The Gulf Standards Organisation (GSO) of the Gulf Cooperation Council (GCC) has published a technical regulation that recognises extended shelf-life for chilled vacuum-packed red meat. This recommends that all GCC members bring their regulations for the shelf-life of chilled, vacuum-packed red meat into alignment. The GCC is a cooperative (bloc) of six Middle Eastern countries: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE).

The GCC’s recently published technical regulation recommends the shelf-life for Australia’s chilled vacuum-packed beef and buffalo meat be extended to 120 days, and 90 days for sheepmeat and goatmeat. These dates are determined from slaughtering date. If accepted, it will align Qatar’s shelf-life for chilled beef and Oman’s for chilled sheepmeat and goatmeat with other GCC’s members (Table 1). The UAE, Saudi Arabia and Kuwait had already extended their individual shelf-life requirements for Australia’s chilled, vacuum-packed red meat.

The new regulation also allows for flexibility in packaging. Previously, chilled beef needed to be packed under a modified atmosphere, an expensive practice that is not commonly used by Australian industry.

Implications for Australian red meat exporters

This recommendation across the GCC bloc provides Australian exporters with greater flexibility to supply high quality and competitive red meat products to these markets.

Extended shelf-life for vacuum-packed meat reduces freight costs by enabling Australian chilled meat to be shipped via sea rather than air. Depending on the destination and consignment weight, air freight can be 5-10 times more expensive than sea freight. Longer shelf-life also allows products to remain on sale for longer. This leads to reduced wastage and higher returns for retailers.

Having a common regulation requirement across the GCC bloc will reduce documentation requirements and costs for Australian red meat exporters to these markets.

Producers and exporters can contact their Middle Eastern importers to explore potential opportunities for meat exports to GCC countries. They should also continue to monitor the Department of Agriculture, Fisheries and Forestry’s Manual of Importing Country Requirements (Micor) and can log in to view Market Access Advice notices for further updates to shelf-life regulations.

Table 1 – Value of GCC total fresh or chilled red meat1 imports in 2021 and their maximum shelf-life2

| Country | Beef (US$m) | Sheepmeat (US$m) | Goatmeat (US$m) | Beef (days) | Sheepmeat (days) | Goatmeat (days) |

|---|---|---|---|---|---|---|

| Bahrain | 35.3 | 28.7 | 0.6 | 120 | 90 | 90 |

| Kuwait | 150.6 | 64.3 | 0.4 | 120 | 90 | 90 |

| Oman | 21.7 | 12.9 | 8.0 | 120 | 1202,3 | 1202,3 |

| Qatar | 81.2 | 99.6 | 5.0 | 902 | 90 | 90 |

| Saudi Arabia | 246.3 | 43.6 | 16.9 | 120 | 90 | 90 |

| United Arab Emirates | 395.5 | 241.1 | 111.8 | 120 | 90 | 90 |

| Total | 930.7 | 490.1 | 142.6 |

1 Beef & other bovine meat HS6 code used are 0201.10, 0201.20, 0201.30. Lamb and mutton HS6 codes used are 0204.10, 0204.21, 0204.22 and 0204.23. Goatmeat HS6 code used is 0204.50 (Fresh or chilled or frozen).

2 Maximum shelf-life at the time of writing.

3 If accepted, the recommendation could result in a reduction in the maximum shelf-life for sheepmeat and goatmeat imports to Oman.

