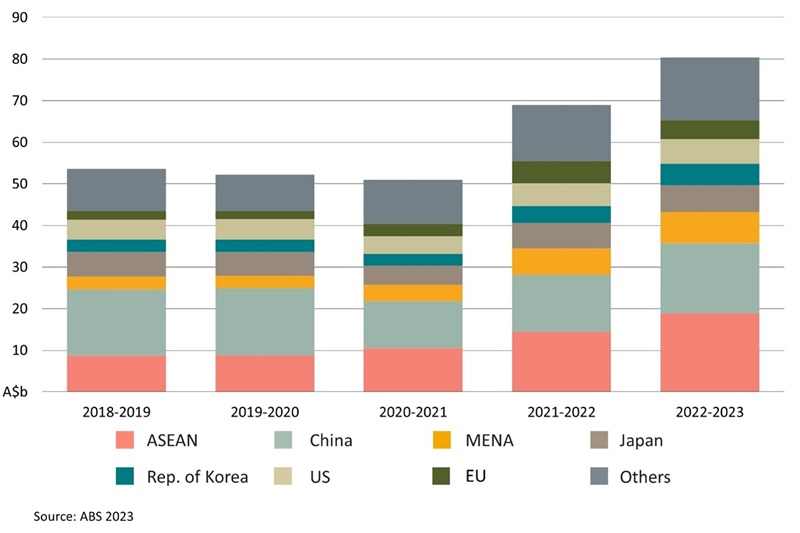

Australia exported $80.4 billion in agriculture, fisheries and forestry (AFF) products in the 2022–23 financial year – a record high, and a 17% increase on the previous year (Figure 1). Record crop production in 2022–23 coincided with an increase in demand for Australian grain due to global supply disruptions and increased prices, allowing significant gains for Australian farmers. Exporters benefited from decreasing input costs compared to the first half of 2022, including easing costs for fertiliser and freight.

Australia’s emerging and expanding markets

China remains Australia’s largest single export market, worth approximately $17 billion in 2022–23 (Figure 1). The market share of other Asian markets continued to grow, particularly for fast-growing economies in the Association of Southeast Asian Nations (ASEAN) ($19b). In 2022–23, ASEAN’s share of Australia’s AFF exports reached a record high (23%). Japan ($6b) and the Republic of Korea ($5b) also grew their market share.

Figure 1 – Value of Australia’s AFF exports by destination, 2018–19 to 2022–23

Market highlights from 2022–23 include:

- The value of exports to India increased +106% on the previous year after the Australia-India Economic Cooperation and Trade Agreement (ECTA) entered into force in December 2022. Tariff benefits under ECTA were a key factor – however, currency fluctuations and movements in global markets also played a role. The leading commodities were lentils (+220%) and cotton (+199%). The cotton quota under ECTA was fully utilised in the 2023 calendar year and the elimination of the 30% tariff saw sheep meat exports to India surpass $1 million for the first time. ECTA also saw substantial increases in Australian almond, orange/mandarin, broad bean, and seafood exports.

- In 2022–23, Australia was a leading exporter of lentils and other pulses. Lentils entered Australia’s top 10 AFF exports for the first time (Table 1). Temporary tariff-free access for lentils to India, which came into effect in October 2021 and was extended until 31 March 2025, contributed to the increase in exports.

- The start of 2023 saw some tariffs reduced to 0% under existing trade agreements. For example, from 1 January 2023, sheep and goat meat to the Republic of Korea became tariff-free under the Korea-Australia Free Trade Agreement (KAFTA). Exports of sheep and goat meat increased +54% by volume, and +49% by value compared to the previous year.

- The value of exports to Indonesia increased +25% to $4.9 billion, as growing bilateral trade continued to support Indonesia’s economic development. Increases in wheat (+63% in value) and cotton (+12% in value) exports were important for Indonesia’s growing food processing and textile industries. Although Indonesia was impacted by Foot-and-Mouth Disease and Lumpy Skin Disease outbreaks, leading to a decrease in live cattle exports, concerns around meat safety propelled demand for packaged product. The value of beef and veal meat exports increased +33% in 2022–23.

- Exports to Mexico increased +71% to $482.2 million in 2022–23. This included the commencement of exports of canola which reached $169.9 million. Imports support Mexico’s oilseed crushing industry, and this industry is projected to grow with the population and increased demand for stockfeed.

