Charley Xia

Heatwaves and high water prices to affect production

Intense heat and dry conditions in January reduced production of berries, broccoli, cauliflower, celery and leafy vegetables. Heatwaves also resulted in an earlier harvest of summer fruit and affected the quality and appearance of fresh produce.

According to the Bureau of Meteorology (14 February 2019), autumn temperatures are highly likely to exceed the median in most horticultural regions. Repeated heatwaves in early autumn could result in reduced yields and blemished produce, and lower returns from horticultural production.

The price and availability of irrigation water are expected to affect production decisions. Water allocations in 2018–19 are lower than in 2017–18, reflecting very low storage levels in key reservoirs.

Chinese demand to boost export prices of fruit and nuts

In 2018–19 export prices of citrus, nuts, stone fruit and table grapes are expected to increase because of rising demand from China. The competitiveness of Australian produce has been improved by tariff reductions, reduced shipping times and favourable exchange rates.

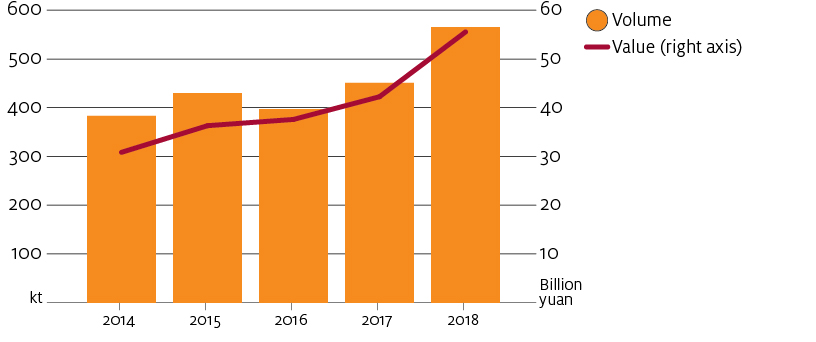

China's imports of fruit and nuts have increased substantially in the last 5 years. The Chinese Government has granted market access to an increasing number of exporting countries, streamlined customs clearance requirements and invested in logistics infrastructure.

Chinese consumption has increased because of rising disposable incomes and improved availability of imported products. Rigorous customs inspections at China’s borders reinforce consumer perceptions that imports are safer than domestic produce.

Source: General Administration of Customs, People's Republic of China

Increasing competition from Chilean fruit in China

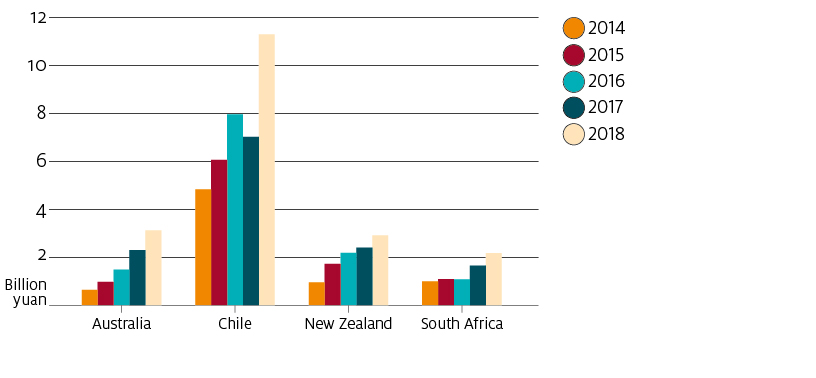

Large-scale fruit production enables Chile to supply the Chinese market with greater volumes than Australia. Chilean blueberries, cherries, nectarines, peaches, plums and table grapes compete against Australian exports. If the Chilean Government is successful in its request to China for market access for its citrus, Australian growers will face strong competition.

Over the medium term, Australia is expected to face greater competition in China from Chile than from other southern hemisphere competitors. The upgrading of the China–Chile Free Trade Agreement in 2017 reduced investment barriers and strengthened commercial ties between the two countries. Newly negotiated protocols have allowed Chile to export fresh fruit to China through combined sea and air shipments via transhipment to a third country. Chilean companies have invested in cold storage and quality inspection facilities in China, and have signed agreements with retailers to expand distribution networks. These developments are expected to support Chile's competitiveness and slow Australia's export growth.

Source: General Administration of Customs, People's Republic of China

Increasing supplies of berries and avocados for the domestic market

Favourable growing conditions in 2018 increased avocado and berry production, putting downward pressure on prices. Strawberry prices in early spring of 2018 were affected by food sabotage, which reduced demand and caused supermarkets to withdraw stock. However, demand since October has increased following support from consumers and the cooperation of industry and supermarkets to resolve concerns. Strawberry prices for the 2019 season are forecast to increase. This is due to some reduction in vines and investment in supply-chain traceability to address consumer concerns.

Recent new plantings of avocados and adoption of high-yielding berry varieties are expected to increase domestic supplies over the medium term, putting downward pressure on prices.

Growing almond production

Favourable growing conditions and higher yields from maturing orchards are expected to support record almond production in 2018–19. Trade tensions between the United States and Australia's major almond export markets, including China, the European Union and India, are expected to support higher prices for Australian growers.

Over the medium term, Australian almond production is expected to increase further as recent plantings in the Riverina, the Riverland and Sunraysia reach maturity. Increasing demand for seasonal labour, irrigation water and bee pollination will affect production costs. More frequent occurrences of heavy rain, warmer weather and untimely frosts will also be challenges in growing regions.

