There is growing interest in goats as a source of lean red meat and as a hardy livestock animal that is resilient to temperature and drought. The global goat population increased by 19.3% between 2006 and 2016, while cattle and sheep increased by 6.7 and 6.8%, respectively.

Goats are a profitable enterprise in Australia’s northern semi-arid rangelands, and Australia’s goat meat production is increasing. There is low demand for goat meat domestically, though researchers are exploring the domestic market. This has resulted in the industry exporting most of its meat products.

Implications for Australian goat meat exporters

Australia is a small producer of goat meat (also called chevon), however, remains the world’s largest exporter. Free trade agreements (FTAs) support Australian goat meat exports into several key markets (Table 1 ), including to the United States (US) and the Republic of Korea. In recent months, China has grown to become one of the primary destinations for Australian goat meat.

The over-the-hook price of Australian goat meat has fallen since June 2022 , which has been attributed to an increased supply of goats from both Australia and the US. Increased global demand for goat meat has the potential to increase Australian goat meat exports, stabilise prices and support the long-term growth of the domestic goat industry.

| Importing country | Trade agreements | Effective from | Current tariff rate |

|---|---|---|---|

| Canada | CPTPP1 | 20 Dec 2018 | 0% |

| China | ChAFTA2 | 1 Jan 2023 | 0% |

| Japan | JAEPA3 | 15 Jan 2015 | 0% |

| Republic of Korea | KAFTA4 | 1 Jan 2023 | 0% |

| Taiwan | - | - | NT$11.3/KGM or 15% |

| Trinidad and Tobago | - | - | 0% |

| US | AUSFTA5 | 1 Jan 2016 | 0% |

Source: WTO 2023, DFAT 2023

1Comprehensive and Progressive Agreement for Trans-Pacific Partnership; 2China–Australia FTA; 3Japan–Australia Economic