Source: UNComtrade 2023

Australian red meat exports to the GCC members

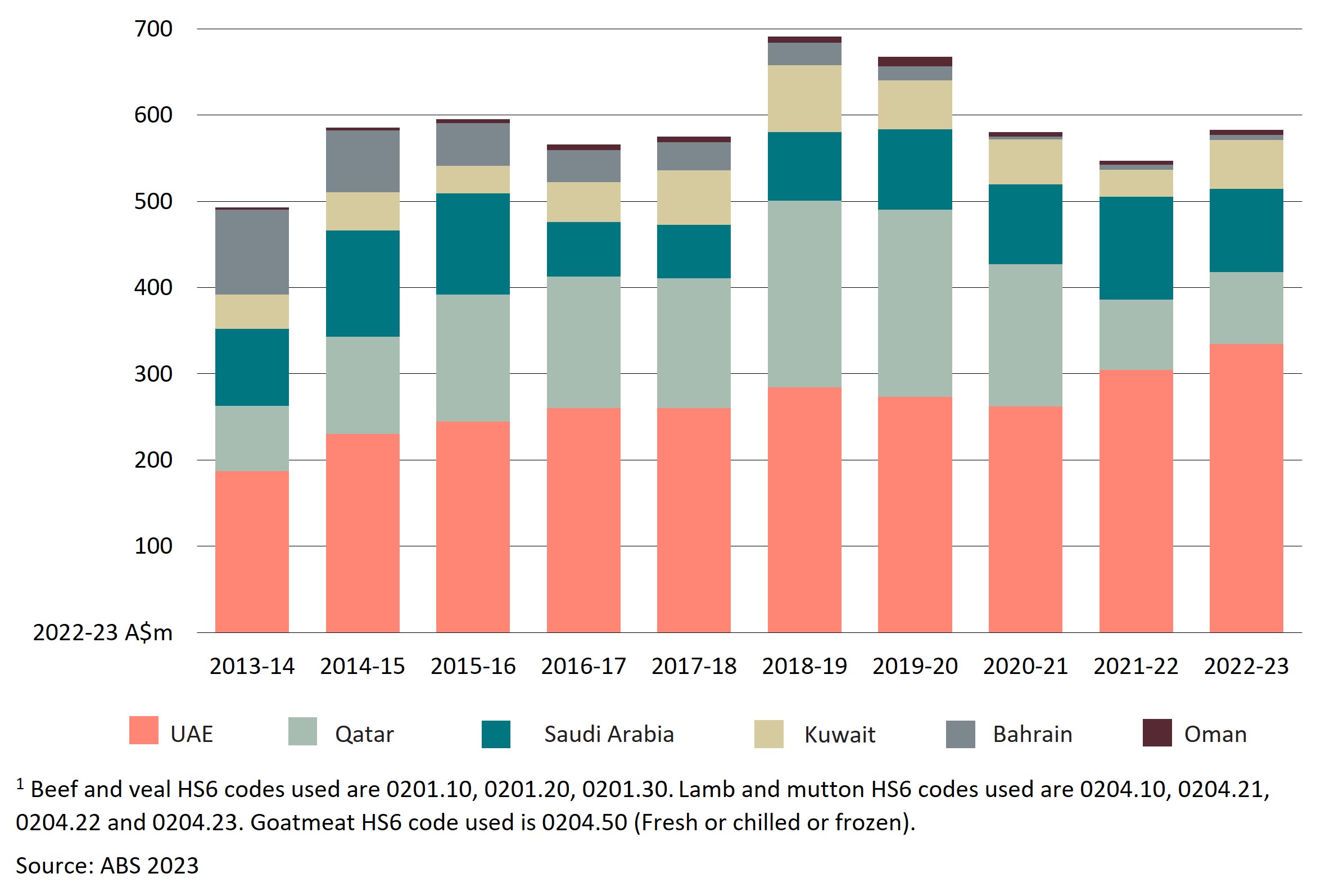

Between 2020–21 and 2022–23, Australia exported an average of A$570 million of fresh or chilled red meat to the GCC member countries each year. Sheepmeat accounted for 57% and beef and veal (primarily beef) accounted for 43%, on average (ABS 2023). The value of Australian goatmeat exported to the bloc in 2022–23 was approximately A$83,000.

The value of Australia’s chilled red meat exports to GCC countries peaked at A$690.9 million in 2018–19 (2022–23 Australian dollars). Since then, exports to the bloc decreased to 2021–22 (Figure 1). The decrease primarily affected Australian exports to Qatar, reflecting the end of Qatar’s government subsidy for importing Australian live sheep and lamb on 31 December 2020.

In the last decade, the UAE has been the largest destination for Australia’s chilled red meat to the bloc. The UAE’s imports from Australia have increased steadily over the last decade (Figure 1). There is ongoing demand for higher quality grades and cuts of beef in the Middle East, driven by accelerated economic growth and western-style foodservices.

In 2022–23, the UAE accounted for 57% of Australia’s total chilled red meat exports value (A$582.8m) to the GCC. This was followed by Saudi Arabia (17%), Qatar (14%), and Kuwait (10%), with only ~1% each going to Oman and Bahrain (ABS 2023).

Figure 1 – Value of Australia’s fresh or chilled red meat1 exports to GCC states, 2013–14 to 2022–23