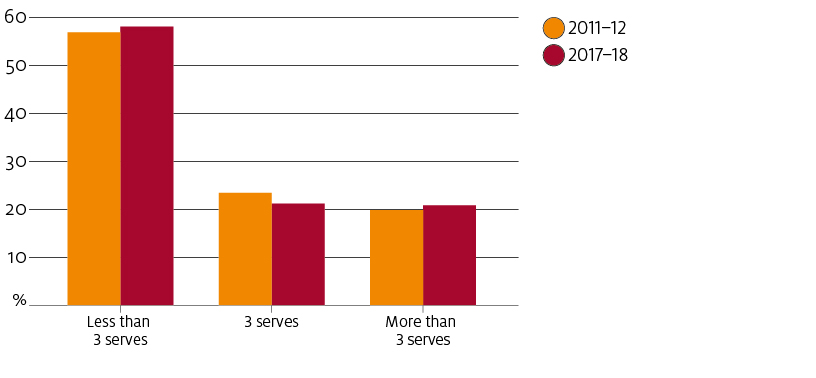

Consumer demand driving diversity of vegetable production

Per person vegetable consumption in Australia has not increased significantly over the last 6 years. Consumer demand for choice and convenience has supported greater diversity of vegetable production, including more varieties of leafy salad greens, lettuces, mushrooms and tomatoes. Demand for year-round availability of produce of consistent quality has also increased investment in protected cropping and water entitlements.

Over the medium term, per person vegetable consumption in Australia is expected to remain close to current levels. Consumer demand for consistent quality produce at affordable prices and rising input costs are expected to drive farm consolidation and specialisation.

Note: Sample population is Australians 18 years and over.

Nutrition Australia defines a standard serve of vegetables as about 75 grams.

Source: Australian Bureau of Statistics

Urban demand for greenery to support nursery growth

Demand for trees and plants by urban businesses and households is expected to support growth in the Australian nursery industry. Demand for tailored products will likely drive greater specialisation among nursery farms.

Opportunities and challenges

Irrigation costs in the Murray–Darling Basin

High water entitlement prices are expected to limit or postpone planned expansion of horticultural production in the southern Murray–Darling Basin.

Strong commodity prices and continuing drought have increased water demand in 2018–19. If Basin inflows are further reduced, competition for allocation in 2018–19 for carryover into 2019–20 would further increase allocation prices in the short term. This would affect the cost of horticultural production, especially for the almond, citrus and table grape industries, which have recently invested to expand production. Sustained high water prices provide an incentive to invest in improved water-use efficiency.

Seasonal labour remains a challenge

Australia’s growing horticultural production has raised industry concerns over shortages and costs of seasonal labour. In 2015–16 average farm expenditure on hired labour accounted for 20% of total cash costs of fruit farms in the Murray–Darling Basin and 21% of total cash costs of Australian vegetable farms. Ongoing collaboration between industry and policymakers will be needed to help horticultural farms secure seasonal labour at competitive costs.

Progress has been made through recent industry and government initiatives. The Harvest Trail job information service, streamlining the Seasonal Worker Programme and increasing incentives for backpackers will help reduce search costs and increase labour supply. Labour hire licence laws in Queensland and Victoria have been passed to target exploitation of workers. Industry initiatives such as the Fair Farms Initiative help farms comply with employment laws. The National Harvest Labour Information Service will gather evidence from agricultural industries to assess the need for an agricultural visa in Australia.

The National Traceability Project

This government initiative is designed to enhance Australia's traceability systems. A cross-jurisdictional working group, led by the Australian Government, with membership from states and territories, is developing a national framework based on government-industry partnerships. Stakeholder consultations for the project closed on 22 February 2019.

Traceability will be increasingly important for Australia’s horticultural industries. Effective traceability systems provide assurance to consumers who increasingly demand information about food safety, quality, provenance and sustainability of production. Maintaining strong export growth will require Australian regulators and industry to comply with the import requirements of key trading partners, such as the new maximum residue limits for agricultural chemicals required by China.

Australian horticultural businesses already comply with a number of standards accrediting traceability. Domestic retailers and industries have worked together to harmonise these standards and reduce auditing costs. The challenge for Australian regulators and industries will be to balance the regulatory burden on businesses and meet the requirements of consumers and trading partners.

Cost of fruit fly incursions to fresh produce trade

Rapid government and industry responses ensured that trade disruptions caused by fruit fly incursions in South Australia and Tasmania in 2018 were minimised. According to the Plant Biosecurity Cooperative Research Centre, fruit flies cost the horticultural industry more than $300 million in 2016. Australia's growing horticultural exports and domestic trade between states and territories mean that an even higher value is now at risk. An increasing number of growing regions could be placed under pressure if habitat for fruit flies expand because of climate change.

Researchers and industries are collaborating to find solutions to eradicate fruit fly in Australia. The Fruit Fly Fund, administered by Horticulture Innovation Australia, is a co-investment by industry, governments and research organisations working to eradicate this pest.

Download

| Document | Pages | File size |

|---|---|---|

Horticulture outlook – March 2019 PDF | 5 | 435 KB |

Forecast data – March 2019 XLS | 12 | 65 KB |

Historical data – March 2019 XLS | 45 | 1.4 MB |

If you have difficulty accessing these files, please visit web accessibility.