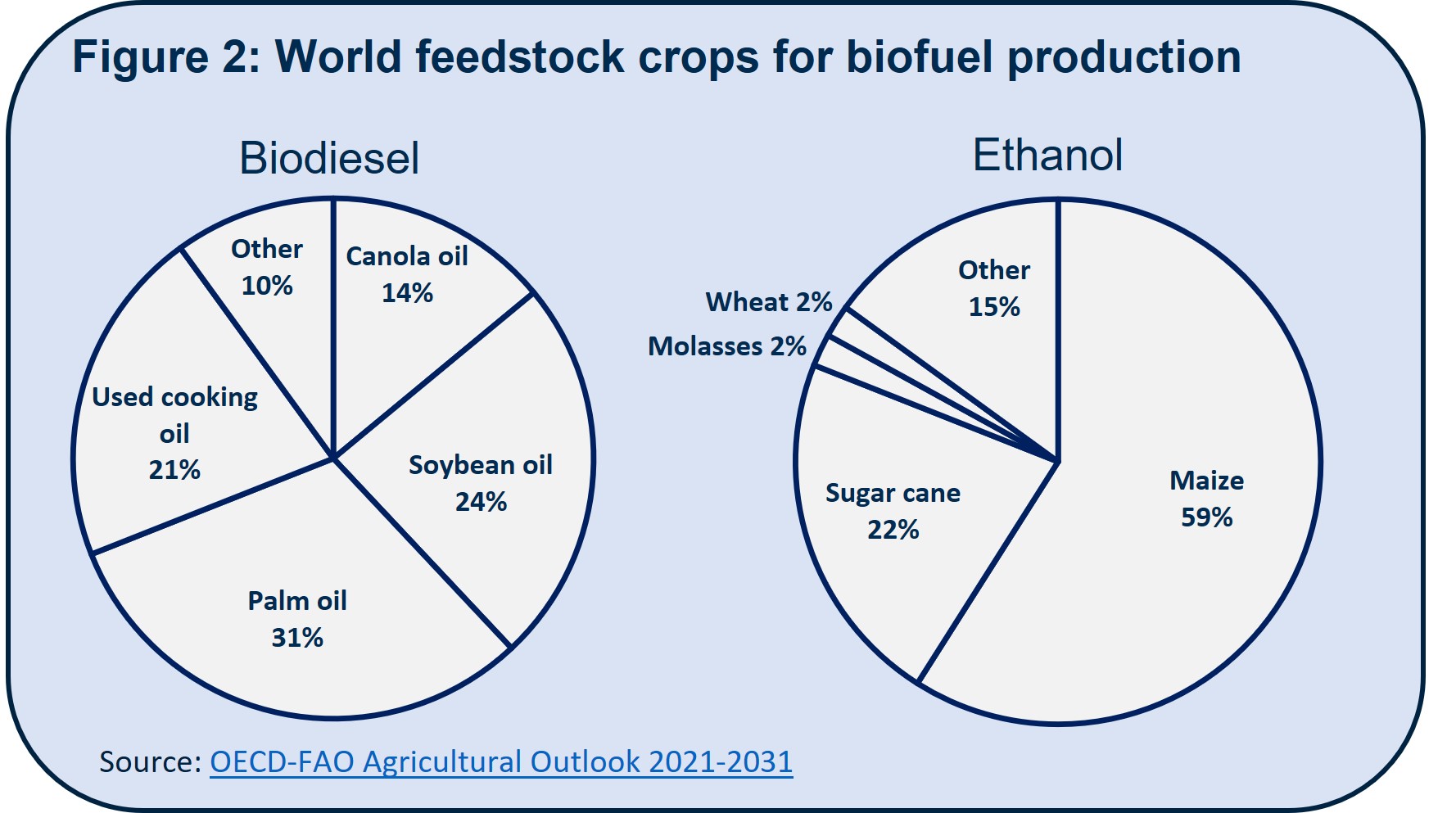

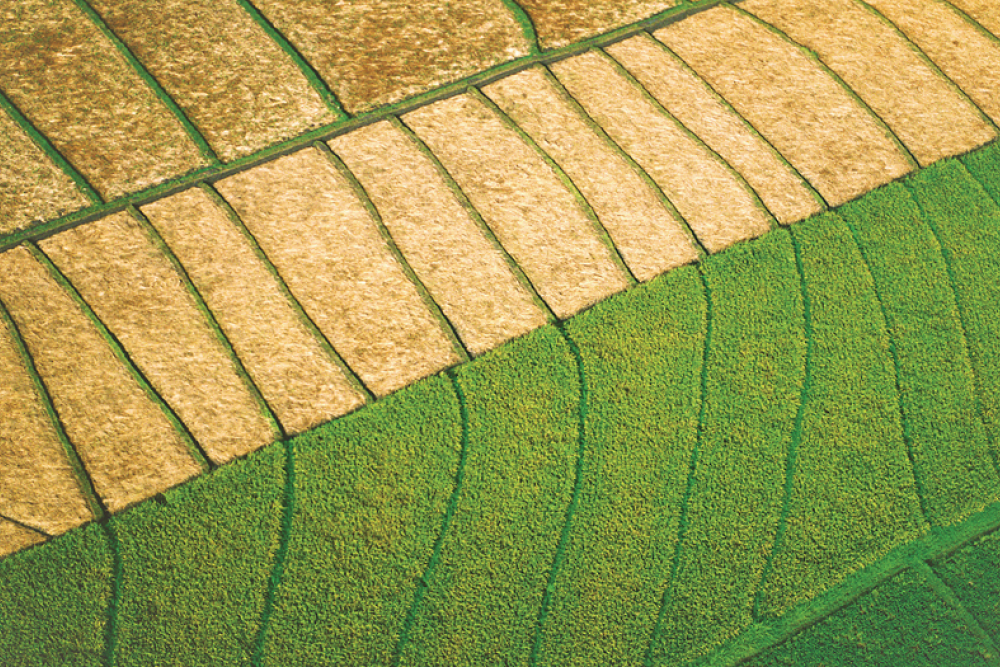

Figure 2: World feedstock crops for biofuel production

The role of agriculture in biofuel production

- Maize, sugar cane and oilseeds are the key feed stocks for biofuel production.

- The OECD-FAO estimate that between 2019 and 2021, 21% of world sugar cane production, 15% of world maize production and 12% of oilseed production was used to make biofuels.

- Other biofuel feedstocks include rice, coarse grains and cellulosic biomass (such as barley straw) for ethanol, while animal fats can be used for biodiesel.

- The majority of Australia’s $5.76b in canola seed exports in 2021-22 will be used to make biofuel in the EU.