Partnership Agreement; 4Korea–Australia Free FTA; 5Australia–United States FTA

Australia’s goat export markets

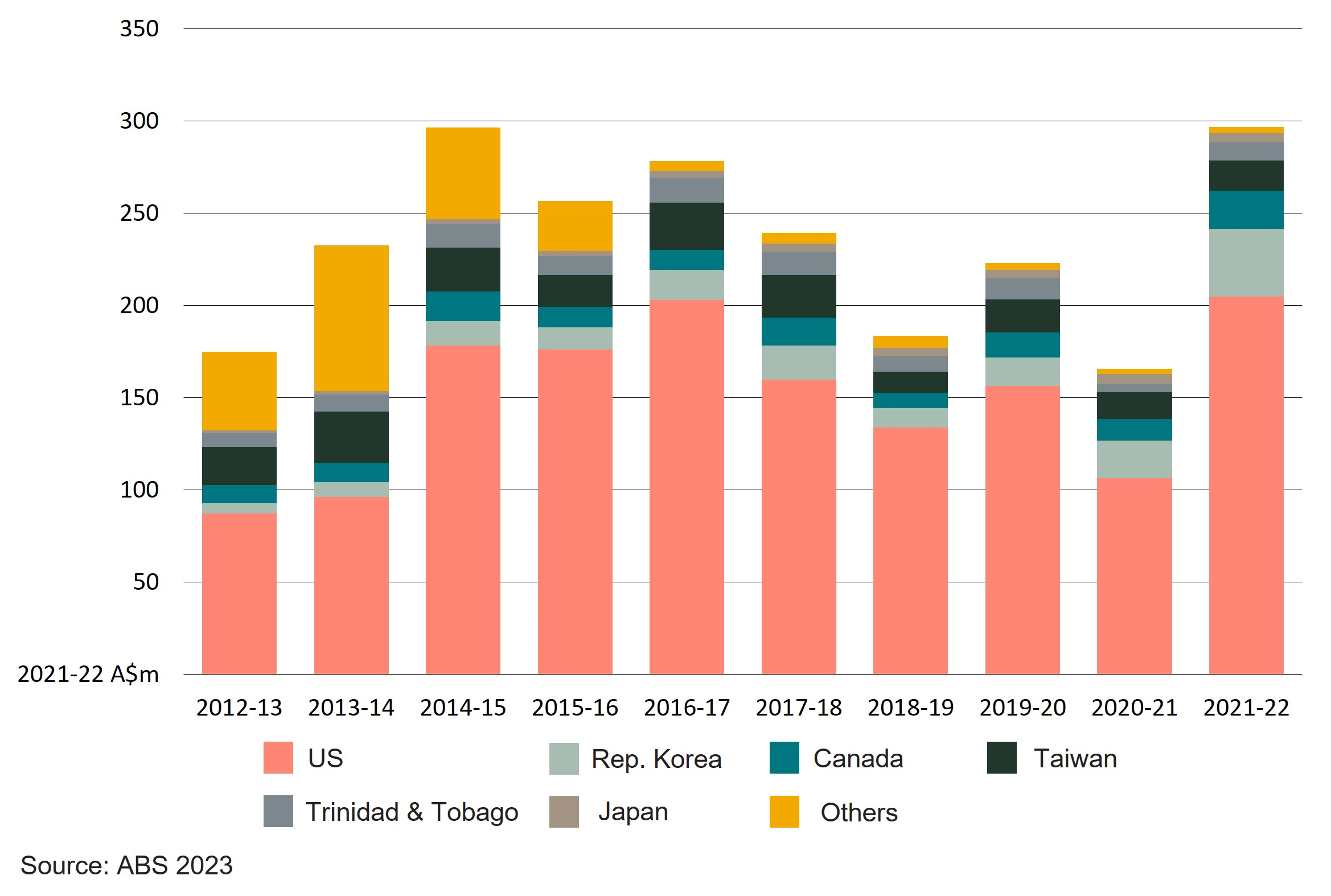

Australian goat meat exports peaked in 2021–22 (A$296.7m). This record value of exports followed a 20-year low in Australian goat meat production (MLA 2023) that had resulted in a fall in the value of exports in 2020–21 (Figure 1) .

Figure 1 – Value of Australia’s goat meat exports to the world, 2012–13 to 2021–22

The main markets for Australia’s goat meat by value were the US (69%), the Republic of Korea (13%), Canada (7%) and Taiwan (6%).

The North America market for goat meat is expected to grow further as a result of population growth, demographic change, and changing consumer tastes (MLA 2023). Goat meat is a lean red meat with low content of fat, cholesterol and saturated fatty acids, making it an attractive choice for health-conscious consumers and is also an acceptable meat across religions.

In the first four months of 2023, China accounted for 23% of Australia’s goat meat exports which were worth A$67.2 million over the same period (ABS 2023), making China the third largest importer of Australian goat meat after the US (35%) and the Republic of Korea (25%). The shift to exporting to China this year is mainly due to lower prices for goat meat, making it more attractive to consumers in China, and the introduction of a 0% tariff for Australian goat meat from 1 January 2023 under the ChAFTA.

Australia’s live goat exports have declined over the past two decades, in part due to the high cost of Australian live goats in key markets. The value of Australia’s live goat exports peaked at A$16.1 million (in 2020–21 dollars) in 2002 but fell to A$4.8 million (-70%) in 2022 (MLA 2023; 2021; 2019). Malaysia is the main destination for Australia’s live goats, however Malaysia’s share of Australian exports has fallen from between 85-90% before 2017 to 41% in 2020 (MLA 2021).

