Michael Dylewski

Global textile demand to remain strong

Income and population growth in key markets will support global demand for cotton‑based and woollen textiles over the outlook period to 2023–24.

Expansion of the global middle‑class consumer base in emerging economies will drive an increase in purchases of cotton‑based textiles and apparel. Income growth is expected to slow in most advanced economies but to increase more strongly in many emerging and developing economies, including China, India and South‑East Asia.

Demand for wool is derived from consumer demand for high value woollen textiles and clothing. Assumed income growth in major wool-consuming markets—including China, the European Union and the United States—will underpin the expected strengthening of global demand for wool.

Lower cotton production to keep prices high

World cotton stocks remain high following an accumulation of stocks between 2009–10 and 2013–14 and again in 2016–17 when production rose in almost all major cotton-producing countries. In 2018–19 world cotton production is expected to fall due to declines in China, India, Pakistan and the United States more than offsetting higher production in Brazil. In 2019–20 and 2020–21 the global area planted to cotton is forecast to fall slightly in response to lower prices, before increasing gradually over the medium term to 2023–24. The average global lint yield is projected to increase slowly over the outlook period, in line with the historical trend.

World cotton consumption is forecast to grow strongly in 2018–19 and to outpace growth in world production until 2021–22, before world cotton production strengthens to 2023–24. This sustained period of consumption growth is projected to lead to a reduction in world stocks over the medium term.

World cotton prices are relatively high compared with recent years and are expected to remain high for the remainder of 2018–19 as a result of strong demand. However, high stock levels and competition from synthetic fibres are forecast to lead to a softening of prices between 2019–20 and 2020–21 before prices recover gradually over the remainder of the outlook period.

Total Australian cotton production is forecast to decrease significantly in 2018–19, driven by a decline in the area planted to cotton as a result of significantly reduced water levels in irrigation dams and very low levels of stored soil moisture.

Australian cotton production and exports are projected to remain unchanged over the outlook period to 2023–24. Production growth will be constrained by the availability of irrigation water following two years of dry seasonal conditions in eastern Australia. The last 3 recharge events for irrigation dams in the main cotton-producing regions occurred in La Niña years—events that cannot be predicted over the medium term. However, any future increase in irrigation water availability from such an event would present an upside risk to cotton production and exports.

Australian wool production to fall as prices stay high

Total Australian wool production and exports are forecast to fall in 2018–19. Continuing dry seasonal conditions across most wool‑growing regions are expected to reduce the number of sheep shorn nationally and the average wool cut per head. From 2019–20 the sheep flock is forecast to begin recovering and increase each year to 2023–24. This will lift wool production and exports over the outlook period.

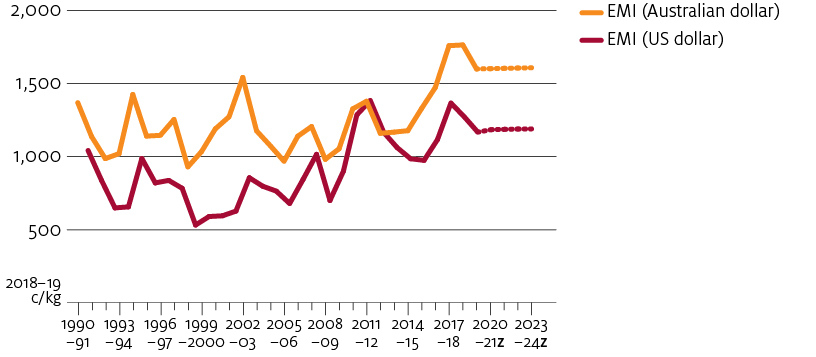

The Eastern Market Indicator (EMI) price for wool—a weighted average price across different wool types—is forecast to increase in 2018–19. Wool prices are currently high compared with recent years, especially in US dollar terms—the currency predominantly used to purchase Australian wool. The EMI declined slightly in late 2018 but is expected to recover over the remainder of 2018–19 as the supply of wool falls.

In 2019–20 the EMI is forecast to fall, reflecting expected higher volumes of wool coming to market as flock rebuilding commences. The current high EMI is creating an incentive for processors to substitute away from wool for synthetic fibres, which can be blended with medium micron wools (20.6 to 22.5 microns). For the remainder of the outlook period, price growth will be constrained by continuing growth in flock numbers and wool production to 2023–24.

z ABARES projection.