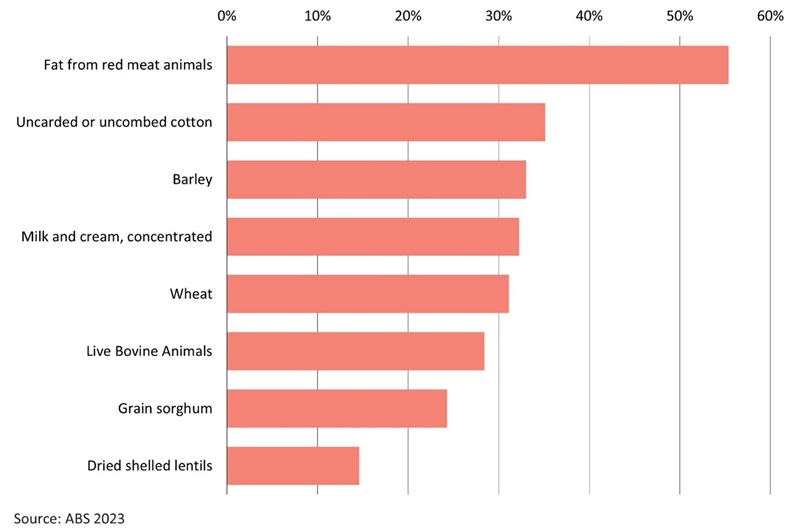

High commodity prices drove Australia’s record export value

Exporters benefitted from high commodity prices in 2022–23 (Figure 2), most notably in the following sectors:

- In response to high global oil prices, the unit export price of inedible tallow – a key ingredient in some types of biofuel – rose sharply in 2021–22. This continued with a further +9% increase in average export price into 2022–23. Australia’s inedible tallow exports exceeded $1 billion for the first time.

- Australian exporters benefited from high global prices for grain. Suboptimal production conditions for other major exporting countries contributed to high prices. The Black Sea Grain Initiative was in effect in 2022–23 and, while in place, helped soften prices. The Russian Federation's withdrawal from the Initiative in July 2023 will likely lead to continued elevated prices in 2023–24.

- Cotton prices peaked in the first half of 2022, remaining high over 2022–23, with global production reduced by drought in the US and destructive flooding in Pakistan. Australia’s average unit export price for cotton in 2022–23 increased by +31% over the previous financial year. Cotton went from being Australia’s 7th most valuable exported AFF commodity in 2021–22 to the 4th most in 2022–23. Economies with established and growing textile industries turned to Australia to fill their demand for cotton. Major export markets included Vietnam (40%), Indonesia (11%), India (8%) and Bangladesh (8%) (ABS 2023).

Figure 2 – Per cent increase in export prices of key commodities, comparing the 2022–23 FY average with the average of the previous three years

Global climate favoured Australia

Higher levels of rainfall brought about by the 2022–23 La Niña event provided exceptional conditions for Australian crop production. This coincided with unfavourable crop-growing conditions for Australia’s key competitors, which in turn contributed to reduced global supply and higher export prices. In the 2022 calendar year, Australia overtook Canada and the US to become the second largest wheat exporter in the world after the EU (UN Comtrade 2023). This followed drought in the US, the EU, and Canada that adversely affected their production of wheat and other crops. The USDA forecasts a continuation of these impacts into 2023–24, including a 10% decrease in wheat production in Canada.

Table 1 – Top 10 Australian AFF exports in 2022–23

| Commodity | Export value (A$b) | Per cent of total AFF exports | Per cent change in value from 2021-22 |

|---|---|---|---|

| Wheat | 16.7 | 20.8% | +48% |

| Beef and veal | 10.7 | 13.3% | +8% |

| Canola | 5.7 | 7.1% | -2% |

| Uncarded or uncombed cotton | 4.9 | 6.1% | +120% |

| Sheep and goat meat | 4.7 | 5.8% | -2% |

| Barley | 3.3 | 4.1% | +12% |

| Uncarded or uncombed wool | 3.2 | 4.0% | -2% |

| Wines | 2.0 | 2.5% | -8% |

| Milk and cream, concentrated | 1.5 | 1.8% | -2% |

| Dried shelled lentils | 1.5 | 1.8% | +52% |

| Others | 26.2 | 32.6% | +9% |

| Grand Total | 80.4 | 100% | +17% |

Source: ABS 2023

Resources

Datasets for AFF imports and exports are available through the Australian agriculture trade – reference tables.

The Australian Government’s network of Agriculture Counsellors provided information for this article. More information about the Agriculture Counsellor network, including contact details, are available on the Department of Agriculture, Fisheries and Forestry website.

Go further, faster with Austrade

Go to Austrade’s Go Global Toolkit to learn the export basics, find the right markets and understand market requirements.