Australia’s role in global goat meat production and trade

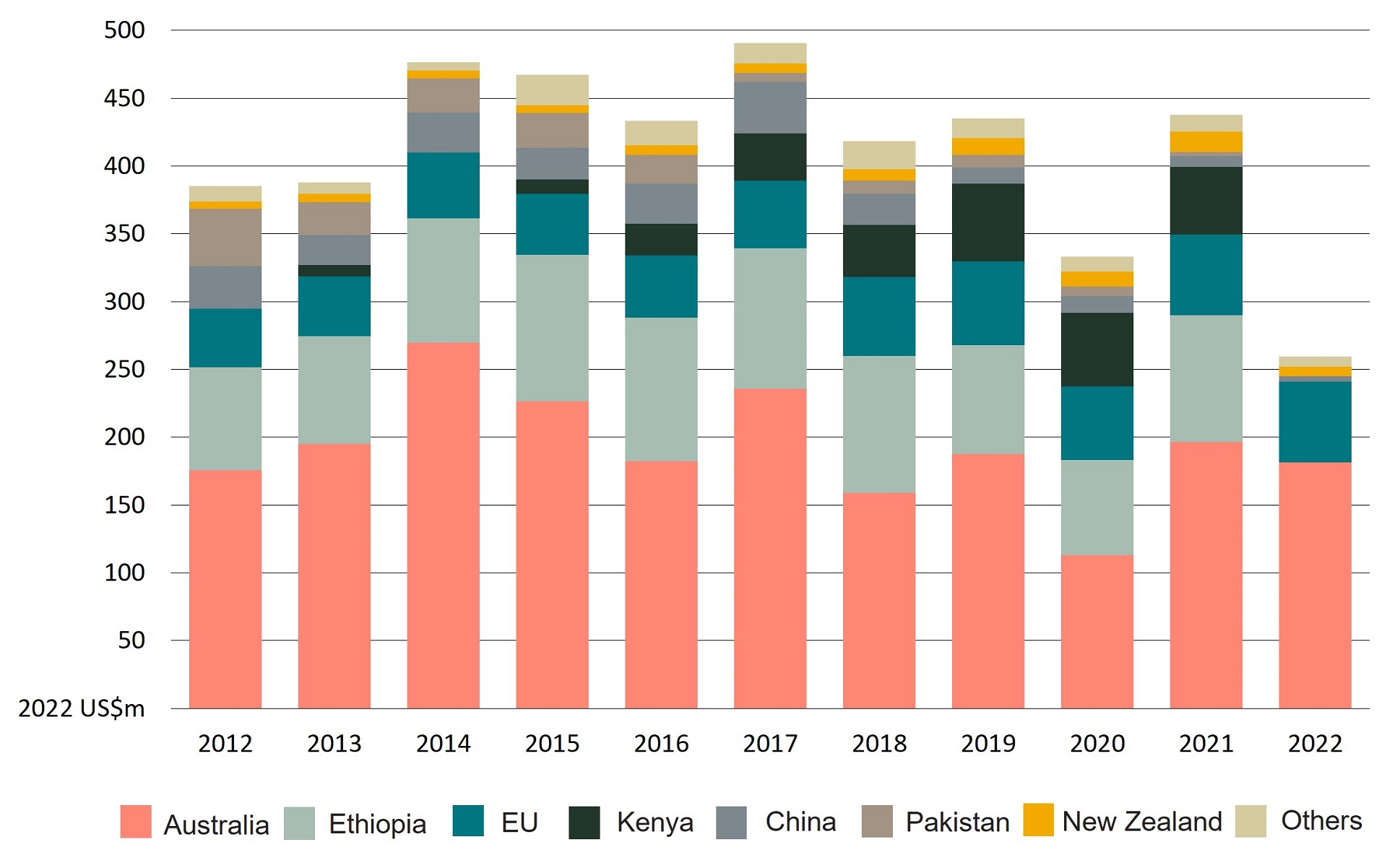

Asia and Africa hold the largest share of the world’s global goat population (Mazhangara et al. 2019). In 2021, Australia accounted for less than 0.5% of global goat meat production by volume (UN Comtrade 2023). In the same year, however, Australia accounted for 45% of the world’s US$437.6 million goat meat exports (Figure 2 ). Other large exporters were Ethiopia (21%) and the European Union (EU) (14%).

Figure 2 – Major goat meat exporting countries by value, 2012 to 2021

Australia’s average unit export price (US$11.97/kg) between 2019 and 2021 was higher than the global average of US$9.06/kg. Ethiopian and EU prices were US$7.98/kg and US$8.13/kg respectively, in the same period.