Source: ABARES

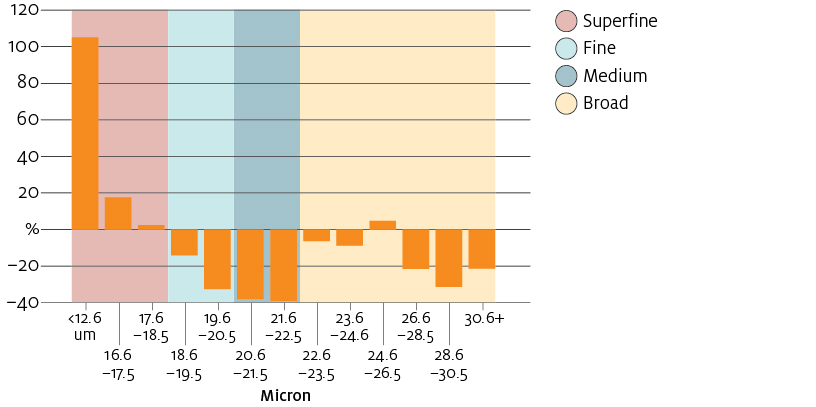

Dry conditions increase superfine wool supply

The 2018–19 forecast of lower total Australian wool production is not expected across all wool types. Of the wool tested as at January 2019, the supply of fine and medium wools (18.6 to 22.5 microns and traditionally favoured by many Chinese processors) fell by about 25% year‑on‑year. Dry seasonal conditions have pushed the average micron of these wools lower. This has resulted in a higher supply of lower quality superfine wools (18.5 microns or less) coming onto market.

The staple strength of drought‑affected wools has held up well but the increasing supply of lower quality superfine wool is assumed to continue to 2023–24. This is likely to influence the variation in prices across different wool grades and put pressure on finer grade wool premiums.

Notes: Year-on-year percentage change in bales of wool tested.

Sources: Australian Wool Testing Authority; Australian Wool Innovation Limited

Opportunities and challenges

Trade tensions create uncertainty

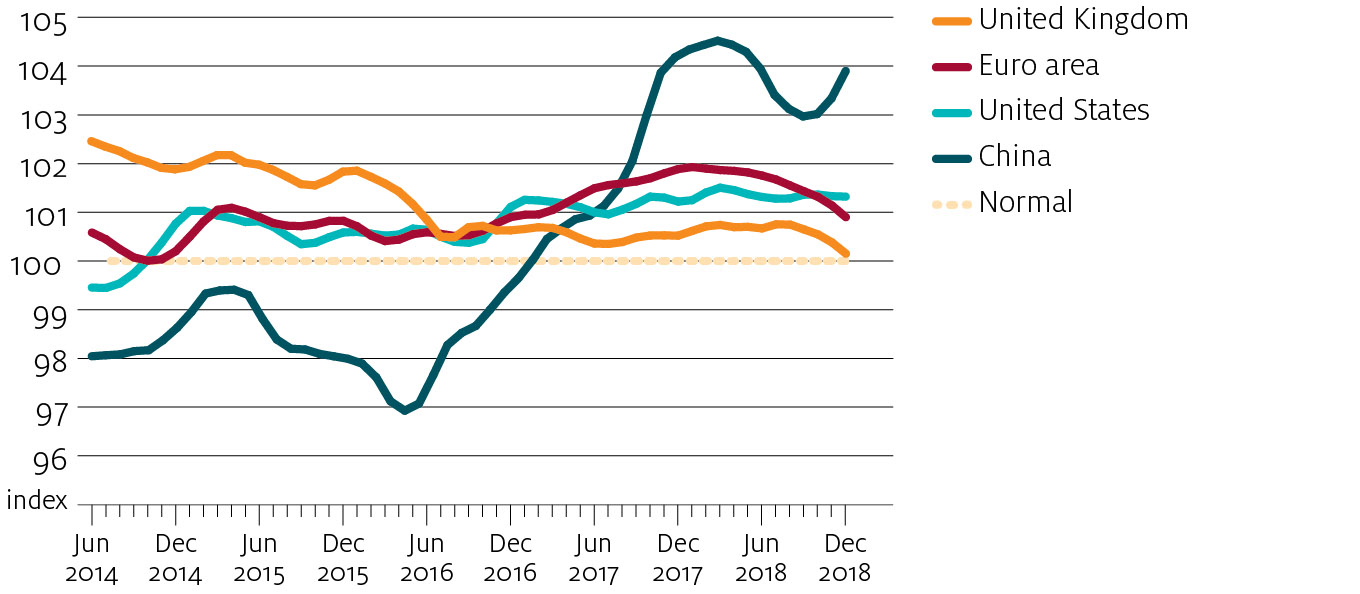

The United States is a major importer of textiles and clothing processed in China. The global impact of the trade tensions between the United States and China on world textile demand and trade remains uncertain and contingent on many factors. These include the extent of any future retaliatory import tariffs imposed by these countries and whether global trade tensions broaden to include other nations. A decline in Chinese demand for natural fibres would likely impact Australia’s wool industry more severely as Australia exports cotton to a broader range of countries than it does wool.