Imports of chilled red meat by the GCC members

Imports by countries

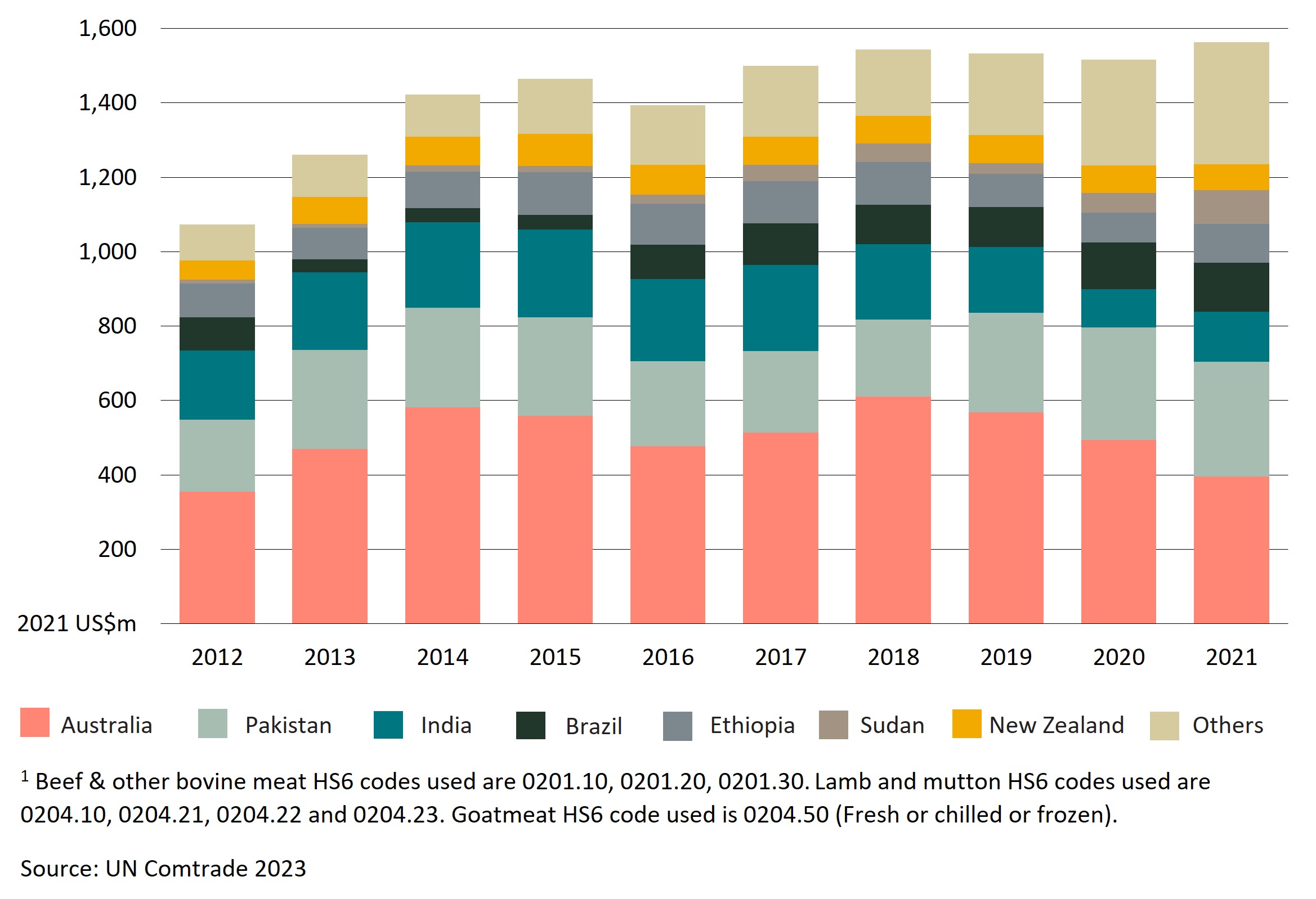

Australia has been the largest exporter of chilled red meat to GCC members over the last decade. However, since 2018, Australia’s share has fallen as Pakistan and Brazil’s shares increased (Figure 2). The cost of production in these countries is lower than in Australia.

Between 2019 and 2021, Australia accounted for an average of 32% of the total value (US$1.5b) of the GCC imports followed by Pakistan (19%), India (9%) and Brazil (8%) (UN Comtrade 2023).

Australian chilled red meat is transported to the Middle East mainly as airfreight which was impacted by COVID-19 through lower service frequency and higher costs. This also coincided with the termination of Qatar’s subsidy for Australian live sheep and sheepmeat in 2020.

Figure 2 – Value of the GCC’s fresh or chilled red meat1 imports by country, 2012 to 2021

Between 2019 and 2021, the average unit import price for Australian chilled red meat to GCC members was US$9.35/kg compared with Pakistan, India and Brazil’s prices of US$4.57/kg, US$6.99/kg, and US$5.01/kg, respectively. With extended shelf-life for Australian chilled meat to GCC members, exporters may be able to reduce transport costs making Australian products more competitive in GCC markets.