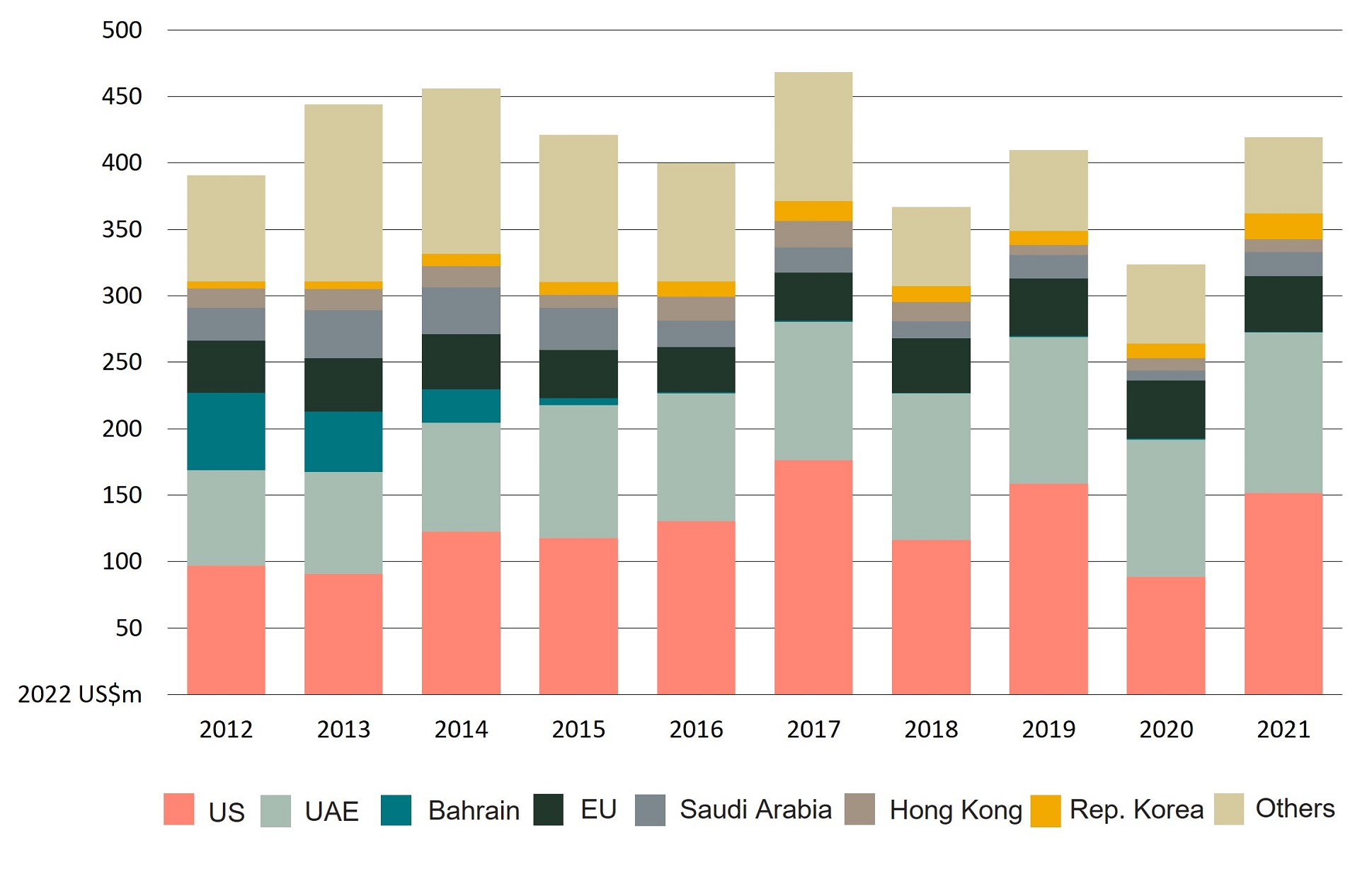

The US is the main importer of goat meat globally (Figure 3). Between 2019 and 2021, the global import market averaged US$384.2 million, with the US accounting for 35% of global goat meat imports. Other key importers in the same period were the United Arab Emirates (UAE) (29%) and the EU (11%).

Figure 3 – Major goat meat importing countries by value, 2011 to 2022

The highest average unit import price between 2019 and 2021 was US$23.80/kg (Andorra) compared to global average of US$9.21/kg. The US average unit import price was US$10.94/kg compared to UAE (US$8.68/kg), the EU (US$10.00/kg), the Republic of Korea (US$12.34/kg), Saudi Arabia (US$8.53/kg), and Hong Kong (US$14.86/kg).

Australian goat meat production

Goat meat production in Australia is dominated by semi-wild rangeland production, with small quantities produced on commercial farms. However, managed goat meat production is rising in Australia. It is estimated that managed or semi-managed goat numbers increased by 82% between 2015–16 and 2020–21 (MLA 2023).

Most of Australia’s goats are sourced from New South Wales. However, Victoria is the main goat meat processing state. In 2022, Victoria processed 56% of Australia’s 1.7 million live goats (MLA 2023). Queensland (27%), South Australia (14%), New South Wales (2%) and Western Australia (1%) were the other states that processed goat meat in 2022.

Resources

More information about the Australian goat meat industry is available via the Goat Industry Council of Australia (GICA) and the Meat & Livestock Australia (MLA). AUS-MEAT also has tools for Australian producers.

The department publishes Australian red meat export statistics, including goat.

The Australian Government’s network of Agriculture Counsellors provided information for this article. More information about the Agriculture Counsellor network, including contact details, are available on the Department of Agriculture, Fisheries and Forestry website.

Go further, faster with Austrade

Go to Austrade’s Go Global Toolkit to learn the export basics, find the right markets and understand market requirements.