The effect of the trade tensions on Chinese consumers, who represent a substantial and rapidly growing final market for apparel, has been mixed. Consumer confidence and (to a lesser degree) garment sales declined in China between February and August 2018 but recovered strongly in the remaining months of 2018. These data indicate that Chinese demand for textiles and clothing—which directly influences demand for Australian natural fibres (wool in particular)—may not necessarily weaken if trade tensions continue.

Notes: Amplitude‑adjusted. Normal (long‑term average) = 100. An indicator above 100 signals a boost in consumers' confidence towards the future economic situation.

Euro area comprises Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

Source: Organisation for Economic Co‑operation and Development

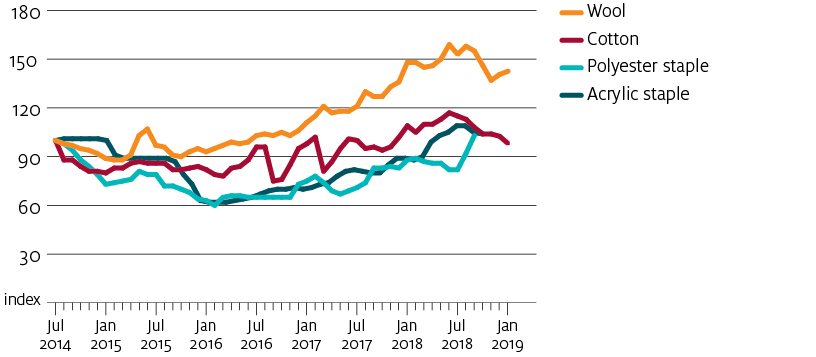

Competition from substitute fibres

Competition from substitutable synthetic fibres, such as polyester, remains a risk to cotton markets in light of current high cotton prices. Relatively low oil prices in recent years have increased the price competitiveness of synthetic fibres against cotton. An assumed small decrease in oil prices in 2019–20, influenced partly by global trade tensions, could put downward pressure on cotton prices. If oil prices remain relatively low over the outlook period, the projected recovery of cotton consumption could be adversely affected because of greater substitution towards synthetics.

Synthetic fibres are also substitutable with medium micron wool. Current high wool prices create an incentive for textile manufacturers to substitute lower cost fibres. This incentive presents a downside risk to demand for Australia's medium micron wool exports and wool prices.

More broadly, evolving tastes and preferences continually influence the production and consumption of natural fibres, often in ways that are difficult to estimate and cannot be factored into a medium-term forecast. For example, animal welfare and social and environmental concerns have the potential to decrease wool demand. Similarly, increasing awareness of the environmental impact of synthetic garments can encourage cotton use in textiles and clothing.

Notes: July 2014 = 100. Eastern Market Indicator, Cotlook 'A' Index, Chinese polyester staple fibre (1.5 denier) and North Asian acrylic staple fibre (1.5 denier). Data for polyester staple and acrylic staple available until September 2018.

Sources: Australian Wool Exchange; Cotton Outlook; Fibre2Fashion

Cotton support policies remain significant

Government support policies in major cotton-producing countries play an ongoing role in influencing cotton demand and global trade.

China's cotton stocks can have a major influence on the world cotton market. The country's support policies for its domestic cotton industry, including the level of its stocks and timing of stock drawdowns, remain a source of uncertainty over the outlook period. Any changes to China's cotton policies would have important implications for world textile markets and on regional cotton industries.

In 2018 China reduced its cotton stocks considerably following 3 years of aggressive selling. The US Department of Agriculture forecasts that China's closing stocks of cotton will decrease by about 20% in 2018−19. If China continues to reduce its stocks, it could put downward pressure on its demand for imported cotton, and cotton prices, in the short term.

In India and major cotton-producing countries in Central Asia, government policies promote investment in textile industries and contribute to exports of textile products rather than raw cotton. For example, the Gujarat state government in India recently announced the removal of incentives to support ginning and spinning, with funding redirected to processing. The impact of this policy on Australia's competitiveness in cotton export markets is likely to be minimal given Australia's comparative advantages in producing high‑quality cotton rather than processing.

Download

| Document | Pages | File size |

|---|---|---|

Natural fibres outlook – March 2019 PDF | 6 | 742 KB |

Forecast data – March 2019 XLS | 12 | 65 KB |

Historical data – March 2019 XLS | 45 | 1.4 MB |

If you have difficulty accessing these files, please visit web accessibility.