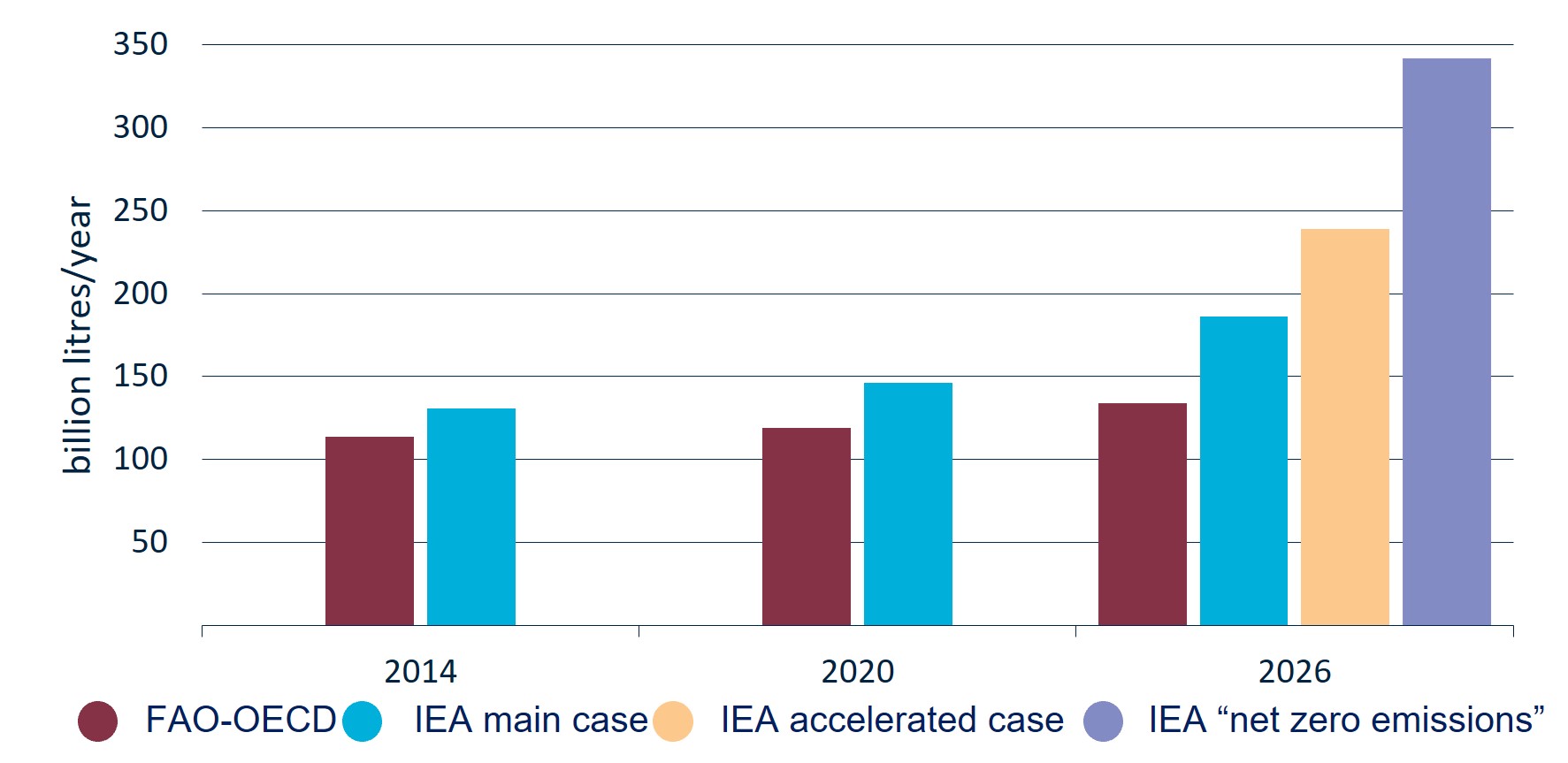

Figure 3: IEA and OECD-FAO projections for global biofuel demand

- The International Energy Agency (IEA) expects biofuel demand to grow from 146 billion litres/year in 2020 to between 186 and 342 billion litres/year in 2026 (an increase of 27%-134%).

- The magnitude of the increase will depend on whether countries meet their expressed policy goals of increasing biofuel use and the relative price of biofuels compared to oil.

- The OECD-FAO forecast more modest biofuel consumption growth than the IEA (134 billion litres of biofuel in 2026).

International biofuel policy impacts on Australian agriculture

- The EU intends to increase the use of biofuels and phase out the use of palm oil as a biofuel feedstock. This will increase the overall demand for biofuel feedstock, particularly feedstocks such as canola.

- India has proposed a target of 20% blending of ethanol in petrol, and 5% blending of biodiesel in diesel by 2030. India is unlikely to become an export market for Australian ethanol or by-products from raw sugar production.

- The diversion of Indian sugarcane away from sugar and towards ethanol production may have indirect benefits to Australian sugar exporters.

Australian biofuel production

- In 2021, Australia produced 180 million litres of fuel ethanol and 18 million litres of biodiesel.

- The main feedstock of Australia’s three ethanol producers are wheat starch and molasses (from sugarcane). The main biodiesel feedstocks are tallow and vegetable oil (used and virgin).

- Australia is the third largest sugarcane producer worldwide. Most excess bagasse is burnt to generate electricity, however, other countries have used its energy potential for biofuel.

Download

December 2022 – Snapshot of global biofuel market (PDF)

December 2022 – Snapshot of global biofuel market (Word)

Connect with us

Follow our @AusAgTrade Twitter account for all your #TradeTips and Market Intel.

Subscribe to our monthly Agriculture Market Intelligence Insights newsletter.