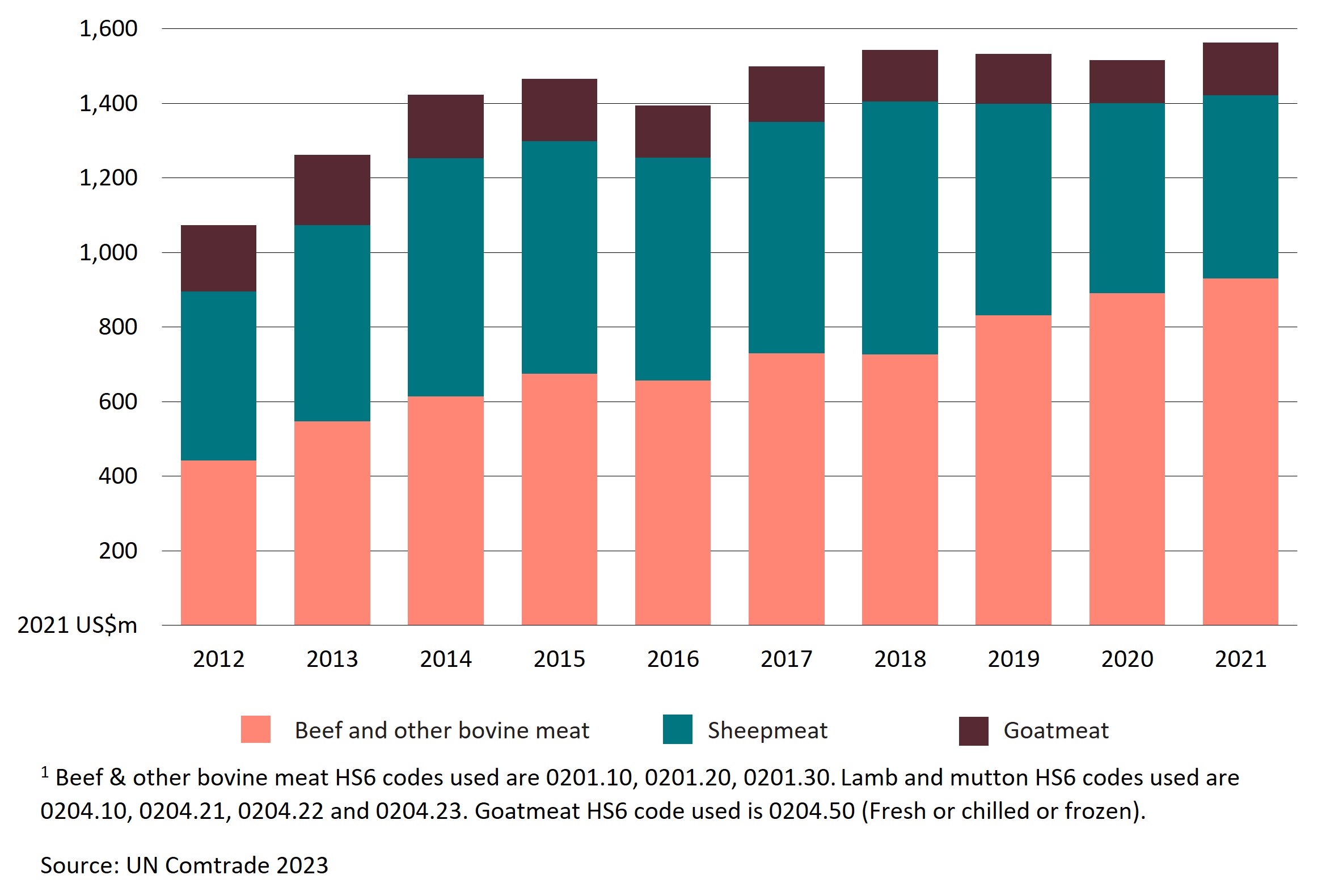

Imports by products

Beef (including other bovine meat such as buffalo) was the main red meat product imported by GCC members over the last decade. In 2021, chilled beef accounted for 60% of the value of imports followed by sheepmeat (31%) and goatmeat (9%) (Figure 3).

Between 2012 and 2021, imports of chilled beef increased from US$441.9 million (2021 US dollars) to US$930.7 million (+111%). Over the same period, chilled sheepmeat imports have shown more modest growth, but overall increased by 28% to reach US$490.1 million, while chilled goatmeat fell by 20% to US$142.6 million.

Goatmeat imports remain a relatively small share of all red meat imports in the GCC. Over the past decade, the value of goatmeat imports have remained relatively flat at around $US150m. In 2021, Australia’s share of the GCC goatmeat imports was 4%, with Ethiopia (47%) and Kenya (36%) as the main exporters (UN Comtrade 2023). With the growth in Australia's goatmeat production, there is opportunity for industry to take advantage of the extended shelf-life to increase its market share.

Figure 3 – Value of the GCC’s fresh or chilled red meat1 imports by products, 2012 to 2021

Further Information

Import requirements for the Middle East region are available through the Manual of Importing Country Requirements website.

The Australian Government’s network of Agriculture Counsellors provided information for this article. More information about the Agriculture Counsellor network, including contact details, are available on the Department of Agriculture, Fisheries and Forestry website.

Go further, faster with Austrade

Go to Austrade’s Go Global Toolkit to learn the export basics, find the right markets and understand market requirements.